Breaking Into Retail Is Tough. Data Can Help.

New brands trying to grow in retail often face the same issue: limited visibility. It’s not about product quality. It’s about proving that the product works when it’s actually on the shelf.

That starts with showing the right data. Retail Intelligence gives you what you need to show execution, performance, and potential, all in one place.

This article walks through how newer brands can use Wiser’s tools to get real numbers, learn from them, and build a story that buyers can trust.

Why New Brands Struggle Without Retail Execution Data

Buyers have too many products to evaluate and not enough time. If your brand is unknown, they look for signs of risk: no sales history, small team, no proof the product will move.

That’s where many brands hit a wall. Good ideas fail when execution isn’t visible or consistent.

You don’t need more spin. You need to show what’s happening in stores and why it matters.

Why In-Store Visibility Comes First

If your product isn’t on the shelf, nothing else matters. A strong retail story starts with clear execution data.

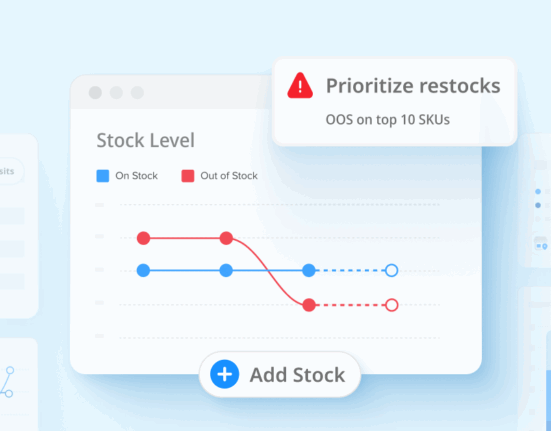

Wiser helps you track:

- Whether your product made it to shelf

- If it was stocked and placed correctly

- When and where it sold

- How it compared to other brands

- What shoppers thought when they saw or bought it

This is practical data you can act on. It also helps you explain wins and losses without guessing.

How to Use Retail Intelligence and Crowdsourced Data to Build a Brand Story

Once you’re in even a handful of stores, the next step is to learn what worked and use that to open more doors. Here’s how:

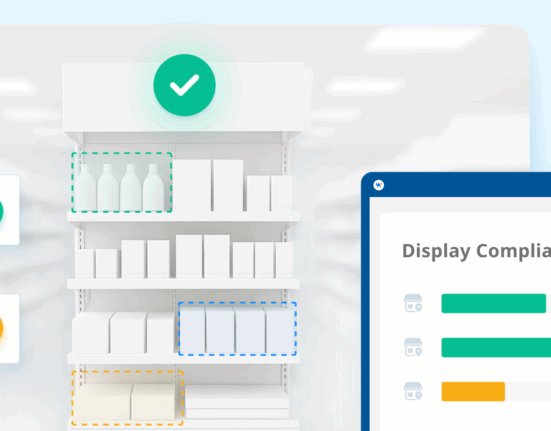

1. Prioritize Store Execution

Get eyes on the shelf. Whether through your team, a partner, or Wiser’s crowd, make sure your product is available and displayed right. If you don’t know what happened, you can’t explain the results.

2. Connect Sales and Store Conditions

Don’t just look at total sales. Use Wiser’s store-level data to spot patterns:

- Which stores had good retail displays and strong sales

- Which stores underperformed and why

- How sales change when displays or stock levels change

This helps you avoid guessing and focus on facts.

3. Listen to Shopper and Customer Feedback

Use surveys or mystery shopper data to collect:

- Feedback on packaging and shelf visibility

- Purchase intent and what mattered in their decision

- Thoughts after using the product

This adds depth to your report. You’re not just saying the product sold—you’re showing why.

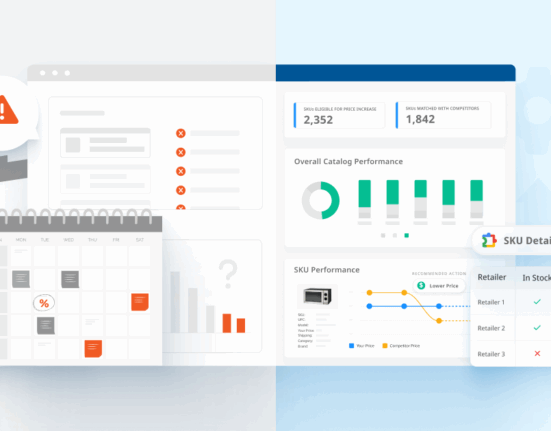

4. Package Retail Data Into a Clear Report

Bring all your data together: store visits, execution, sales, and shopper feedback. Put it into a format that’s easy to share and consistent across new launches.

Wiser lets you create simple reports that show what happened and why it matters. This becomes your proof when talking to new buyers.

Why This Approach Improves Retail Strategy

When you show that you’re tracking performance at store level, acting on insights, and closing gaps, buyers see you differently. You’re not just asking for shelf space. You’re showing that your brand can perform when given the chance.

That matters, especially in categories where most new items don’t last long.

Final Takeaway: The Value of Retail Intelligence for Emerging Brands

Good products need more than good marketing. They need to be seen. They need to be available. And they need data to back up their impact.

Retail Intelligence helps you tell that story clearly. For new brands, that can be the difference between staying local or scaling into new accounts.

Useful Links

→ Wiser’s Retail Intelligence Solution

→ How Retail Audits Work

→ Talk to Our Team

Suspect there’s a bottleneck impacting your brand story? Calculate the impact of missed retail execution opportunities here.