TL;DR

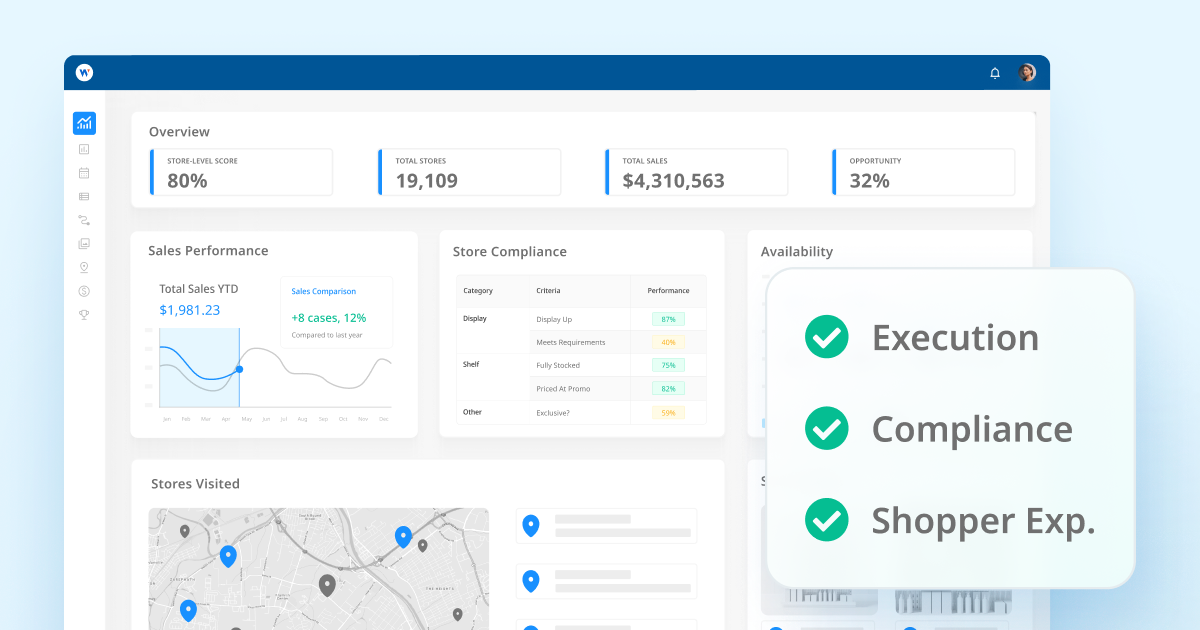

Retail Intelligence turns in-store observations into actionable, revenue-driving insights.

- 12 key capabilities from crowdsourced audits to AI shelf monitoring that show you what’s happening in every store and why.

- Connect execution to sales, benchmark against competitors, and capture shopper sentiment to protect margins and boost compliance.

- Use these capabilities to move from reactive fixes to proactive action across all regions, formats, and product launches.

What Is Retail Intelligence?

Retail Intelligence is how brands and retailers turn in-store observations into actionable data. It’s the real-time visibility into what’s happening at the shelf, showing whether products are in stock, promotions are set correctly, or displays are attracting shoppers, and providing the insights that guide how to fix issues fast.

A complete retail intelligence program doesn’t just identify problems. It explains why they happen and connects them to sales, shopper sentiment, and competitive activity. Below are 12 capabilities that form the foundation of that approach, rephrased in a way that matches the questions decision-makers often ask.

1. What is “reach” as it relates to in-store intelligence?

In retail intelligence, reach refers to how widely your program can capture store-level data across regions, countries, and retail formats. Broad reach ensures you’re not making decisions from a limited view. Local market support adds geographical and operational context, so execution insights remain accurate and relevant everywhere you sell.

A program with strong reach doesn’t just collect more data, it collects the right data. For example, understanding differences in merchandising compliance between markets or identifying region-specific out-of-stock issues allows you to make targeted, efficient interventions instead of broad, costly assumptions.

2. What are crowdsourced audits and how do they work?

Crowdsourced audits use trained shoppers to visit stores and capture real-time conditions like pricing accuracy, product placement, and promotion setup. This human element verifies execution details automation might miss, giving you a clear and unbiased view of the shopper experience. They can also add on sentiment beyond what the team or another data source might, such as first moment of truth in the category, ease of locating, or which package size they’re most likely to buy.

Because these audits can be deployed quickly, they’re ideal for spot-checking seasonal campaigns, competitive activity, or new product launches. They can also be used to validate data from other sources, helping you identify discrepancies before they become larger business risks.

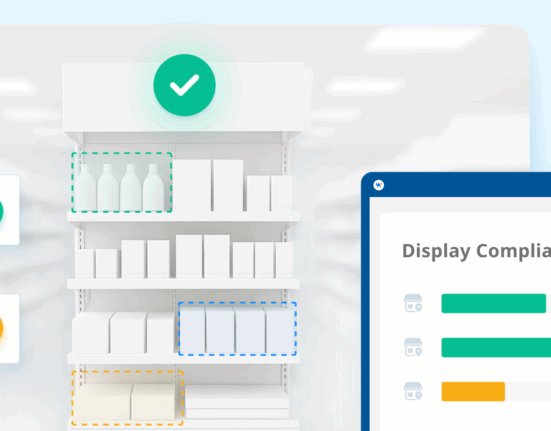

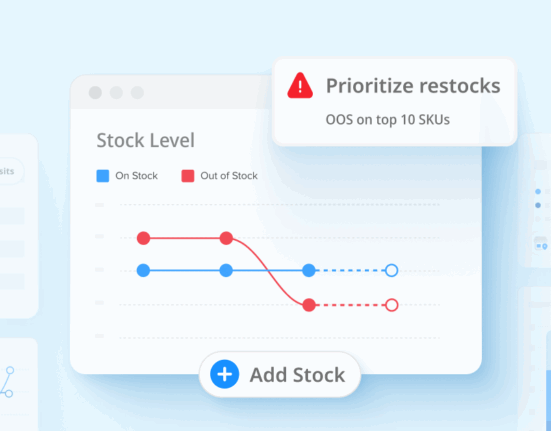

3. How is AI-powered shelf monitoring used in shelf intelligence?

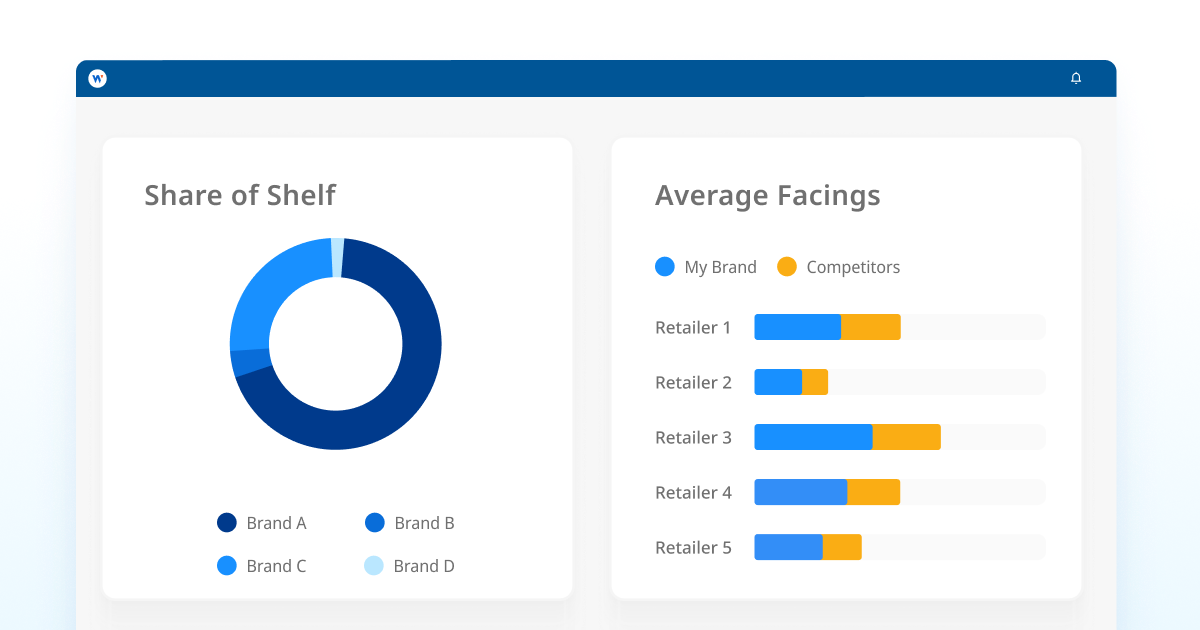

Image recognition uses AI to analyze shelf photos and convert them into structured data on facings, stock levels, and compliance. It lets brands and retailers measure share of shelf, detect out-of-stocks, and verify planogram execution at scale without manually counting items.

This approach improves both accuracy and speed. Instead of waiting days for manual counts, you can process thousands of images in hours, compare results across locations, and trigger alerts when high-priority SKUs drop below target availability.

4. How can I validate promotional execution or investments in trade marketing?

Retail intelligence can confirm whether promotions are running as planned, including correct timing, placement, and pricing, so your trade marketing spend delivers the intended return. This verification protects investment, prevents compliance lapses, and ensures shoppers see what you’ve paid to promote.

Validated promo execution also supports stronger retailer relationships. When you can prove execution status (and identify problems early), it’s easier to negotiate better terms, secure premium placement, and justify future marketing spend.

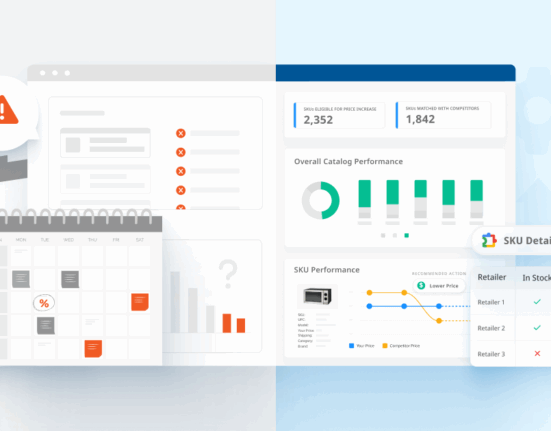

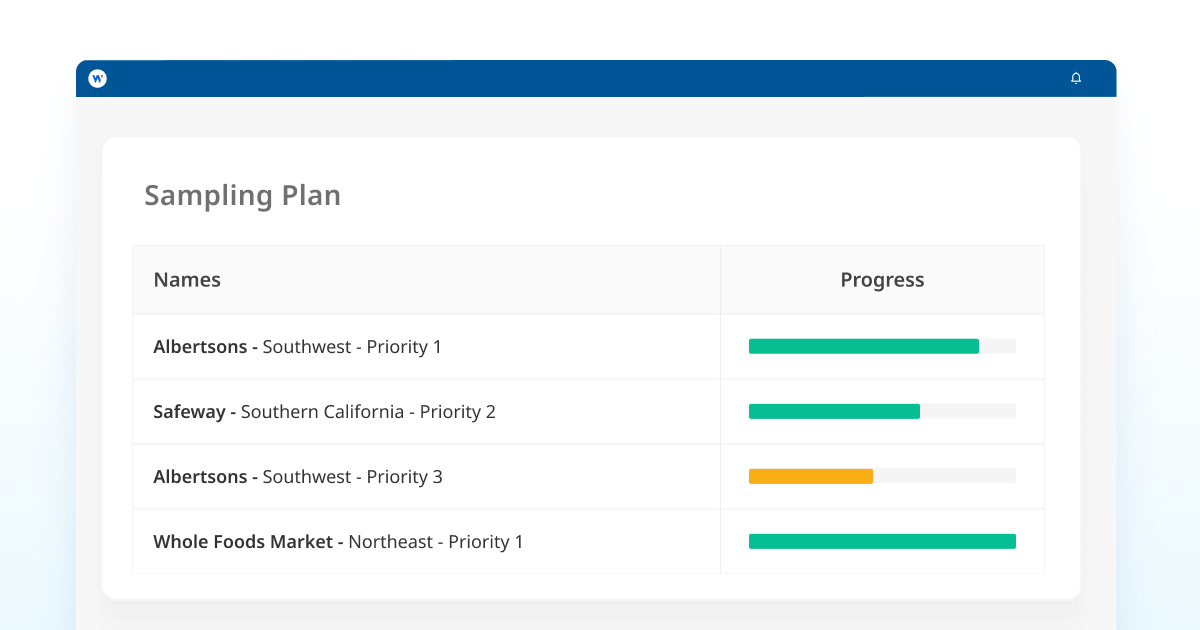

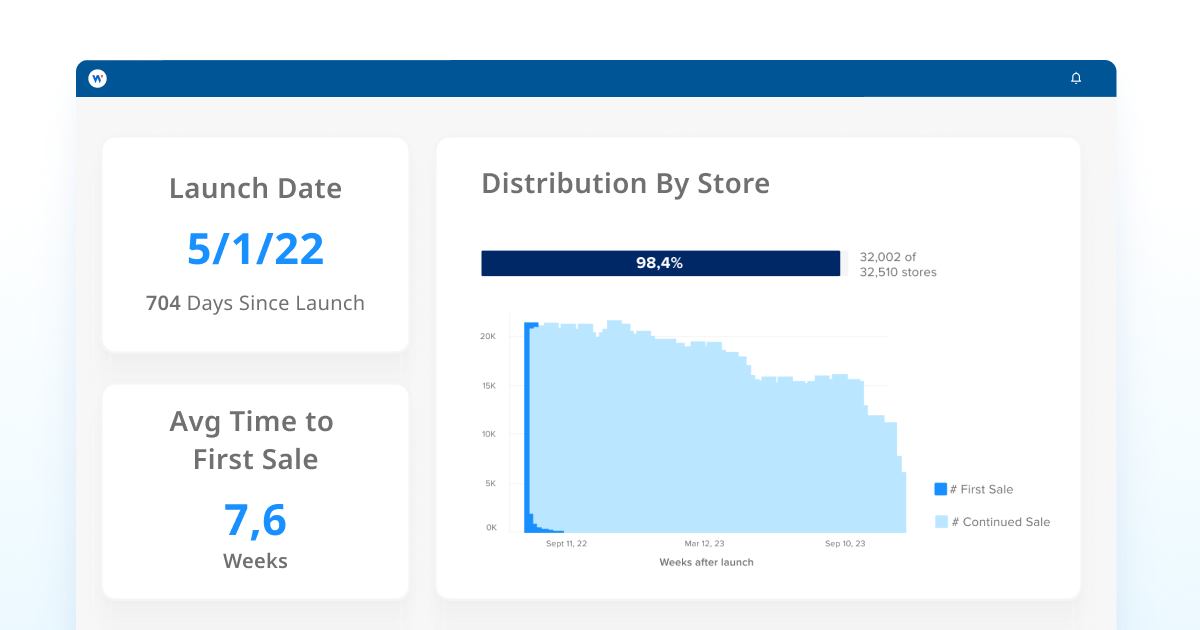

5. How can I track new product launches and early availability?

Launch monitoring ensures new SKUs are on shelves, positioned correctly, and priced as planned, weeks before you’re able to verify with scan data or other sources. In the first weeks after launch, this helps protect momentum, avoid early stockouts, and make rapid corrections before lost visibility impacts sales.

By tracking launch execution closely, you can compare performance across regions or retailers, identify early adopters, and quickly address underperforming locations. This is especially important for innovation-heavy categories where speed to shelf drives competitive advantage.

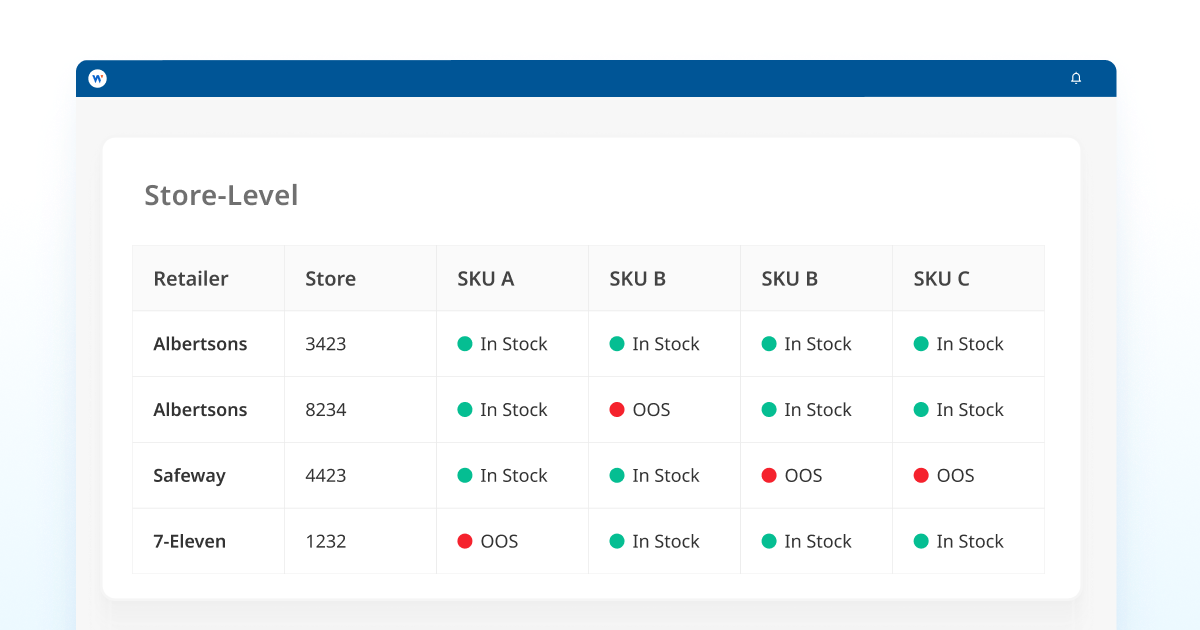

6. How can I see store-level execution and distribution?

Retail intelligence provides a granular view of how each store is executing your programs and whether inventory is distributed correctly across locations. This visibility allows you to identify phantom inventory or “dark stores” where products aren’t on display despite having stock.

Store-level execution data is also valuable for refining supply chain decisions. If certain stores repeatedly underperform in execution despite having stock, it may indicate a need for improved merchandising support, targeted training, or alternative fulfilment strategies.

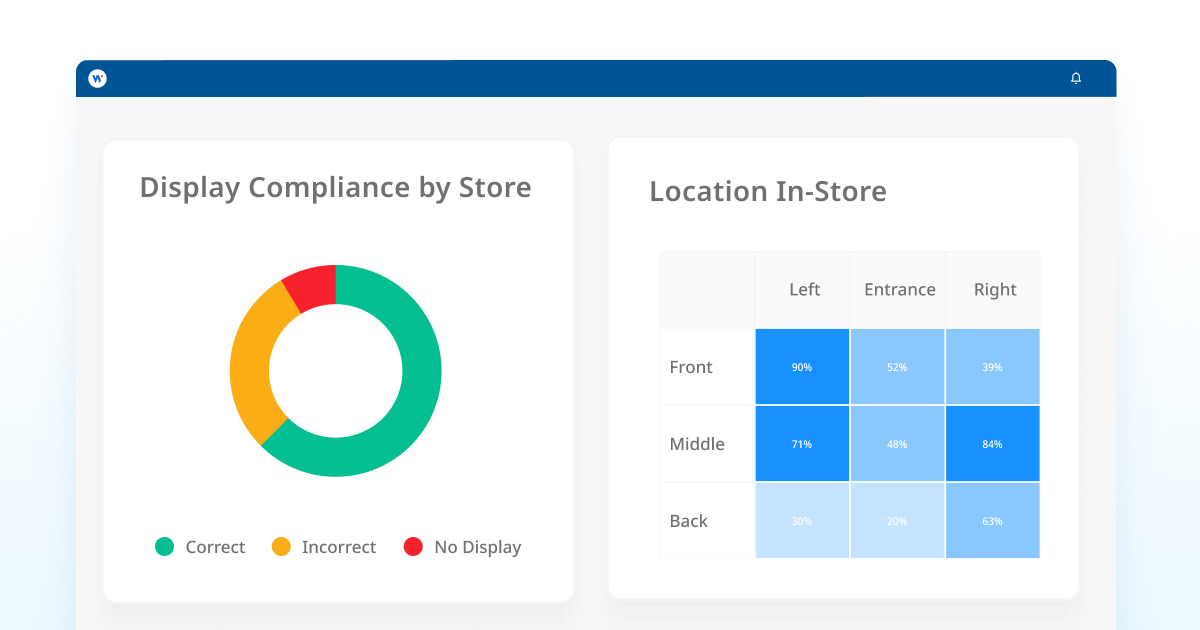

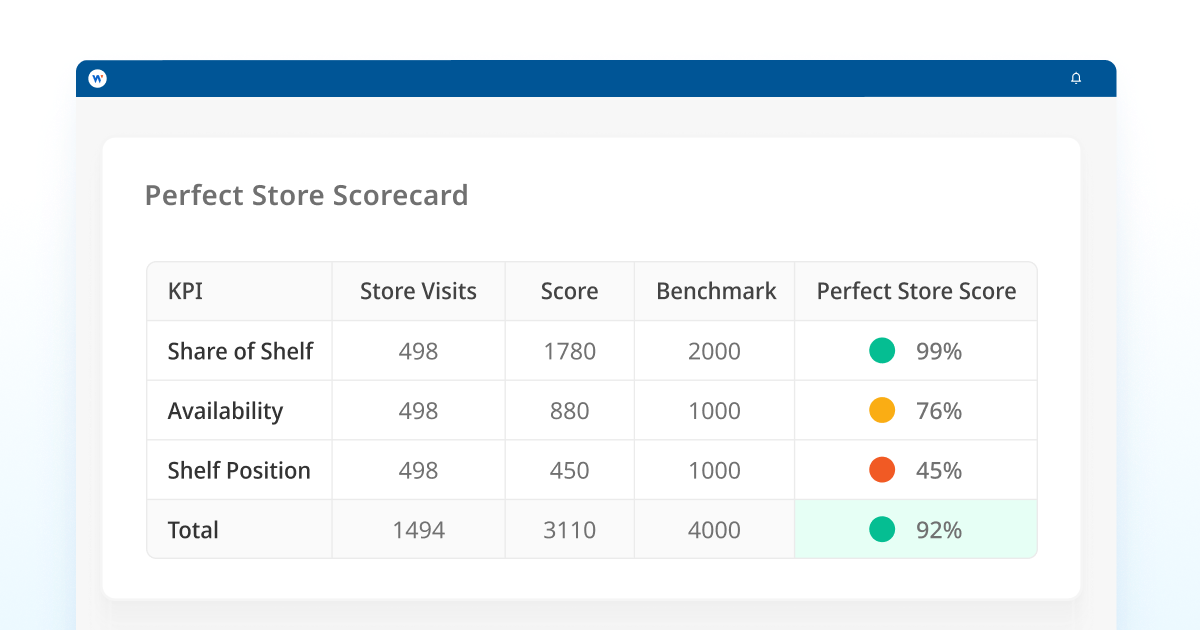

7. What is a perfect store program and why does it matter?

Perfect store scoring rolls multiple execution metrics—like compliance, availability, and display presence into one score. It simplifies tracking, lets you compare stores at a glance, and gives teams a benchmark for improvement.

Over time, perfect store scores can reveal patterns in execution excellence and pinpoint persistent problem areas. Brands can then set realistic improvement targets, focus resources where they’ll have the most impact, and track progress in a consistent way across the network.

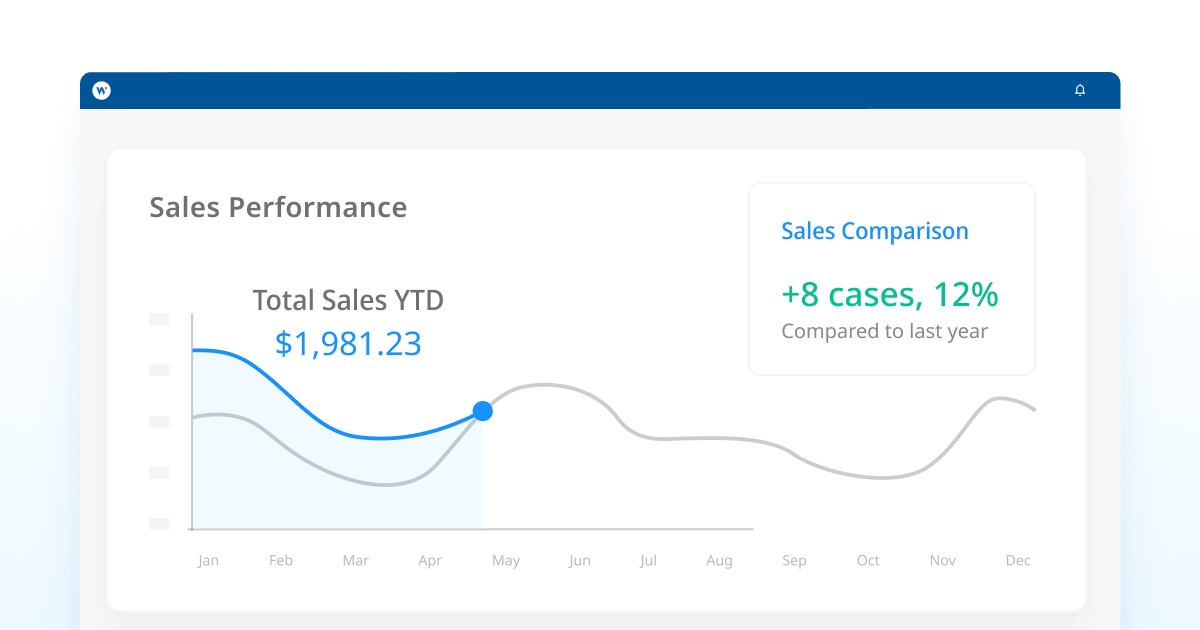

8. How can I connect store execution to sales results?

Integrating retail intelligence with POS, shipment, and inventory data shows how execution affects revenue. For example, you can see if displays not offering the minimum display quantity (MDQ) of items during a promotion directly caused lost sales in specific stores or regions.

This connection transforms execution data from a compliance tool into a profit driver. By tying store conditions directly to sales performance, you can prioritize interventions that have the greatest impact on revenue and margin.

9. How can I do category and competitive benchmarking?

Competitive benchmarking compares your retail performance to other brands in the same category. It reveals where you lead or lag in share of shelf, promotional presence, or price positioning so you can adjust strategy in context. It can also capture category trends over time, like the shifts in the seasonal aisle content, new SKUs entering the category, or the specific shipper displays a competitor put up in the aisle.

This perspective helps identify whether a decline in performance is due to your own execution or increased competitor activity. It also supports more informed negotiations with retailers by demonstrating your relative value in driving category growth.

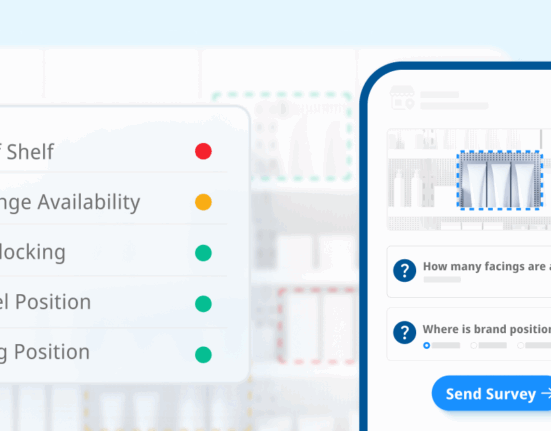

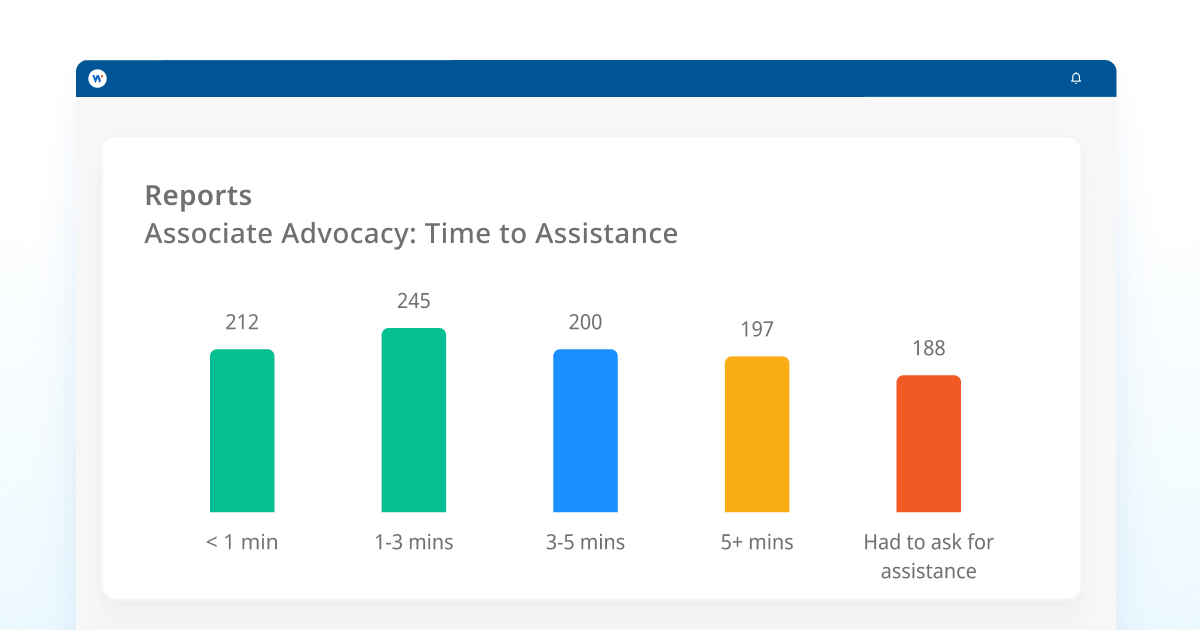

10. How can I measure the rate of recommendation from sales associates?

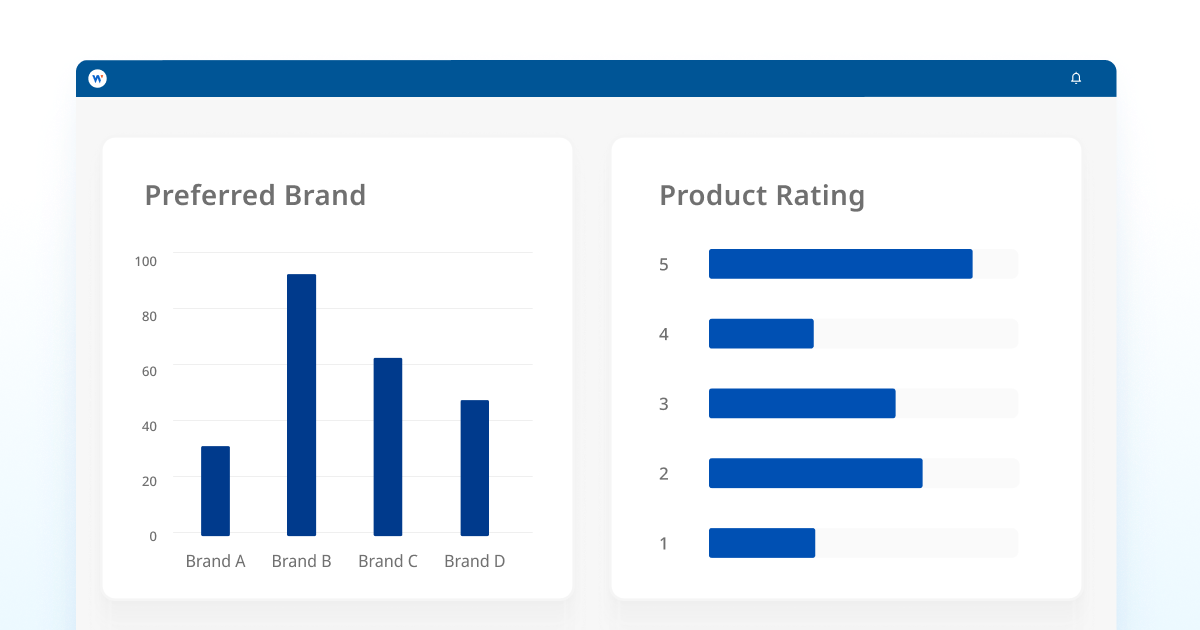

In-store retail intelligence can track whether sales associates are recommending your products to shoppers. By combining shopper insights, mystery shops, or post-purchase interviews, you can measure brand advocacy at the associate level and identify training or incentive gaps.

Measuring recommendation rates gives you an early signal of whether your frontline engagement strategy is working. High advocacy often correlates with better sales performance, while low rates can point to issues with product knowledge, pricing confidence, or competing incentives.

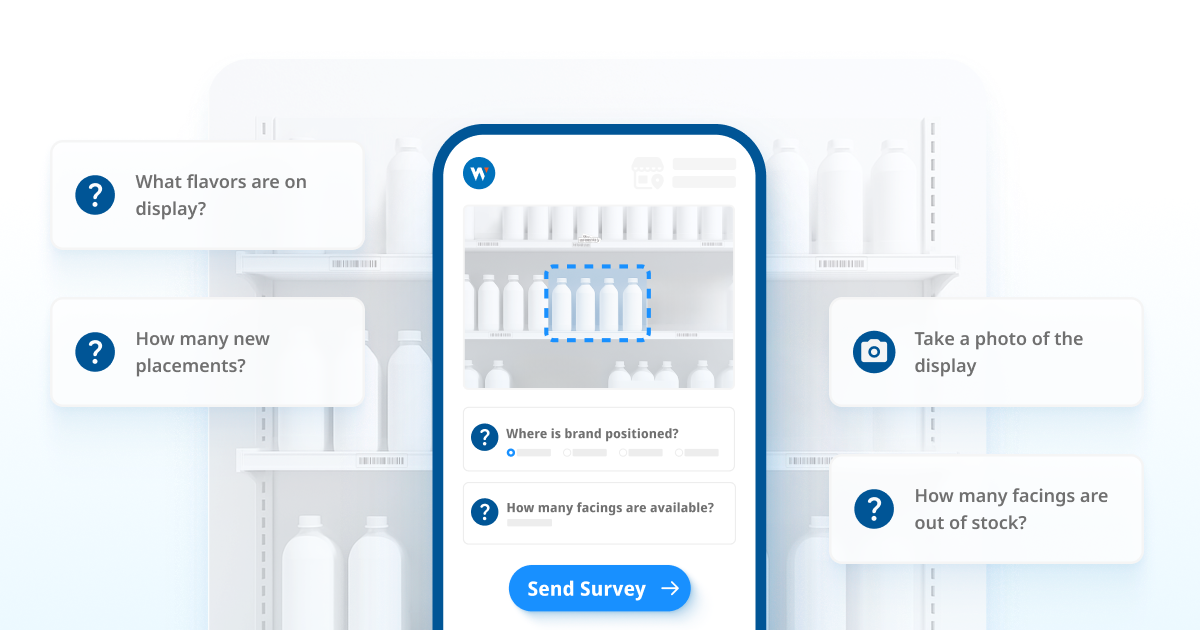

11. How can I measure shopper sentiment at the shelf?

Shopper sentiment capture uses surveys or intercept interviews to understand how customers perceive your product, pricing, or display in the moment. It adds the “why” behind execution data, helping you refine strategies for better shopper engagement.

By pairing sentiment with behavioral data (like purchase conversion rates), you can identify whether perception issues are preventing otherwise well-executed programs from delivering results and adjust messaging or merchandising accordingly.

12. How can I gather deeper shopper or associate insights?

Custom and long-form surveys go beyond quick checks, gathering in-depth feedback on brand perception, message clarity, or unmet needs. They complement quantitative retail intelligence with rich qualitative context.

This qualitative layer is often what turns raw data into strategic action. By understanding the motivations and barriers behind shopper behavior or associate performance, you can design programs that address the root causes rather than just the symptoms.

Why these capabilities matter now

Each of these questions addresses a different execution risk, from missed promotions to low associate advocacy to lost competitive positioning. Together, they give you the visibility, context, and speed needed to protect investment, improve compliance, and create a better shopper experience.

Calculate how the retail challenge you’re facing today impacts your bottom line with our ROI calculator.

Ready to Take the Next Step?

The most successful brands don’t just track retail execution; they act on it. Wiser Retail Intelligence brings these capabilities together into one platform, so you can see what’s happening in every store, understand why it’s happening, and respond before it impacts your bottom line.

Talk to our team today to learn how we can help you improve execution, maximize promotional ROI, and win at the shelf.

Glossary:

Crowdsourced Audits – Store visits performed by trained shoppers who collect real-time data on pricing, product placement, promotions, and shopper sentiment.

Image Recognition – AI technology that analyzes shelf photos to measure stock levels, facings, and planogram compliance at scale.

Perfect Store Program – A scoring system that combines multiple execution metrics (availability, display presence, compliance) into one easy benchmark for comparison across stores.

Planogram – A retailer’s schematic showing the exact placement and number of product facings on shelves.

First Moment of Truth – The instant when a shopper first notices a product and forms an initial impression that influences purchase decisions.

MDQ (Minimum Display Quantity) – The minimum number of items required on a display to meet promotional or merchandising standards.

Phantom Inventory – Stock that appears in a retailer’s system but is not actually available on the shelf for shoppers.

Category Benchmarking – Comparing your in-store performance (share of shelf, pricing, promotions) against competitors within the same product category.

POS Data (Point of Sale) – Transaction-level sales data collected at checkout, often used to link in-store execution to revenue results.

Shopper Sentiment Capture – Surveys or intercept interviews conducted at the shelf to measure how customers perceive your product, pricing, or display.

Last Updated September 2025