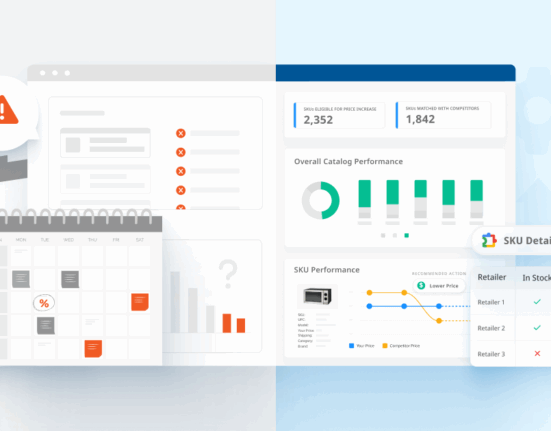

One of the major challenges we see brands facing is the underutilization of data analytics in retail execution. In some cases, it’s about not using enough data; but more often, it’s about poor actionability tied to the data received. While data-driven strategies are becoming more widespread, CPG brands often still lag other industries when it comes to leveraging big data for action-based insights. Much of this is due to fragmented data sources from multiple retailers and channels, as well as traditional business models and slower decision-making processes, hampering their ability to adopt real-time, data-driven strategies compared to more agile industries like tech and e-commerce.

The Need for Real-Time Shelf Data

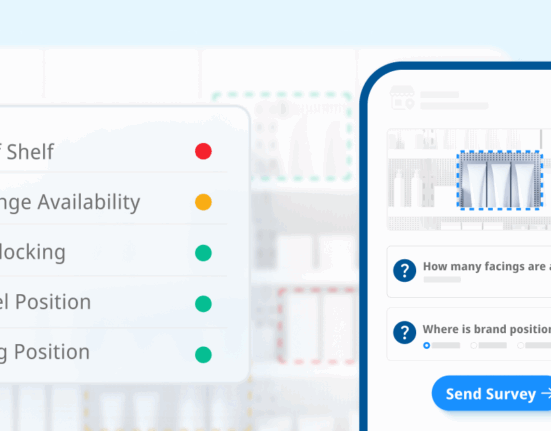

Many brands continue to rely heavily on traditional data sources like Nielsen or IRI to analyze sales trends. However, these sources provide only part of the picture. What’s often missing is the real-time, granular insights from the shelves where purchase decisions are made. At Wiser, this means understanding the “why” behind the “what.” Take a common scenario: brands, especially those in emerging markets or launching new products and promotions, can compare anticipated sales lift to actual results. But when things don’t go as planned, identifying the cause remains a guessing game. Was a promotional display set up next to a competitors? Or was the shipper tossed upon arrival? Is inventory sitting in the back room, unopened by store associates (a frequent issue in dollar stores)? Was it poor product placement by a distribution partner? Without precise data, it’s tough to pinpoint the root cause of underperformance at the store or regional level.

Consider a specific example from our customer, So Good So You (SGSY) SGSY faced challenges ensuring that their wellness shots were consistently available and properly merchandised across key retailers. Common problems included delays in re-stocking popular products like immunity-boosting and energy shots and frequent out-of-stock situations due to high demand or phantom inventory. Compounding these issues was the delayed picture that sales data could provide, making it hard to respond promptly to these problems. As their Head of Retail Operations noted, “It sometimes took weeks before we even realized there was an issue. By the time we knew, we had already lost [sales] opportunities.”

Wiser tackles these challenges directly with:

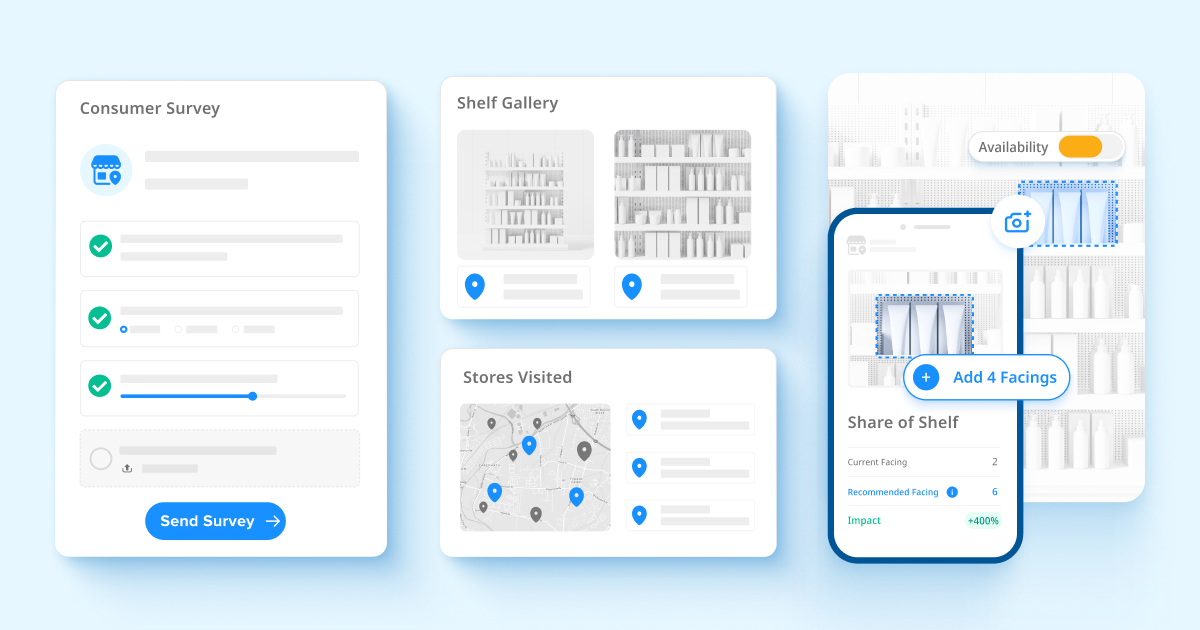

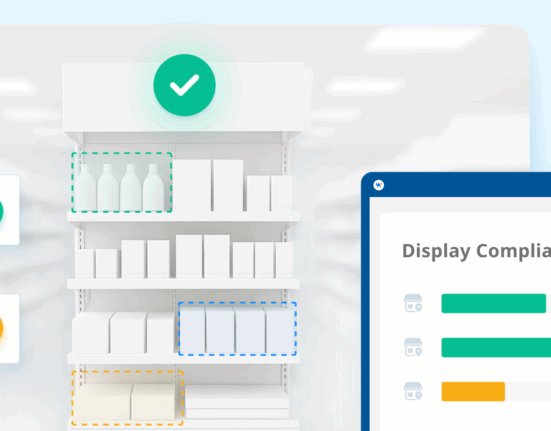

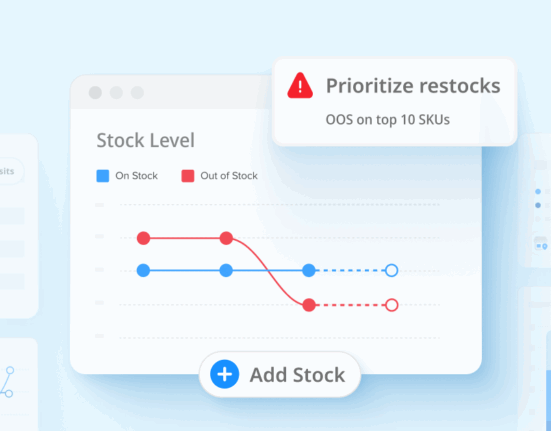

- Expansive shopper networks that report on the health of products and the shelf in regions without field teams. This includes capturing in-store images, monitoring product placement, and tracking stock levels, connecting the “what” (such as lower sales) more directly to the “why.”

- Wide-ranging customer surveys to gather feedback on shopper preferences, such as which SKUs to introduce in specific regions. The feedback supports pitches to retail buyers and drives successful product expansions.

- Integrated datasets that normalize and layer sales data with in-store actions, offering a comprehensive view of shelf performance and team effectiveness.

- Predictive analytics and automated reporting tools built into a CPG-oriented workflow, enabling brands to focus on execution instead of data gathering.

Supported by a platform that unifies all store-level data and provides scalable, shelf-level insights, brands like Ferrero and Kellogg can also optimize in-store execution at the store level in real-time.

If you’d like to learn more about our work in the CPG space and explore how we can help you drive sales growth, please reach out.