When brands think about retail execution, mass retailers like Walmart and Target often dominate the conversation—and for good reason. But some of the biggest share gains and growth opportunities sit within the more operationally constrained and often under-supported worlds of drug, dollar, and club channels.

Each of these formats comes with its own set of challenges, shaped by shopper habits, in-store operations, and varying levels of retail control. Winning across these environments requires audit strategies and execution plans that are tailored to the nuances of each channel.

In this blog, we’ll break down:

- What makes execution different in these channels

- Common issues and pain points

- How brands are adapting their audit and response strategies to stay ahead

Drug Stores: Low Footprint, High Turnover, Tight Control

The Challenge:

Chains like CVS, Walgreens, and Rite Aid typically run smaller-format stores with rapid product turnover and limited space for secondary placements. These retailers are highly structured, which can limit store-level flexibility and delay on-the-ground adjustments.

Common Execution Issues:

- Planogram resets delayed or partially executed due to staffing or logistics

- Out-of-stocks lingering without timely replenishment

- Seasonal or pharmacy-focused merchandising crowding out CPG displays

- Pricing inconsistencies tied to weekly ad changes

Smart Retail Audit Strategies:

- Run quick, photo-driven compliance checks for shelf resets

- Audit for presence of promotional signage or secondary placements in tight aisles

- Pair in-store audits with online checks to monitor local pricing consistency

Pro tip: Even a 10-minute mystery shopper visit can confirm compliance in 20+ key categories. These “lite audits” allow you to scale visibility across the full fleet without overloading budgets.

Dollar Stores: Wide Reach, Lean Teams, Fragmented Execution

The Challenge:

Chains like Dollar General, Family Dollar, and Dollar Tree have expanded aggressively and become high-velocity channels for value-driven CPG products. But store-level execution often suffers due to lean staffing, operational constraints, and rapid growth.

Common Execution Issues:

- Disorganized shelves or product dumping

- Promotions not set due to staff availability

- High SKU density in small store formats

- Persistent out-of-stocks for fast-moving items

Smart Retail Audit Strategies:

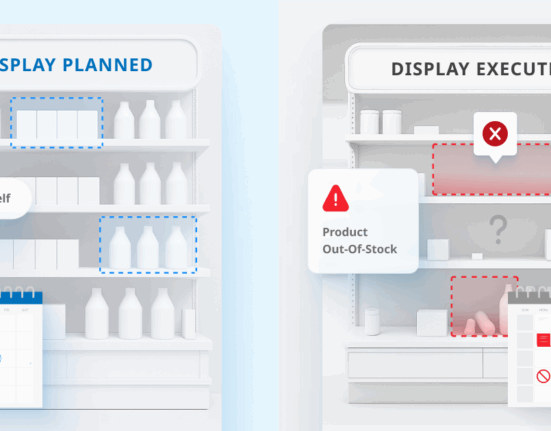

- Use audits to gut-check SKU presence, shelf condition, and whether displays are built—not just shipped

- Prioritize low-coverage or rural stores for crowdsourced audits where field teams have limited reach, especially in markets where visibility is hardest to maintain

- Monitor execution during key promotional periods like back-to-school, Halloween, and seasonal resets to identify consistent breakdowns and create retailer-specific improvement plans

Why it matters: Dollar stores often dominate in underserved or rural markets. Visibility here ensures your brand remains present and available to price-sensitive, impulse-driven shoppers.

Club Stores: Fewer SKUs, Bigger Stakes, All-or-Nothing Execution

The Challenge:

With retailers like Costco, Sam’s Club, and BJ’s, brands operate in a highly curated environment—few SKUs, limited facings, and strict merchandising standards. At Costco in particular, brands often have limited influence once the product hits the floor, and execution success relies heavily on warehouse staff and early-stage coordination.

Common Execution Issues:

- Pallets missing signage or shelf strips

- Incorrect stacking or display orientation

- Incorrect pricing displayed on digital shelf tags

- Delayed set-up of new promotions or special packs

Smart Retail Audit Strategies:

- Conduct audits focused on full-pallet presentation—check for signage, stack configuration, and SKU availability

- Audit the actual placement of the pallet in-store to understand impact on performance

- Align audits with the first 7–10 days of a promotional window, when most volume moves and response time is still actionable

- Flag recurring issues across warehouses to support conversations with buying and operations teams

Key insight: At club, it’s not about a wide assortment—it’s about getting execution right. A single pallet error can erase weeks of promotional planning. Early detection through focused audits helps brands escalate fast and protect volume.

Cross Channel Best Practices: How Leading Brands Adapt

Regardless of channel, here are a few universal truths we’re seeing from the best execution teams:

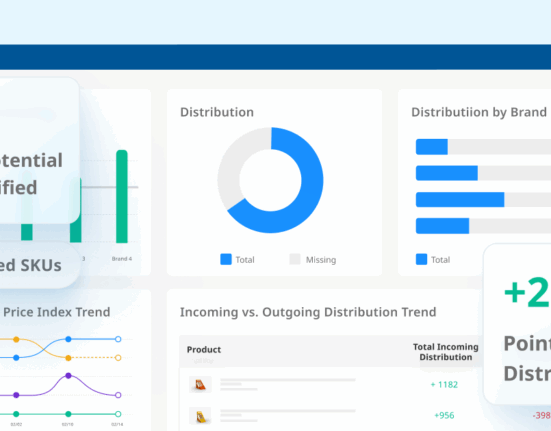

✅ Adapt audit depth and frequency by store type. Make checklists actionable, tailored, and aligned to each retailer’s operating model.

✅ Leverage crowdsourcing to supplement coverage. With thousands of stores and limited field bandwidth, flexible audit models help cover more ground without overstretching budgets.

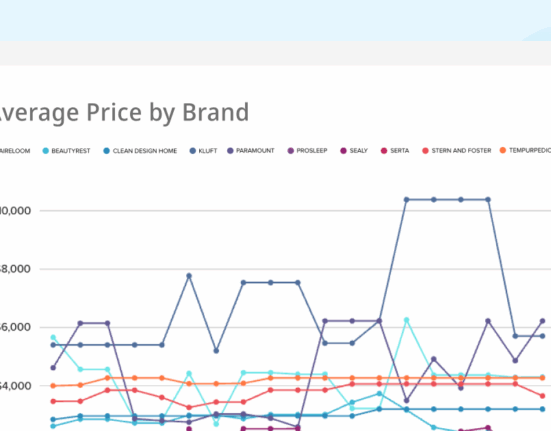

✅ Tie audits to other data sources. Layering audit findings with shipment, POS, and digital shelf data gives brands a more credible, complete view of execution—and helps justify next steps with retail partners.

Final Thought: Execution Is a Moving Target—Be Ready to Adjust

Winning in mass retail is only part of the picture. Drug, dollar, and club channels operate on different rules, and demand different approaches.

Execution isn’t static—and it isn’t perfect. But with channel-specific audits, smart coverage strategies, and connected data, brands can stay ahead of the gaps and show up where it counts.

Right place. Right way. Right time.