TL;DR

This guide outlines five pricing pitfalls brands face and how to avoid them using competitive intelligence:

- Define discount bands and cadence to protect hero SKUs.

- Build retailer-specific overlays instead of one-size pricing.

- Enforce MAP program and marketplace hygiene during peak periods.

- Use 2024 data as calibration, not a copy-paste playbook.

- Act on live competitor intelligence with pre-approved response rules.

Wiser’s data-driven insights help brands execute confident, margin-protective strategies across every retail partner.

How to Turn Market Visibility into Smarter Black Friday Pricing Decisions

Black Friday is won by teams that know where they can win, when to move, and how deep to go, before the competition does. That clarity doesn’t come from instincts; it comes from a disciplined view of the market: live prices and promotions, availability and content accuracy, and clear signals about how shoppers responded in the past. This guide shows how to turn that view of the market into smarter, steadier pricing decisions that protect margin this Black Friday.

Pitfall 1: Equating “more discount depth” with “more sell-through”

Why it hurts: Deeper isn’t always better. Peak discount windows vary by category and by day during Cyber Week, so what moves demand is the combination of depth + cadence, not across-the-board cuts.

Fix: Work from discount bands, not averages.

- Define 2–3 discount bands (e.g., light: 10–15%, mid: 16–20%, deep: 21–25%+) that moved demand in your category.

- Give each product a role, then cap its discounting depth:

- Eg: Hero = sets price perception. Keep in Light (occasionally low-Mid). Use the hero to signal value, not to carry all the discount.

- Adjacencies (accessories/bundles) = profit helpers bought with/near the hero. Live in Mid. Plan to have these recover margin.

- Bundles / value-packs = elasticity lever. Use Mid/Deep instead of pushing the hero deeper; shoppers get value, while you protect your hero’s margin.

- Set a basic cadence: a light pre-event discount teaser, a focused Black Friday main offer, and weekend clean-up offers for tail SKUs.

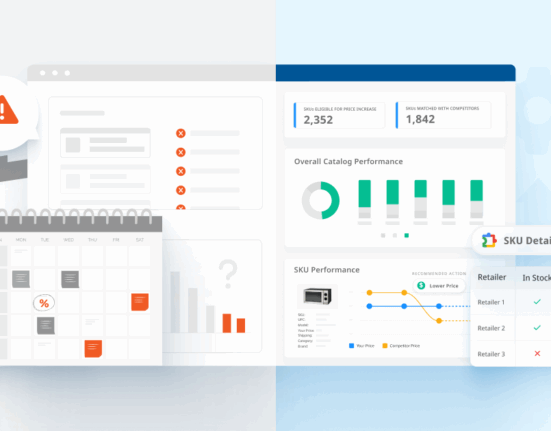

How Wiser helps: We analyze competitive discount depth bands and timing by category, brand and retailer so you can define guardrails and align depth, timing, and funding across channels. We also provide SKU-level views so floors, ceilings and day-by-day choices are grounded in evidence.

Pitfall 2: Treating all retailers the same

Why it hurts: Retailers differ in discount cadence, price-match policies, and category focus, and marketplaces are even more volatile. A one-size plan erodes margin where it isn’t needed and underperforms where intensity is higher.

Fix: Add retailer-specific overlays.

- Calibrate floors/ceilings by partner: set your min/max discount limits for each retailer and marketplace.

- Reserve brand funding for proven moments (e.g., hero anchor on Black Friday, value-packs over the weekend).

- Align with account teams on the few SKUs that set price perception at each partner.

- Tie co-op funding to clear guardrails and outcomes: release funding when agreed depth/timing/MAP standards are met.

How Wiser helps: We compare price, promo depth, availability, and assortment by retailer, highlight the moments that historically mattered, and translate those into retailer-level guardrails your teams can execute.

Pitfall 3: Underestimating MAP and marketplace hygiene during peak periods

Why it hurts: A single MAP slip or rogue marketplace price can reset reference prices across channels and force you into reactive discounts.

Fix: Treat peak season as an enforcement sprint.

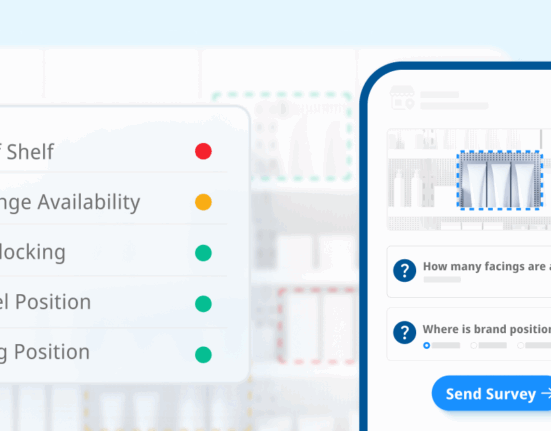

- Monitor MAP continuously; script escalation paths with retailers and sellers.

- Watch marketplaces for price drift and Buy Box volatility; prepare remediation playbooks.

- Pair price protection with content accuracy (titles, images, attributes) so price perception matches product value.

How Wiser helps: We monitor prices continuously across retailers and marketplaces, including adherence to reseller policies like MAP, and surface issues with evidence and clear escalation paths. Brands use this to protect price integrity and partner trust; retailers use it to keep a fair playing field in their category.

Pitfall 4: Using 2024 pricing data as a script instead of a calibration

Why it hurts: Last year’s results were shaped by different inputs (inventory, costs, item mix), different competitors/marketplace dynamics (new sellers, new bundles, shifting price-match behavior), and different shoppers (changes in sensitivity and timing). In short, 2024 isn’t 2025: copy-pasting last year’s plan risks both over- and under-discounting this year.

Fix: Use Black Friday 2024 to set starting points, then adjust for 2025.

- Extract 2024 bands and timing, then re-weight for this year’s inventory and margin goals.

- Refresh assumptions with early-season reads (Prime Day fall events, early November promotions).

- Keep cadence flexible: if industry data shows deals started earlier, ramping from mid-October and intensifying into Cyber Week, plan to meet shoppers where they already are.

How Wiser helps: We can summarize 2024 patterns (bands, timing, retailer differences), fold in early-season 2025 signals, and help convert that into right-sized guardrails and cadence for your categories.

Pitfall 5: Pricing without live competitive intelligence

Why it hurts: Retailers can adjust promotional depth by the hour. Without live reads, you often learn about threshold crossings after demand has moved.

Fix: Instrument alerts tied to pre-approved actions.

- Alert when key competitors cross your share-moving thresholds on must-win SKUs; connect each alert to a “match/hold/move” rule so account teams act quickly.

- Use day-by-day targets recognizing that peak value can vary by category (for many categories, Black Friday is the anchor; others peak on adjacent days).

How Wiser helps: We provide real-time views of competitor moves, configurable alerts around your thresholds, and SKU-level drill-downs so account teams act quickly and consistently.

FAQ’s:

Q: How can competitive intelligence improve Black Friday results?

A: It gives brands real-time visibility into competitor pricing and promotional behavior, enabling faster, evidence-based decisions.

Q: What are discount guardrails and why do they matter?

A: Guardrails define how deep and how often to discount, protecting margin while staying competitive across retailers.

Q: How can brands use last year’s data effectively?

A: Treat past data as calibration, not a script—adjust based on new category, shopper, and competitor dynamics.

Last Modified October 2025