In the consumer-packaged goods (CPG) industry, seasonal retail displays are planned months in advance—often 8 to 9 months before they hit store floors. Brands like Haribo, General Mills, and Nestlé lock in Halloween promotions in Q1, ship mid-summer, and expect execution by late summer.

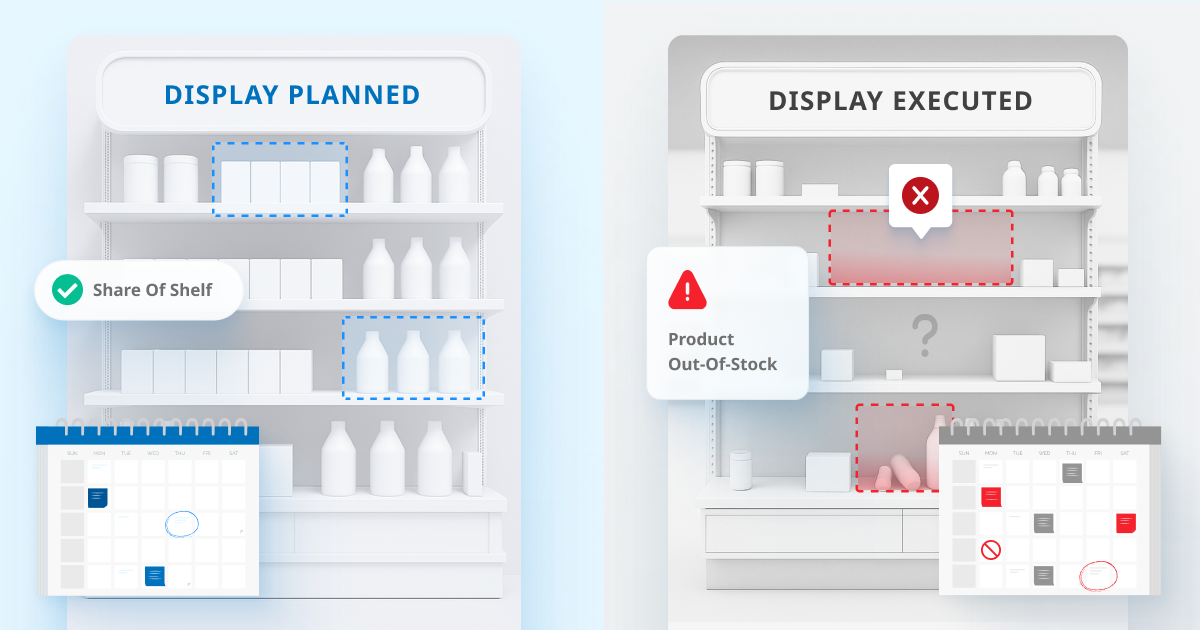

But despite early planning, retail display execution frequently diverges from strategy. Market conditions evolve. Store layouts change. Competing displays disrupt original plans. And without real-time visibility, brands are left without answers—or the ability to intervene.

Fixed Planning Cycles vs. Market Dynamics

Major retailers such as Walmart, Target, and large grocery chains operate on rigid seasonal calendars. Display designs, volumes, and merchandising strategies must be locked in long before the actual in-store execution occurs.

This long lead time makes agility nearly impossible. Even when a display no longer fits current shopper behavior or store traffic patterns, it often proceeds without adjustment. The strategic team is disconnected from field-level conditions, and the result is suboptimal planning and execution.

The Disconnect Between Centralized Planning and Store Execution

Displays are centrally developed with defined planograms, creative assets, and execution playbooks. However, in-store display compliance is managed locally, where variability in staff, layout, and cooperation create wide discrepancies.

Field teams must often re-align store managers on:

- Display placement intent (e.g., front-of-store vs. seasonal aisle)

- Timing and compliance expectations

- Visual merchandising standards

Execution quality is highly dependent on store type and visit frequency. In high-volume, high-compliance chains like Target, adherence is stronger. In independent or under-visited locations, compliance varies widely. Field reps may have more flexibility in some stores to install permanent or ad hoc displays—but it all depends on how closely each store follows corporate guidelines and how frequently they’re visited by brand reps.

Retail Display Visibility Remains a Blind Spot

Most brands cannot accurately measure in-store execution performance. Existing tools—like POS data or shopper panel analytics—capture sales trends and consumer behavior but cannot attribute outcomes to specific merchandising elements, such as display location or quality.

- Panel and POS data show what sold, not why it sold.

- Receipt-level data offers behavioral trends, but lacks execution context.

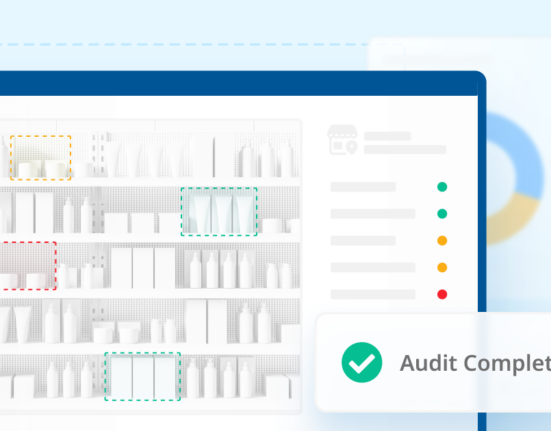

- Manual display audits or crowdsourced photos provide insights, but the process is resource-heavy and rarely scalable.

As a result, brands struggle to answer foundational questions:

- Was the display installed correctly and on time?

- Was it placed in the right location?

- Did the display meet visual and structural standards?

- How did it perform relative to competitor displays nearby?

Why Poor Execution Undermines Seasonal Promotions

Seasonal promotions represent major investments across marketing, supply chain, and retail execution. When display execution falls short:

- Sales lift is reduced or lost entirely

- Competing brands gain share through superior placement

- Retailers question the ROI of trade promotions

- Brands lack evidence to understand what went wrong

In today’s market, retail analytics are no longer optional—they’re foundational to measuring promotional effectiveness.

Building a Closed-Loop Retail Display Execution System

To close the gap between the strategic planning process and in-store execution, brands must adopt a closed-loop merchandising framework. This means aligning upstream planning with downstream visibility and performance.

Key components include:

- Real-time display monitoring tools to verify compliance

- Competitor benchmarking to understand relative presence

- Localized execution guidance based on actual store conditions

- Integrated post-event analysis linking execution data to sales performance

Some CPG leaders are already combining field intelligence, crowdsourced imagery, and visual merchandising insights to close the 9-month gap between strategic planning and execution. But the gap is still real, and most teams are flying blind.

Bottom Line

In CPG retail, success hinges not just on what’s planned—but on what’s actually executed. Promotional campaigns can only deliver ROI when display compliance, store-level visibility, and execution insights are connected in real time.

The solution is not more planning—it’s smarter, adaptive execution driven by real-world data.

Because in the end, the decision to buy happens in the aisle—and execution is the last mile of strategy.