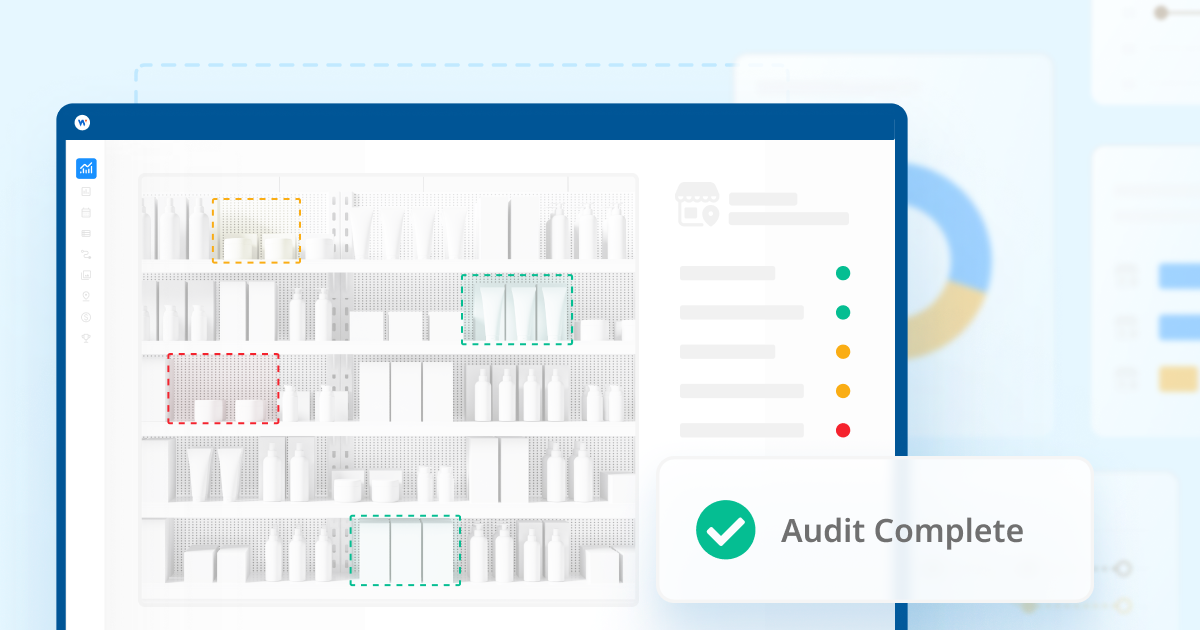

Essential Knowledge to Optimize Your Retail Audit Process

A well-executed retail audit provides critical visibility into everything from shelf conditions and associate performance to customer sentiment and promotional effectiveness. However, each channel presents its own challenges—both operationally and in terms of data access. Below, we’ll explore seven major retailer types, the unique hurdles they pose, and how you can leverage crowd-based or third-party audits to stay ahead.

Mass Retailers (e.g., Walmart, Target)

Common Challenges

Mass retailers encompass large footprints and high-traffic environments that can lead to:

- Disorganized shelves caused by rapid shopper turnover and incomplete restocking

- Limited staff availability or turnover, causing missed planogram resets and persistent out-of-stock items

- Broad geographic reach, making it difficult to maintain consistent store execution across hundreds or thousands of locations

How Mystery Shoppers and Audits Help

Crowdsourced store visits can cover a wide number of doors quickly, verifying planogram compliance, shelf conditions, and promotional placements. Regular audits—supported by photo evidence—highlight exactly where problems arise, so you can take corrective actions faster. By combining objective data from multiple regions, you also gain a “big picture” view of brand presence and key performance trends in mass-market channels.

Tip: Implement large-scale, photo-verified audits that emphasize planogram compliance, promotional display accuracy, and timely out-of-stock detection across high-foot-traffic, geographically dispersed store networks.

Grocery Retailers

Common Challenges

Grocery retailers can be national chains or smaller, region-specific grocers. Common issues include:

- Managing multiple SKUs across diverse categories, increasing the risk of mislabeled pricing or missing items

- Promotional displays that may be overlooked or removed prematurely, limiting ROI on trade marketing

- Frequent employee turnover, which can disrupt proper shelf stocking and product rotation

How Mystery Shoppers and Audits Help

Well-structured audits allow focus on priority SKUs to confirm availability and accurate pricing. Photo documentation—especially for displays and endcaps—ensures promotional efforts are executed correctly. By integrating regular visits (daily, weekly, or monthly), you can track accurate trends around inventory turnover and on-shelf compliance. This data-driven approach helps optimize merchandising strategies, reduce out-of-stocks, and bolster category performance.

Tip: Focus audits on core SKUs and seasonal promotions, leveraging in-person checks and visual proof to maintain accurate shelf placement, proper product rotation, and consistent availability in a fast-turnover environment.

Independent or Convenience Stores

Common Challenges

Convenience (c-store) and independent retailers often have small formats, making it tougher to monitor each location. Typical hurdles include:

- Limited or cramped shelf space, jeopardizing brand visibility and leading to frequent out-of-stocks

- Fragmented ownership structures, making it more difficult to implement and track standardized promotions

- High reliance on impulse-driven products, requiring regular restocking and clear displays to capture shopper attention

How Mystery Shoppers and Audits Help

Discrete visits can quickly gauge shelf conditions, promotional signage, and impulse-section effectiveness. For brands, these audits reveal whether product lines are consistently stocked and if displays align with guidelines. Regular data collection across many small operators helps build a cohesive understanding of in-store execution, ensuring both established and emerging brands have a clear path to market success in these localized settings.

Tip: Conduct frequent, discreet audits that capture shelf conditions, impulse-item availability, and display compliance, ensuring each independently owned location maintains brand standards despite limited space and staffing.

Natural Channel (e.g., Whole Foods, Specialty Natural Stores)

Common Challenges

Natural channel retailers prioritize specialty items and higher product standards, which can lead to:

- Selective shelving requirements that make it harder to secure or retain shelf space

- High expectations for attractive displays and consistent stock, as customers often perceive these stores as premium

- Consistent introduction of new products, making it difficult to stay on top of the competition

How Mystery Shoppers and Audits Help

Frequent audits reveal whether your products are displayed according to brand guidelines and remain in-stock. Photos of shelves, promotional stands, and signage are particularly useful in capturing the level of brand representation. By comparing feedback across multiple natural retailers, brands can fine-tune distribution strategies and maintain the high-quality presentation that this channel’s shoppers expect.

Tip: Use targeted audits to confirm that specialized merchandising, strict product standards, and premium shelf presentations are upheld — validating both in-stock consistency and brand image in health-focused environments.

Club Retailers (e.g., Costco)

Common Challenges

Club retailers focus on bulk sales, often requiring membership. Notable issues include:

- Replacement-Style Inventory: Slower-moving items might be rotated out entirely, complicating your ability to maintain continuous shelf presence.

- Membership & Geographic Constraints: Tracking execution is tougher when you can’t easily dispatch your own teams everywhere or rely on existing data streams.

- Bulk Displays & Damage: Pallet-style displays can be prone to damage or disorganization, particularly in high-traffic areas.

How Mystery Shoppers and Audits Help

Regular in-person checks provide concrete evidence about whether an item has been replaced once out of stock, how pallets are displayed, and if signage is in place. By tapping into a crowd that already holds memberships, brands can bypass any geographic and access limitations to gather up-to-date intel from many locations. These audits help clarify inventory rotation patterns, reduce the risk of overlooked stock, and preserve brand image within busy warehouse-style environments.

Tip: Coordinate membership-based audits to monitor large pallet displays, inventory rotation practices (including replacement-style restocking), and overall presentation, ensuring that bulk items remain visible, undamaged, and properly merchandised.

Drug Store Retailers

Common Challenges

Drug stores often blend healthcare, beauty, and convenience items under one roof. Typical challenges include:

- Limited staff on the floor, creating gaps in restocking or customer service

- Certain products locked behind counters or in cabinets, making them harder to audit and purchase

- Large beauty or personal care sections prone to clutter, mismatched pricing, or incomplete planograms

How Mystery Shoppers and Audits Help

Mystery shoppers can confirm if locked items remain accessible and properly labeled, while also gauging cleanliness and organization in categories like cosmetics. Targeted audits let you focus on your high-priority segments—identifying whether promotions, special endcaps, or secondary placements are functioning as intended. This consistent stream of data clarifies which stores maintain strong brand compliance and which require additional support.

Tip: Center audits on locked merchandise, high-margin health and beauty categories, and planogram adherence, verifying that products remain accessible, correctly priced, and visually appealing under limited staffing conditions.

Dollar Store Retailers

Common Challenges

Dollar stores serve cost-sensitive audiences, typically in smaller footprints with a high turnover of merchandise. Key pain points include:

- Messy or poorly organized shelves, where product placement and signage can be easily overlooked

- Fewer employees to manage displays or restock items, amplifying the chance of missed opportunities

- Rapidly changing assortments, as the store frequently rotates or adds low-cost products

How Mystery Shoppers and Audits Help

Crowd-based audits confirm that merchandise is priced and displayed correctly while ensuring shelves stay stocked with relevant SKUs. By reviewing key sections (e.g., front displays, promotional bins, endcaps), you gain insight into foot traffic patterns and the quality of brand presentation. This information makes it easier to detect problem areas, protect your brand reputation, and capitalize on consumer expectations for low-cost convenience.

Tip: Perform regular shelf checks and price validations to confirm merchandise is effectively displayed, replenished, and labeled, minimizing the impact of cluttered layouts and rapidly changing assortments in cost-sensitive settings.

Real-World Success Stories

Confectionery Placement in C-Stores: A confectionery brand struggled to keep its items visible in independently operated convenience stores. By deploying a discreet audit program, they collected real-time photos of checkout counters and impulse sections, revealing that products were often hidden or placed behind competing SKUs. Armed with store-specific data, the brand’s teams worked closely with store managers to reposition products, resulting in a significant increase in front-of-store compliance and a boost in impulse-driven sales.

Display Verification in a Grocery Chain: A snack manufacturer rolled out secondary displays in a major regional grocery chain but received reports of missing or misassembled units. Through routine audits, they confirmed that nearly a quarter of endcaps were either noncompliant or replaced prematurely. With clear photo evidence and location details, the brand collaborated with the retailer to correct display issues, ultimately restoring proper visibility in over 90% of audited stores and driving measurable sales lift.

Competitive Audit for a Frozen Food Brand: A frozen food brand competing in a large warehouse club suspected their rival enjoyed better product placement. They organized membership-based audits to capture shelf photos, promotional signage, and item placement in freezer aisles. Auditors discovered the competitor’s products held prime visibility, while the brand’s items were harder to spot. This data led to negotiations for improved display locations and more compelling promotions, driving higher sell-through rates once the brand secured better in-store positioning.

Best Practices for Your Retail Audits

Plan and Schedule Consistent Audits

Vary the frequency and depth of audits based on your brand’s goals, SKU complexity, and the retailer’s importance.

Standardize Data Collection

Use clear instructions, digital tools, and photo capture to create uniform reporting. Consistency drives better comparisons over time.

Prioritize Swift Corrective Action

Once issues are found—like out-of-stocks or mispriced items—act quickly to minimize missed sales and brand damage.

Leverage Crowdsourced Coverage

Enlisting a broad network of shoppers or a third-party partner lets you gather geographically dispersed feedback, even in membership-based or niche channels.

Refine and Repeat

Build on each cycle of audits, learning which methods and metrics best pinpoint true performance gaps. Continuous measurement leads to continuous improvement.

By dedicating attention to each unique channel and harnessing on-the-ground insights—particularly in places where data is often scarce—you’ll establish a more consistent, impactful retail presence. Whether you’re tackling the mass market or niche channels, targeted retail audits can help you keep the shopper experience top-notch and protect your brand at every turn.