Sophie Arcucci provides insights into the performance of drive-through chains, the challenges facing SMEs and the keys to success.

FEEF : What are the main figures on retailers’ performance ?

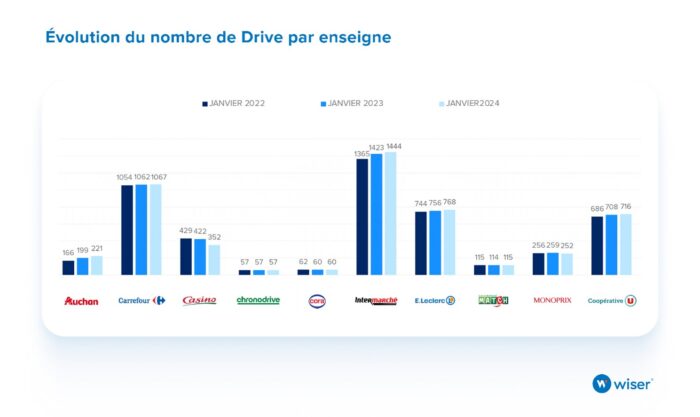

Sophie Arcucci : An analysis of the number of new drives opening in France reveals a clear trend: the regions with the highest number of openings, such as Île-de-France, Aquitaine, and Rhône-Alpes, are often those with large consumer catchment areas and high population density. The Île-de-France region, which leads the way with 28 openings, is a good illustration of this dynamic, because of its large urban population and high purchasing power, which favours the growth of drive-through outlets over convenience stores.

Similarly, Aquitaine and Rhône-Alpes, with 8 and 6 openings respectively, show how areas with strong economic and tourist activity are favouring the expansion of drive-in services to meet the needs of a growing population and seasonal visitors. This expansion could be seen as a direct response to consumers’ expectations for greater convenience and efficiency in their shopping habits.

FEEF : What are the three main challenges for SMEs ?

Sophie Arcucci :

Challenge 1 : Finding a place in a limited range of products !

For SMEs, getting into and staying in a chain’s limited range, especially in the context of drives, involves a series of strategic challenges and negotiations. The process of negotiating with retailers is fundamental, and must be approached with a clear understanding of the concept of holding drive-through products.

The average range of products in supermarket chains varies considerably.

Carrefour dominates with an average range of 21,324 products, offering a comprehensive shopping experience. In contrast, ChronoDrive offers an average range of 8,145 products, optimised for quick and essential purchases. For independent chains, E. Leclerc has an average range of 10,786 products, Intermarché has an average range of 15,402 products (an increase of 42.8% on E. Leclerc), and Système U offers an average range of 16,232 products (50.5% more than E. Leclerc).

These differences illustrate distinct strategies adapted to different consumer segments. In terms of logistical implications, drive-in services can make use of in-store picking, often enabling the average assortment to be extended by taking advantage of in-store stock availability. This contrasts with remote drives, where the assortment can be more limited due to the specific and separate storage space. In this way, chains with in-store picking can better meet consumer expectations in terms of product variety, while remote drives could focus on efficiency and speed of service.

This configuration has a direct influence on the assortment strategy of each retailer, which seeks to strike a balance between product diversity and efficiency.

SMEs need to approach negotiations with an awareness of these strategies and align their offerings accordingly. Each retailer’s assortment strategy can vary greatly, with some focusing on product diversity and others on specific categories where they want to develop market strength.

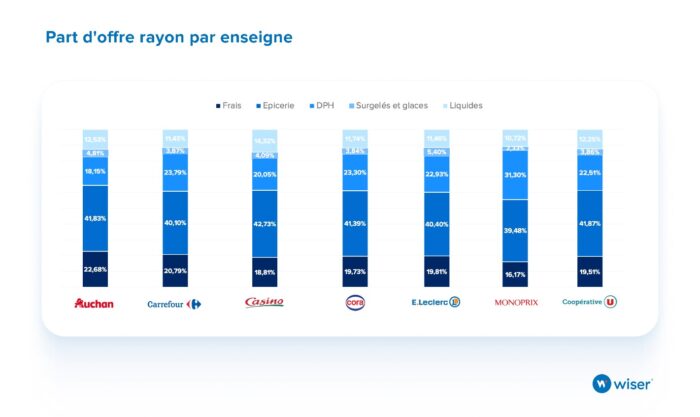

General Trends :

- Groceries : This category is predominant across all formats, accounting for around 40% of the range. This underlines the importance of basic products, which are essential in the offers of the drives.

- DPH ( Drugstore, Perfumery, Hygiene) : There is considerable variation between chains in this category. Monoprix stands out with the highest proportion at 31.30%, which may indicate an orientation towards customers actively seeking care and health products.

- Fresh and Liquid : These categories also show a significant presence, but with less variation between chains, indicating their crucial role in consumers’ daily purchases.

Each store adapts its range to meet the specific preferences and buying habits of its customers. This adaptation reflects not only the commercial objectives of each store, but also regional or targeted consumer trends. Differences in the distribution of categories can influence the way in which products are selected and promoted, depending on the market segments that each retailer wishes to capture.

It is important for SMEs to monitor their holdings with quality, localised data, as this has a direct influence on visibility and sales. Advanced analytical tools can help to monitor this holding and understand the sales dynamics according to variations in the drive’s assortment.

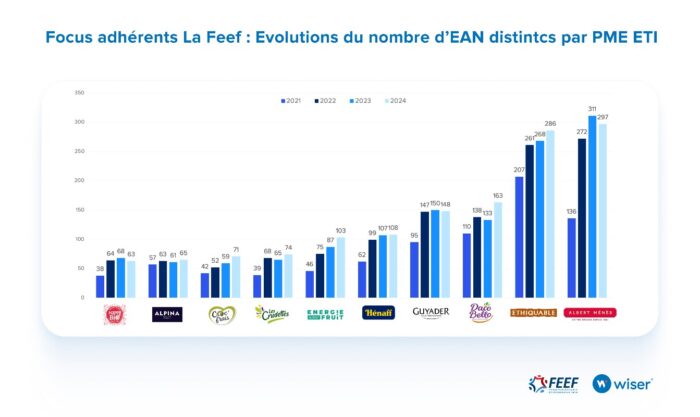

Significant growth in the Drive circuit for SMEs !

Albert Ménès and Guyader are showing remarkable increases, with growth of 118% and 56% respectively, suggesting an effective response to the diversified needs of consumers in Drive.

Wellness-oriented brands such as Energie Fruit and HAPPY BIO are showing substantial increases, reflecting the growing demand for healthy and organic products within the Drive channels. Henaff is gaining in popularity, probably due to a preference for authentic, high-quality products available quickly via the Drive.

This evolution of product ranges within the Drive channel suggests that SME’s are actively adapting their offerings to meet the dynamic needs of the market.

Last important element in an e-commerce development strategy, visibility and search on Drive sites play a vital role !

Product placement in online departments is crucial: products listed among the first results or in prominent sections on drive pages receive much more attention and traffic. SMEs need to negotiate not just the presence of their products, but also their optimal placement.

What’s more, in the age of e-commerce, consumers often use the search function to simplify their purchases. For example, a customer typing in “honey” or “water” expects to find what they’re looking for quickly. It is therefore essential for SMEs to ensure that their products are optimised for these search terms and appear among the first results. This includes using relevant keywords and regularly updating product descriptions to ensure visibility. This is also a topic for discussion with retailers.

Finally, private labels often occupy a significant share of product categories, depending on the brand, offering direct competition to SMEs. It is important for SMEs to analyse the presence and performance of private labels in their target categories in order to better position their products.

Challenge 2 : Analyse Drive breaks

Managing online stock shortages is a major challenge for small and medium-sized businesses, particularly in the context of the drive-through channel, where immediate product availability is essential to guarantee an order on the site, maintain customer satisfaction and promote growth. It’s a challenge shared by retailers too.

Analysing and understanding the share of out-of-stock items in the drive is therefore a significant growth driver.

Effective out-of-stock management can turn a logistics challenge into a growth opportunity. By identifying the causes and patterns of stock-outs, SMEs can analyse the source of the problem and optimise their logistics and supply chain to better meet demand.

It is crucial to make a distinction between a remote drive, which has specific logistics, and a pick-and-place drive, where products are taken directly from shop shelves. In a remote drive, a shortage may be due to problems specific to this distribution system, whereas a shortage in a picking drive may directly reflect stock shortages in the shop. This distinction helps SMEs to target actions more precisely.

In categories such as ultra-fresh produce, managing stock-outs is particularly critical. The perishable nature of these products requires daily monitoring to minimise losses and guarantee availability. Out-of-stocks in these categories can have an immediate impact on sales and customer satisfaction.

To effectively manage these shortages, I strongly encourage the use of data on a daily basis. Obtaining daily statements from all drive sites enables SMEs to react quickly to any shortages. This data can not only be used to detect problems, but also to analyse trends and the nature of out-of-stocks: identification of frequent out-of-stocks in a particular outlet or regional out-of-stocks, identification of an anomaly linked to the purchasing centre.

Challenge 3 : Managing the sales force to develop the Drive channel

SMEs aiming to develop a field action strategy for their Drive channel development require a dynamic and well-informed approach. By using relevant data and continually adapting the actions of their sector managers, SMEs can not only improve their Drive performance, but also strengthen their overall market positioning.

Drive initiatives can be aligned with actions in physical shops to create consistency in communication and sales strategy. This optimises the impact of marketing and sales initiatives across all distribution channels.

The entire sales force must have access to daily drive data in order to effectively prioritise their actions and discussions with distributors.

The drive channel requires responsiveness in order to take targeted action on stock, DN or price problems, thus increasing the chances of maintaining a constant and optimal product presence.

FEEF : What are the keys to success ?

Sophie Arcucci : To optimise the success of SMEs in a competitive and dynamic business environment such as the Drive channel, a number of key strategies can be implemented :

Continuous market monitoring

The importance of regular market monitoring cannot be underestimated. Simple, effective daily monitoring is essential to capture rapid changes in stock levels and other market dynamics. This proactive approach enables us to intervene quickly in the event of stock shortages, ensuring that our products remain available to consumers without interruption, as well as analysing your holdings and those of your competitors in order to adjust your actions.

Performance indicators for out-of-stock

Setting up precise performance indicators to monitor stock shortages is essential. These KPIs enable us to measure the effectiveness of your management and implement corrective actions promptly. By monitoring metrics such as the frequency and duration of stock shortages, we can better prevent availability problems and maintain customer satisfaction.

Analysis of product ownership and publication quality

This analysis gives you complete visibility of the local and regional performance of your products, enabling you to adjust your promotional and distribution actions to meet the specific needs of each distributor.

Dynamic sales force strategy

Effective management of your sales force is crucial. Equipping your sales force with real-time data tools on drive performance, stock levels and whether or not your products are in stock allows you to adapt your sales approach in an informed way. This includes targeting promotions and sales efforts to align with retailer requirements and local consumer preferences.

These strategies not only enable you to respond effectively to market demands, but also position your SME for sustained, successful growth in the Drive channel.

FEEF : What are the points to be aware of ?

Sophie Arcucci : When exploring the potential of the Drive channel for SMEs, it is essential to take into account certain points of vigilance specific to this distribution channel. Performance can vary greatly depending on the product category, out-of-stock management is crucial, and the conformity of product publications must be meticulously monitored. Here’s a closer look at each of these points :

Variable performance by Drive category

It is important to recognise that different product categories respond differently to the Drive model. Products intended for long-term storage and ultra-fresh produce, for example, have very different logistical requirements and consumer expectations. Analysing the potential of your range on the Drive channel is therefore essential to understanding which categories are best suited to this model and to adjusting your strategies according to the specific characteristics of each product. This will enable you to maximise the efficiency of your distribution and better meet consumer expectations.

Out-of-stock management

Managing stock-outs is another critical point for SMEs operating in the Drive channel. An out-of-stock situation can not only lead to an immediate loss of revenue, but can also potentially affect the reputation of your range. It is therefore essential to carry out regular, detailed analyses of out-of-stocks, segmented by product category. These analyses will help you identify the underlying causes of stock-outs and develop proactive strategies to prevent them, such as adjusting forecast stock levels or improving logistics processes with your partners.

Compliance of product publications

Finally, the importance of compliance and optimisation when publishing your products on Drive platforms cannot be underestimated. Consumers interact with your products primarily through the images and descriptions available online. Ensuring that these elements are not only compliant with platform standards but also optimised to attract and inform effectively is crucial. Clear, professional and attractive photos, accompanied by accurate and convincing descriptions, play a major role in consumers’ purchasing decisions and can significantly influence the performance of your products in the Drive channel.

By taking these points into account and implementing the right strategies, you can significantly improve your performance and positioning in the Drive channel.

To conclude

Navigating the Drive channel effectively requires careful attention to variable performance by category, proactive management of out-of-stocks, and meticulous optimisation of your product publications. By taking these points into account and adapting your strategies accordingly, you can not only improve your presence in the Drive market but also maximise your impact with consumers.