Tariffs are up, but prices increases are lagging

With raw materials like wood, metal, and foam hit by new tariffs in early 2025, the expectation was clear: furniture prices would rise, and fast. But if you’ve been tracking online prices across major retailers, that story hasn’t played out so directly. In fact, average prices across chairs, mattresses, and tables have shown anything but a straightforward inflationary trend.

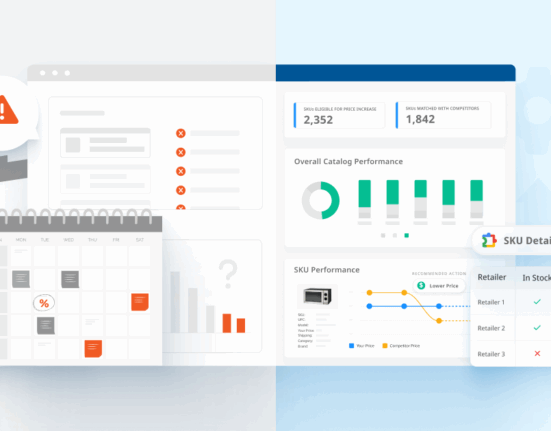

Brands and retailers are getting creative, using tactics like promotional resets, assortment changes and SKU rotation to manage cost pressures under the radar. The result? Pricing that appears stable on the surface but is actually fluctuating in strategic, category-specific ways.

Volatility signals strategy, not crisis

Take chairs, for example. Prices dropped, then surged, in some cases rebounding nearly 90% over just 12 weeks. These kinds of V-shaped trends aren’t signs of market instability; they’re markers of margin tactics, end-of-season clearances, and fresh assortment rollouts. Mattresses followed a different playbook: staggered markdowns, volatile rebounds, and brand-level strategies that masked broader declines.

Retailer behavior also diverged. Walmart maintained consistency, potentially leveraging pre-tariff inventory or domestic sourcing, while Macy’s and Bloomingdale’s made bolder moves, especially in high-end categories. This selective approach to tariff pass-through reveals the balancing act many are facing: absorb costs now or risk losing price-sensitive shoppers?

The Real Story Is What You Don’t See

The biggest takeaway? The full impact of tariffs may still be coming. By delaying or softening cost increases, brands are protecting shelf prices (and consumers)… for now. But future hikes could be steeper or more sudden. Our analysis underscores why SKU-level tracking is essential: broad averages alone don’t capture the strategic shifts happening in the background.

This isn’t just theoretical. In mid-May, Walmart announced it would begin raising prices on over 4,200 popular items, including home goods and furniture, due to elevated tariffs on Chinese imports. Despite sourcing two-thirds of its U.S. goods domestically, the retailer acknowledged that the scale of the tariffs surpasses what any retailer can handle without passing costs on to consumers.

The price hikes are coming. The smart play is knowing where (and when) to shape your response.