In today’s retail landscape, convenience and flexibility continue to play a key role in winning customer loyalty. While Buy Online, Pick Up In-Store (BOPIS) has been around for some time, it has seen significant growth in recent years due to shifting consumer behaviors and the increased demand for omnichannel experiences. This approach combines the ease of online shopping with the immediacy of in-store pickup, offering a win-win for both consumers and retailers.

For Consumer-Packaged Goods (CPG) brands, embracing BOPIS is not just about keeping up with the times—it’s about turning logistical challenges into growth opportunities.

In this blog post, we’ll explore what BOPIS is, its impact on CPG brands, how brands can leverage it for their advantage, and how a platform like Wiser can optimize execution and on-shelf availability to stay ahead of the competition.

What Is BOPIS?

Buy Online, Pick Up In-Store (BOPIS) is a retail strategy where customers purchase products online and collect them from a physical store at their convenience. This method marries the convenience of online shopping with the immediate gratification of in-store pickup, eliminating shipping fees and reducing wait times. It’s become increasingly popular, especially after the surge in demand for flexible shopping options during the pandemic.

BOPIS not only enhances customer satisfaction but also drives additional foot traffic into stores, presenting opportunities for cross-selling and upselling. However, implementing BOPIS isn’t without its challenges, particularly for CPG brands that need to balance online and in-store inventory demands.

The Effects of BOPIS on CPG Brands

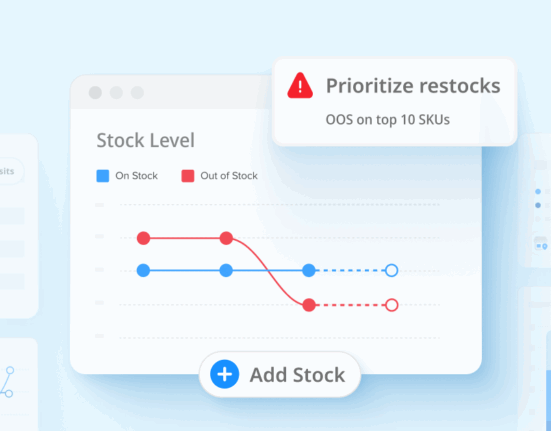

Inventory Management Challenges

One of the most significant impacts of BOPIS on CPG brands is the complexity it adds to inventory management. Traditionally, physical stores maintain inventory levels based on walk-in customer demand. With BOPIS, stores must also account for online orders reserved for in-store pickup, which can tie up inventory and delay replenishment cycles.

For example, when a customer places a BOPIS order, the item is reserved and remains in the store’s inventory until picked up. This can lead to situations where inventory meant for walk-in customers is unavailable, potentially resulting in lost sales and dissatisfied customers.

The blending of sales channels also affects inventory management. Accurate forecasting becomes more difficult when it’s unclear which channel will drive demand. Misalignment can lead to overstocking in one area and stock-outs in another, negatively impacting on-shelf availability and customer satisfaction.

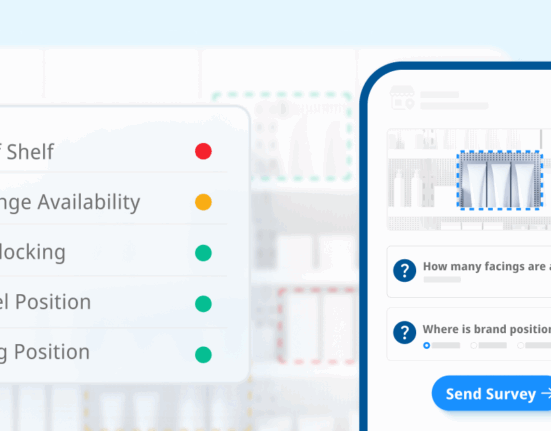

On-Shelf Availability and Out of Stock Risks

Delayed pick-ups in BOPIS can exacerbate out of stock risks. Since BOPIS orders can block inventory for extended periods—sometimes up to 30 days depending on the retailer’s management systems—there’s a strain on on-shelf availability. This scenario is particularly challenging for CPG brands with perishable goods or high-turnover products.

Stock-outs not only result in immediate lost sales but can also erode brand loyalty. Customers faced with empty shelves may switch to competing brands, affecting long-term profitability.

Complexities in Sales Tracking and Data Analysis

One significant impact of BOPIS on CPG brands is the complexity it introduces in tracking sales data between online and in-store channels. Traditionally, sales metrics for online and physical stores are tracked separately, each offering distinct insights into consumer behavior and performance. However, BOPIS blurs these lines, making it challenging to attribute sales accurately to either channel.

For instance, a customer may browse products online, make a purchase, and pick up the item in-store. Should this sale be attributed to the online channel because the transaction occurred there, or to the physical store because the fulfillment and potential for additional in-store purchases happen there? This ambiguity complicates sales analysis, inventory forecasting, and performance evaluations.

Challenges Across Various Teams

Within a single organization, different teams often manage online and in-store operations. Marketing strategies, sales targets, and performance metrics may vary between these teams. BOPIS requires a collaborative approach, but the overlapping responsibilities can lead to internal challenges:

- Attribution of Sales: Determining which team gets credit for the sale can impact commissions, incentives, and resource allocation.

- Data Integration: Disparate systems for online and in-store data can make it difficult to consolidate information for a comprehensive analysis.

- Strategic Alignment: Aligning goals and strategies across teams becomes more complex when sales channels are intertwined.

These challenges can hinder a brand’s ability to understand consumer behavior fully, optimize marketing efforts, and make informed business decisions.

How Brands Can Win Using BOPIS

Despite these challenges, BOPIS offers significant opportunities for CPG brands willing to adapt and innovate.

Optimize Inventory Management

Implementing an integrated inventory management system is crucial. Real-time tracking of inventory across both online and physical channels ensures accurate availability information and reduces the risk of stock-outs. By forecasting demand for both walk-in and BOPIS customers, brands can adjust their base-stock levels to meet overall demand efficiently.

Prioritize Customer Experience

Customer satisfaction should remain at the forefront. Clear communication regarding order status, pickup instructions, and store policies enhances the BOPIS experience. Training staff to handle BOPIS orders efficiently can reduce wait times and improve the customers’ perception of the brand.

Leverage Data Insights

BOPIS provides valuable data on consumer behavior. Brands can analyze purchasing patterns to optimize product placements, tailor marketing efforts, and predict future trends. This data-driven approach allows for more strategic decision-making, improving both sales and customer satisfaction.

Implement Flexible Policies

Adjusting policies around BOPIS order reservations can mitigate inventory blocking issues. For instance, setting reasonable pickup windows and automating restocking processes for unclaimed orders can help maintain optimal inventory levels.

How Wiser Can Help Optimize BOPIS for CPG Brands

Navigating the complexities introduced by BOPIS requires robust tools and strategic insights. This is where Wiser, a leading retail analytics and execution platform, becomes invaluable.

Wiser offers a comprehensive solution that unifies sales data from both online and in-store channels, providing a consolidated view that enables accurate sales attribution and deep insights into customer behavior, sales trends, and inventory dynamics. By integrating advanced analytics with real-time inventory visibility, Wiser helps brands optimize stock levels, improve demand forecasting, and reduce the risk of stock-outs or overstocking. The platform’s shared dashboards and reporting tools facilitate collaboration across different teams, promoting transparency and alignment within the organization. Additionally, Wiser’s insights empower brands to personalize marketing efforts with tailored promotions and recommendations, enhancing customer engagement, driving loyalty, and boosting repeat business.

Conclusion

BOPIS is more than a retail trend; it’s a strategic imperative in the modern consumer landscape. For CPG brands, embracing BOPIS can lead to increased sales, enhanced customer loyalty, and valuable data insights. However, the associated challenges, particularly in inventory management and on-shelf availability, require careful navigation.

Platforms like Wiser offer the tools and insights necessary to turn these challenges into opportunities. By optimizing inventory levels, enhancing customer experience, and leveraging data, brands can not only mitigate the risks associated with BOPIS but also capitalize on its full potential.

In an ever-evolving market, staying ahead means embracing innovation and leveraging technology to meet customer needs. BOPIS, supported by intelligent platforms like Wiser, positions CPG brands to thrive in this dynamic environment.