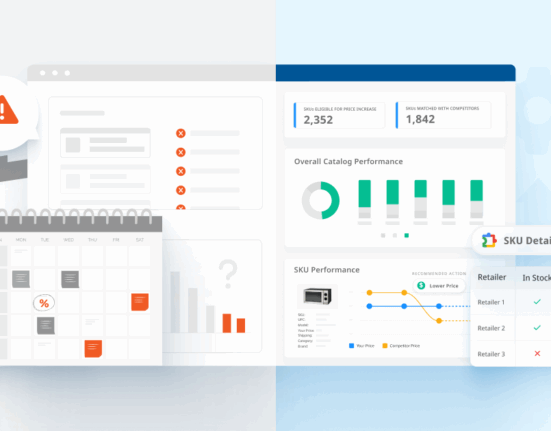

Dans le paysage actuel de la vente au détail, il n'est pas seulement important de comprendre les subtilités des stratégies de prix des grandes enseignes, c'est aussi essentiel pour rester en tête. Notre dernier rapport, "Pricing Strategies Unveiled", fournit une analyse approfondie des prix pratiqués en magasin et en ligne par les principaux détaillants américains, qui pourrait transformer votre approche de la tarification au sein de votre entreprise.

Découvrez les variations de prix en fonction des canaux

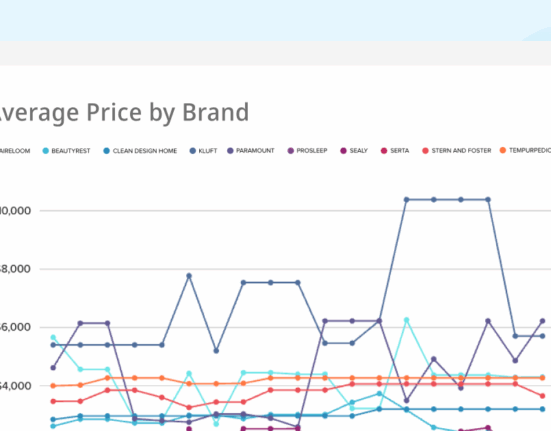

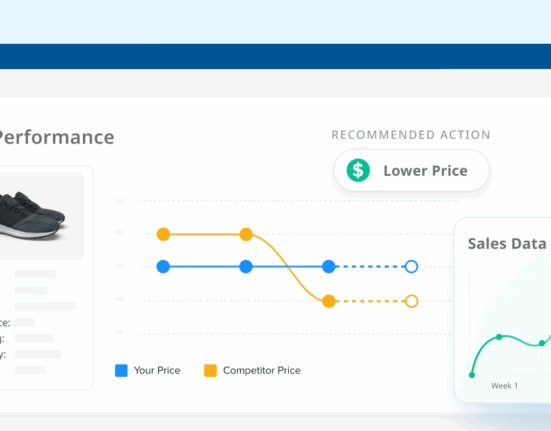

Notre étude complète révèle des tendances fascinantes sur la façon dont des détaillants comme Best Buy, Walmart et Target ajustent leurs stratégies de prix entre les environnements en ligne et en magasin. Le rapport souligne que Best Buy se distingue en tant que détaillant proposant les meilleures offres - en magasin et en ligne - lors de la comparaison de 15 produits électroniques grand public clés. Best Buy est le plus souvent le détaillant le moins cher en magasin, tandis que Walmart a tendance à être le détaillant le moins cher en ligne.

Explorer le rabais de détail stratégique

Découvrez comment les meilleurs détaillants appliquent stratégiquement les remises sur les différents canaux. Par exemple, saviez-vous que les remises moyennes sont généralement plus élevées en magasin pour GameStop, Office Depot, Staples et Sam's Club, mais qu'elles sont généralement plus élevées en ligne pour Costco, Micro Center, Target et Walmart ?

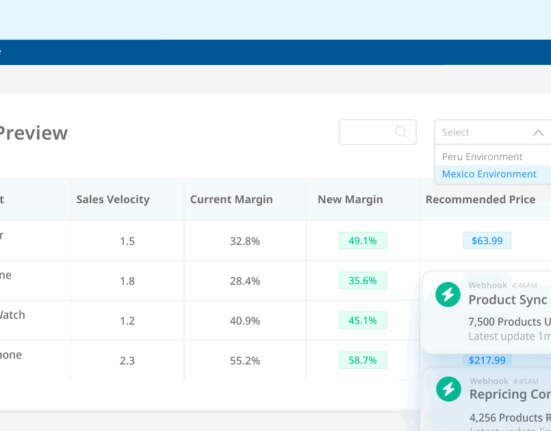

En savoir plus sur les tendances géographiques en matière de tarification

Les stratégies de tarification géographique peuvent avoir un impact significatif sur les ventes et la satisfaction des clients. Notre analyse a révélé que les variations régionales de prix existent mais sont souvent minimes, ce qui permet une stratégie de prix cohérente qui renforce la confiance des clients et simplifie l'expérience d'achat dans tous les domaines.

Êtes-vous prêt à prendre des décisions plus éclairées en matière de tarification ?

Ce rapport est une lecture incontournable pour toute personne impliquée dans les décisions de tarification dans le secteur de l'électronique grand public. Que vous cherchiez à affiner vos stratégies actuelles ou à en élaborer de nouvelles à partir de zéro, les informations fournies ici vous apporteront les connaissances dont vous avez besoin pour prendre des décisions éclairées et fondées sur des données.

Téléchargez le rapport complet pour commencer à optimiser votre stratégie de tarification dès aujourd'hui et vous assurer que vos pratiques de tarification sont aussi dynamiques et informées que le marché sur lequel vous êtes en concurrence.