How to Use Retail Audit Data

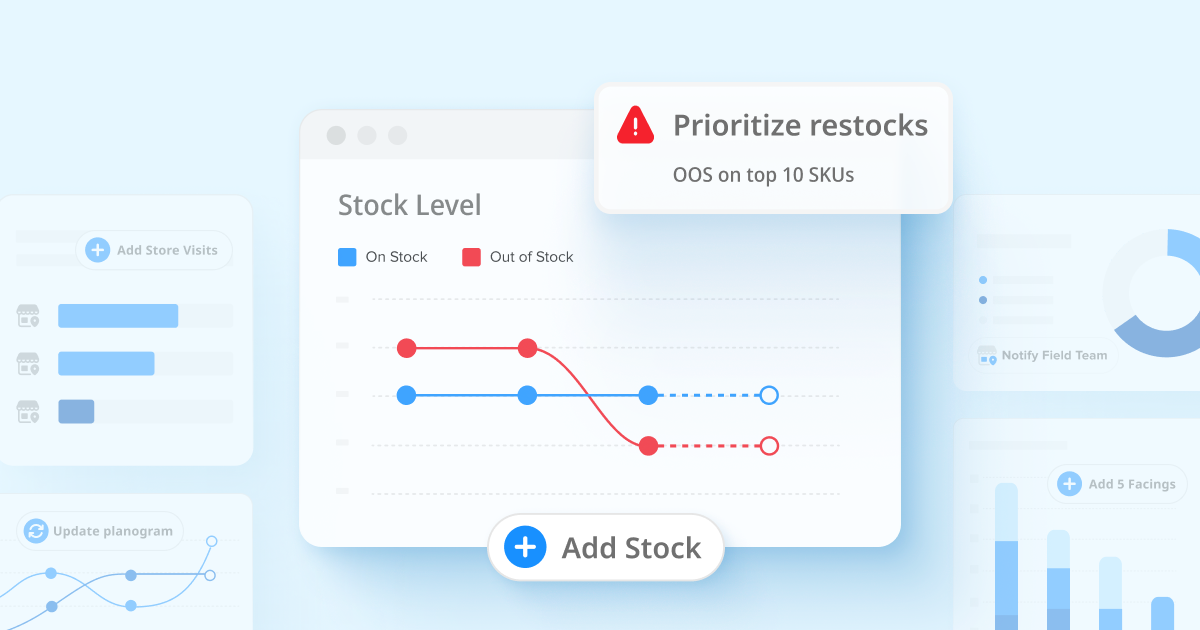

Retail audits are powerful. They give you a real-time snapshot of what’s happening at the shelf—what’s compliant, what’s missing, what’s broken. But too often, brands stop at the data collection stage or act on it as quick as they can—but often reactively. A broken display gets a photo sent to a rep. A missing tag leads to a call. An out-of-stock item triggers a scramble.

The problem isn’t just inaction. It’s fragmentation. Execution teams are often chasing individual issues without a clear sense of priority, repeatability, or long-term fix. The result? Time and effort spent on putting out fires instead of building a system that prevents them in the first place.

This post unpacks how leading brands shift from ad hoc responses to structured, systemic improvements—turning audit data into a strategic engine for better retail performance.

Step 1: Prioritize the High-Impact Few

In a typical audit, it’s easy to drown in detail. Every broken display, every missing tag, every execution miss feels urgent. But smart teams resist the urge to fix everything. The most successful brands know how to separate signal from noise.

Instead, they zoom out to spot patterns:

- Are certain issues repeating across chains, regions, or store formats?

- Are high-volume stores falling short in ways that affect revenue?

- Are promotions failing in the markets that matter most?

This triage mindset lets brands isolate the “high-impact few”—the 10% of issues driving 90% of losses. For example, if signage is missing in 40% of flagship stores for a key launch, that’s systemic. Fix it fast—and fix it everywhere. Meanwhile, scattered issues in low-priority stores can be bundled into the next routine visit.

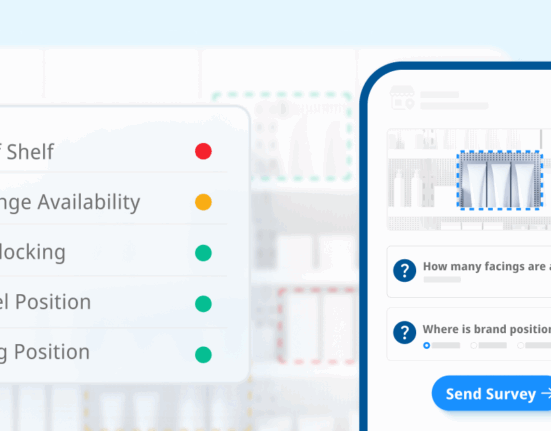

Step 2: Give Field Teams a Real Playbook

Audit data becomes even more powerful when paired with action plans for your field team, brokers, or third-party reps.

Many field teams are left to interpret audit data on their own—or worse, operate on general guidance. Leading brands change that by operationalizing the insights with precision.

Instead of casting a wide net, data-backed instructions provide teams:

- Store-specific tasks based on real conditions

- Clear materials and photos of what “good” looks like

- Guidance on what needs fixing now vs. what can wait

Some brands try to prioritize store visits based on issue severity or sales impact—but in reality, most are still relying on manual triage. A category manager might flag high-priority stores for action, while others get folded into routine visits. Digital instructions are sometimes sent to reps or brokers, but often without consistent follow-up or feedback loops.

The opportunity is to move from ad hoc decisions to a more programmatic approach—where audit data directly informs visit planning, task assignment, and rep focus based on clear thresholds like SKU velocity, compliance risk, or importance.

Step 3: Turn Repeated Issues into Scalable Fixes

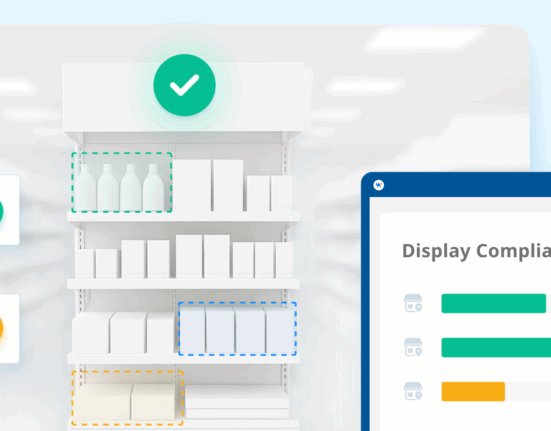

When the same problem shows up across stores—whether it’s missing signage, misplaced products, or pricing discrepancies—it’s a signal that something upstream is broken.

Most teams respond locally: they alert the rep, fix the store, move on. But leading brands look for ways to eliminate the root cause.

- Are specific planograms inconsistently executed?

- Do brokers or store teams need clearer visuals or better training?

- Is a specific retailer consistently falling short on compliance?

Rather than throwing reps at every problem, smart teams centralize these insights to identify patterns. They use audit data to push for changes to process, partner accountability, or even execution standards—so the same issue doesn’t keep coming back.

Step 4: Prioritize Stores—Even If the System Isn’t Perfect

In theory, store visits should be tiered by sales impact or issue severity. In reality, most brands rely on spreadsheets, email threads, or rep discretion to decide where to go and what to fix.

Some teams do attempt prioritization—flagging top-volume stores with major issues or routing high-risk findings to their brokers. But few have built a true triage system with automation, thresholds, or real-time workflows.

The opportunity? Start simple:

- Flag repeat non-compliance in key accounts

- Highlight execution misses on hero SKUs or promotional windows

- Route lighter fixes (e.g., missing tags) via digital instruction, and reserve field time for revenue-critical problems

This kind of focus makes each visit count—and avoids spreading limited resources too thin.

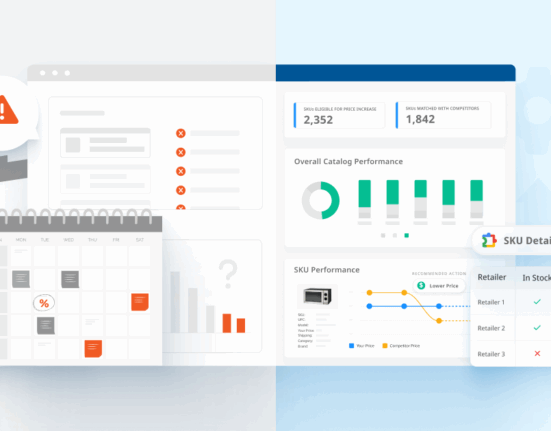

Step 5: Use Data to Lead Stronger Retail Conversations

Many brands collect audit data but stop short of using it as proper leverage in retailer discussions. That’s a miss.

Bringing hard proof—photos, location-level stats, trendlines—shifts the tone from speculation to collaboration. Instead of “we think stores didn’t follow through,” you can show exactly where and how the execution broke down.

This creates space for:

- Co-developing execution plans that actually work

- Securing stronger support on future promotions or launches

- Adjusting trade spend when in-store execution falls short of agreed promo terms

It also helps you justify investment: when you can quantify the revenue loss from poor execution, it’s easier to make the case for more display space, better placement, or additional co-op dollars.

Step 6: Bridge Online and In-Store Performance Gaps

Too often, in-store and online insights are tracked separately, even though shoppers—and breakdowns—don’t follow that logic.

Brands that connect retail audit findings with digital shelf analytics can spot problems others miss:

- Are stockouts online also affecting stores?

- Is mismatched pricing online creating confusion or compliance issues in-store?

- Is weak in-store execution dragging down regional online performance?

The goal is to build a holistic picture of your retail presence—so you’re not optimizing one channel at the expense of another, or missing shared pain points that need joint solutions.

Step 7: Make Execution a Shared Metric Across Teams

Audit data shouldn’t live in a silo. When insights are shared beyond field or ops teams, they become a catalyst for better decision-making across the business.

- Sales can use store-level data to strengthen retailer meetings, justify new program asks, or address objections with hard evidence.

- Trade teams can see which promotions were executed— to plan and adjust future investment based on real performance, not assumptions.

- Category and shopper teams can spot gaps in display presence, product blocking, or shelf flow, and refine future planograms or briefs.

It’s about turning execution from a field-only concern into a business-wide priority. When everyone’s looking at the same reality, you move faster, spend smarter, and fix issues before they cascade.

Audit In Action

A snack brand secured an exclusive endcap at a national retailer to support a new product launch. Audit data shows that many stores failed to set up the retail display correctly—some had no signage, others stocked the wrong products, and a few didn’t set it up at all.

Instead of fixing each store in isolation, the brand:

- Flagged the issue across sales, trade, and category teams

- Reduced trade reimbursement for non-compliant stores

- Provided retail partners with photo evidence and compliance rates

- Updated future promo briefs with clearer setup instructions and visuals

- Prioritized those stores for field visits during the next launch

The result: fewer execution gaps in the next cycle and stronger alignment across internal teams and retail partners.

You’ve got the data, now see what it’s worth.

Use our Impact Calculator to estimate the impact of closing execution gaps in-store.

Conclusion: Retail Audits Aren’t the Goal—Execution Is

It’s easy to treat audits as a checklist: Did the display go up? Was the promotion running? Did stores follow the planogram?

Audit data does sometimes trigger responses—but those responses are fragmented, short-term, and rarely systematized. The brands that win aren’t just reacting faster. They’re stepping back, spotting patterns, and building processes that prevent problems from happening again.

Execution isn’t just a store-level issue. It’s a brand-level opportunity to drive revenue, protect investments, and build stronger retailer relationships.

And it starts by treating audit data not as a to-do list—but as a roadmap for lasting change.