Take a guess: what occasion is being advertised by the following promotions from various sources?

“Free Shipping. No membership, just smiles.”

“40%-50% off Prime Exclusive Men’s, Women’s, and Kid’s Clothing.”

“Daily home deals online all week long.”

If you said Amazon’s successful, self-generated shopping spree known as Prime Day, a mid-summer campaign now in its third year, you’re right. But it’s not only an Amazon phenomenon, because other online retailers and brands are competing fiercely so as not to be left out of a sales opportunity that’s become bigger than Black Friday, by some measures. In fact, while the second advertisement came directly from Amazon itself, the other two were offered as alternatives by eBay (“no membership”) and Target (which seemed to follow a similar strategy of limited-time special offers).

The campaigns surrounding Prime Day are a clear example of the difficulty in scaling promotional monitoring. With so many things to consider in the dynamic world of online retail, here are a few lessons to be learned:

- Faced with direct competition, it can be better to shift the timing of promotions to not coincide with other well-known occasions. In other words, be willing to go beyond the traditional holiday-based promotional calendar.

- To grasp scale, use a wider lens. Take advantage of both recent and historical promotions data across competitors.

- Keep in mind that monitoring should be a continual process. The more this type of review is undertaken, the easier it becomes and the more likely it will be smoothly integrated into business operations.

The sheer variety of promotions available during and leading to Prime Day is hard to imagine, but taking a closer look at some illustrations helps provide a better idea.

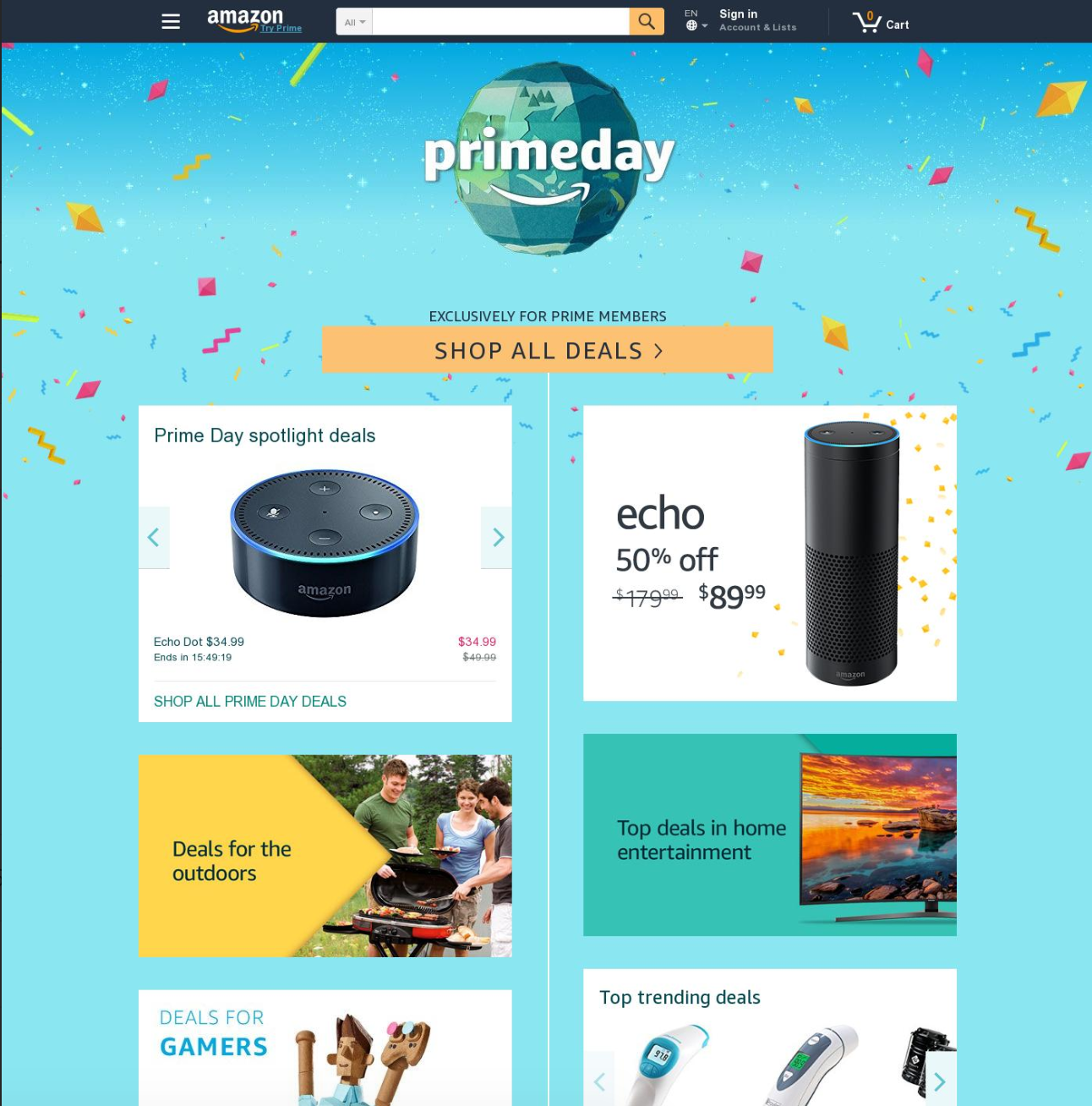

Amazon’s Homepage on Prime Day 2017

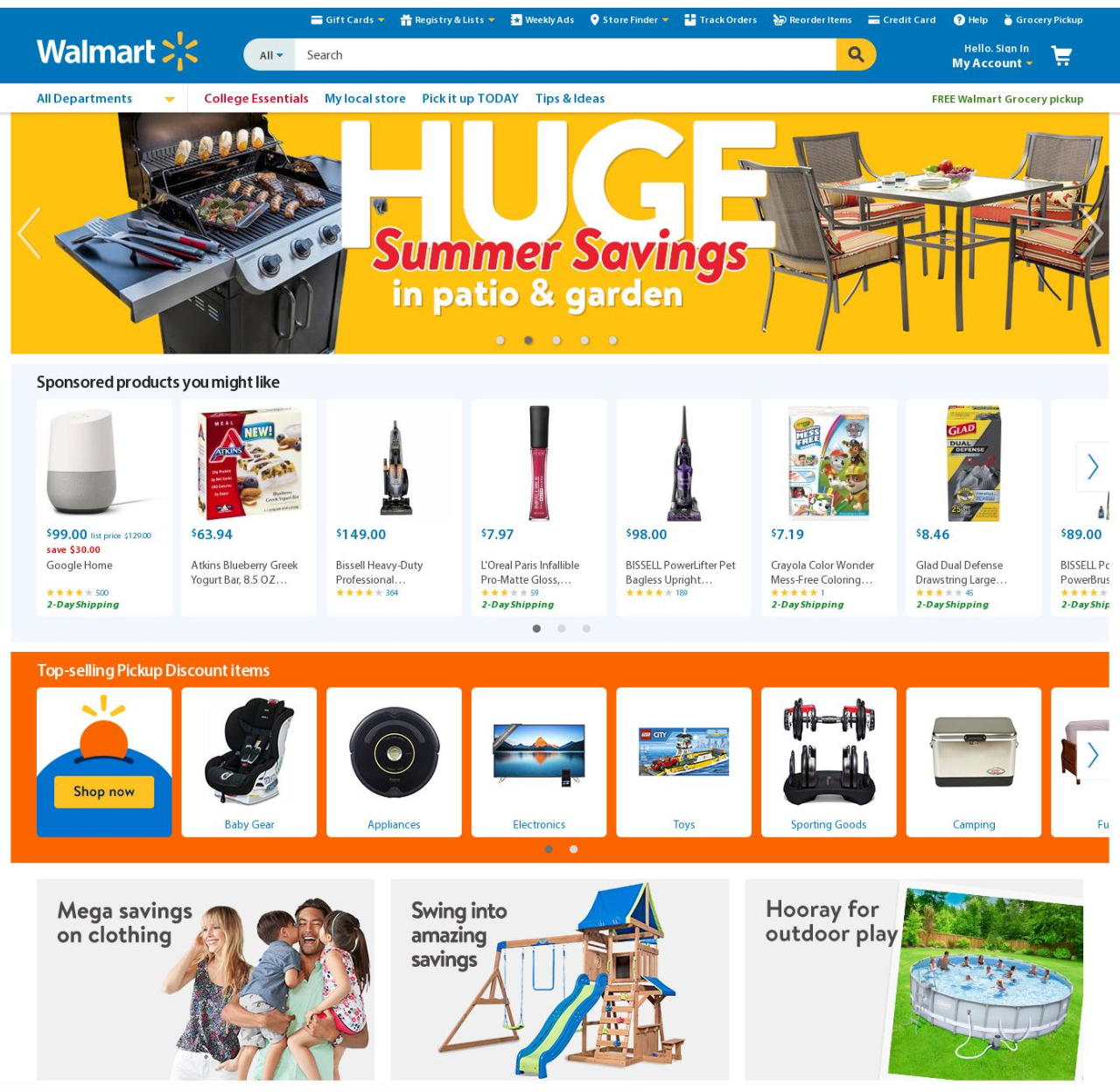

Walmart’s Homepage on Prime Day 2017

A side-by-side comparison of Amazon’s and Walmart’s homepages on July 11th (2017’s Prime Day) is revealing. While Amazon had more than a dozen special promotions in several categories and a new page design to feature them, Walmart chose to highlight various discounted items with less fanfare, other than a large banner touting summer savings.

For other retailers and brands, it’s already a challenge simply crunching all the numbers to analyze which offers and which categories would be smartest to respond to. Even harder is tracking all this promotional activity without an automated system—one capable of taking such snapshots at regular intervals and doing extraction for insights. Additionally, there are not only homepages, but thousands of product pages to scan through.

The best way to stay on top of the process is to access aggregated data. Looking across a slightly larger group of merchants, it’s clear that Amazon outdid other major players in terms of the number of promotions for the week in question, with only Target coming somewhat close to reaching a similar level, but three days ahead of Prime Day, which was a strategic preemptive move.

Promotional Mentions Over Time: July 2017

Interestingly, according to this promotions data, eBay and Target actually had more offers than Amazon. This seems to indicate that like Walmart, they decided not to compete directly on the big day (which could help explain the runaway success for Amazon). Alternatively, a comparison of this year’s big picture to the same time last year may also yield valuable observations.

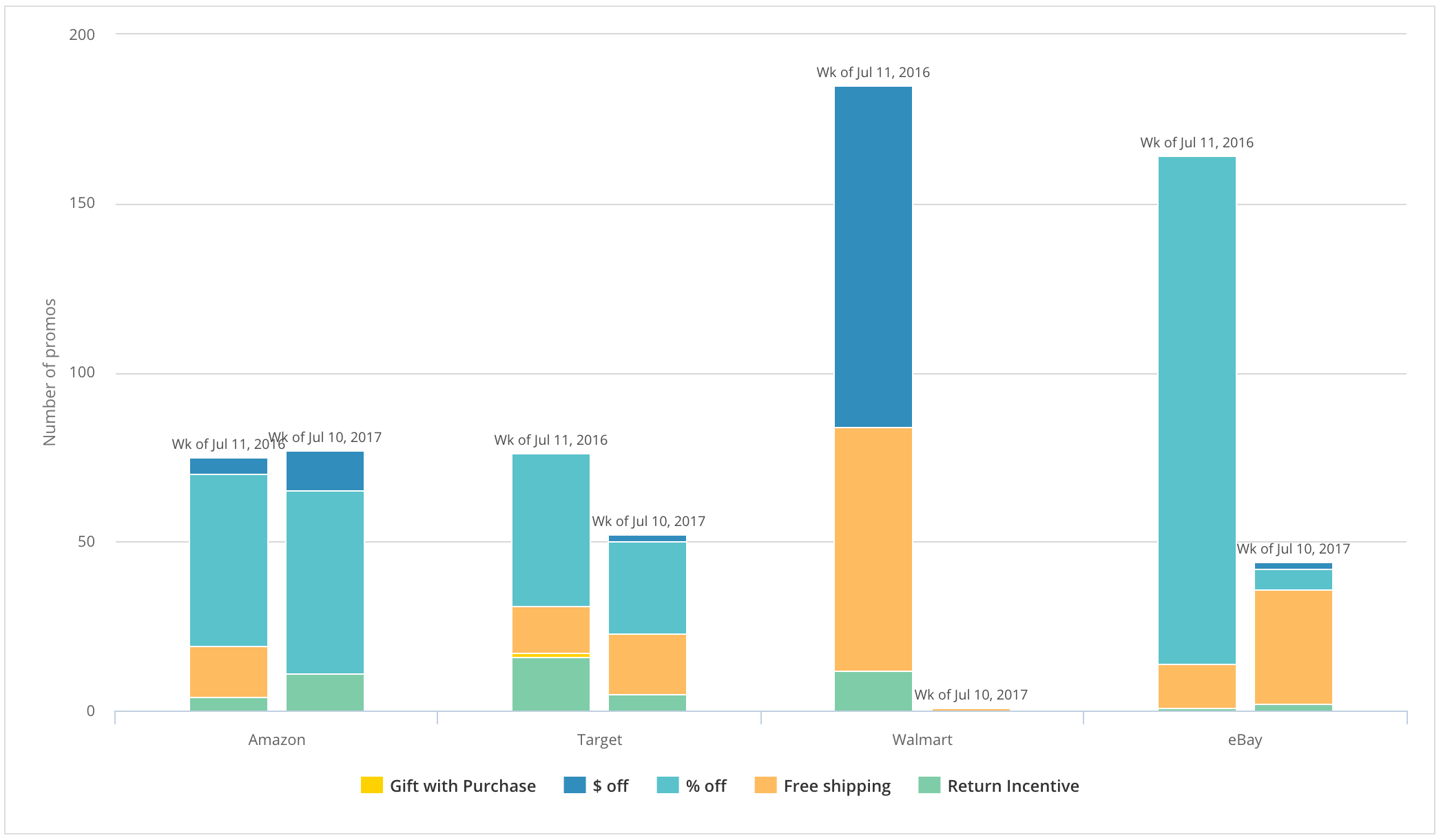

Promotional Mentions July 2016 vs. July 2017, by Type

As shown in the bar chart comparing promotional counts (across homepages, emails, and tweets) during the weeks of Prime Day both last year and this year, Walmart and eBay made a much larger push previously, while Amazon’s levels were roughly the same. This year-over-year view indicates that Walmart was especially focused on dollar-off and free shipping promotions last year but barely registered this time, which suggests some further investigation is needed to understand the other factors in that decision.

Promotions data can sometimes get lost in the mix—there are also assortments, minimum advertised prices, and other concerns to think about. However, remember that customers respond to discounts and other offers because it reflects their sensitivity to pricing, whether they’re looking for the right swimwear or the latest back-to-school deals. Knowing which promotions to run and when, in comparison to others, can mean the difference between success and a lackluster “me too” effort. So, don’t be daunted by the scale of the challenge. As with other areas of eCommerce, this is one that benefits from a methodical, metrics-oriented approach.

Contributing writer: Eric Chuk