What drives shoppers into your stores, both online and brick-and-mortar? For most, the answer will be price. The ability to compare prices, get the lowest prices, find good deals on products, and so on. The bottom line is that price is always top of mind for consumers.

This is backed up by Wiser’s network of smartphone-enabled shoppers. In one survey of more than 3,000 back-to-school shoppers, 82 percent said the main reason they shopped online was to compare prices. A separate Wiser survey of headphones shoppers had price as one of the top-five reasons to buy.

What does this mean for your retail business?

It means you’re constantly on the lookout for the best pricing strategy to appeal to your target audience. One such strategy is price matching.

What Is Price Matching?

Before we get into the specifics, it’s important that you know what price matching is, and what it’s used for.

Price matching is when a retailer lowers a product’s price to match another competitor in the same market. This way, the retailer is more likely to make a sale right then and there. Most retailers have rules for when and how they will price match.

For example, many in-store retailers won’t price match online retailers. It’s also less common with smaller businesses or mom-and-pop shops. There are a few different ways a business can implement a price matching strategy, such as:

- Standard Price Matching – Setting the same price for a product as competitors.

- Retroactive Price Matching – Price matching a product that a customer has already purchased and refunding them the difference in price.

- Price Beating – Pricing products lower than competitors as they change, before a customer approaches.

The purpose of this strategy is to provide the best price for shoppers and improve customer loyalty, which can lead to more purchases in the future.

In today’s hyper-competitive retail market, a price match policy may seem like a good idea. But is it? Let’s look at the pros and cons of price matching to find out.

What Are the Pros of Price Matching?

Price matching’s supporters include some of the biggest names in retail.

Best Buy is known for being an excellent place to price match electronics and big appliances. Walmart.com’s price match allows shoppers to find a lower price from an online retailer on an identical product and have that price matched. Target will also price match many products in-store if shoppers provide proof. Many retailers also have variants on this, including retroactive price match and price adjustment policies.

Here are some reasons why these retailers may have implemented price matching:

Always Competitive Prices

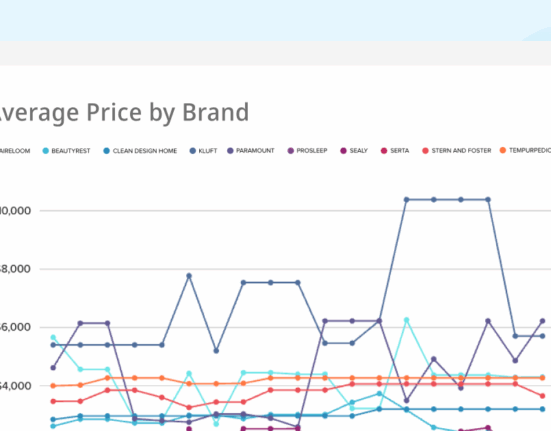

Are your prices competitive? This is a question that most retailers ask, and the answer can be tricky. It can also take a lot of work on your part to ensure prices remain competitive, especially if you manually monitor and reprice your products.

That’s one of the attractive elements behind the price match. It passes the responsibility to monitor competitors onto the shoppers. This isn’t to say you won’t keep an eye on what other retailers are doing, but you have that added layer of protection that consumers can spot and bring price differences right to your door.

Then, a price match policy will give you those always-competitive prices you seek. It will also shift focus to benefits of your business other than price, so shoppers may be more inclined to buy from you due to assortment, shipping, loyalty, service, or other factors.

On its surface, a price match strategy is set up to benefit the shopper at the detriment of the retailer.

Increased Consumer Confidence

You want your shoppers to have faith that your business has their best interests in mind. Consumers are especially savvy today, and many make decisions on where to buy based on ethical considerations, such as whether they agree with a business model or the opinions of a public-facing executive. Overall, shoppers want confidence that they are buying from a reputable, honest, and fair retailer.

Price matching can help with that. On its surface, a price match strategy is set up to benefit the shopper at the detriment of the retailer. This is a good-faith initiative. You have a higher price listed but are willing to lose out on a few dollars to ensure your shoppers get the best deal possible.

Therefore, consumers can have confidence that you are looking out for them. This increases the chances that they will come back to your business in the future. You can create loyal customers through price matching.

Improved Sales Figures

One of the biggest goals for any retailer, naturally, is to sell products. Price matching can directly influence that goal.

Think about it from the perspective of your shoppers. You have the product you want in your hand from a specific retailer but see on your phone that a competitor has the item listed for a lower price. You present this information to a store associate. They tell you they’ll match that price; you check out and go home happy.

On the flip side, you could be told no—and walk away to buy from that competitor. If you’re the retailer in this scenario, you can lose or gain sales based on your price matching policy. Which would you rather do?

What Are the Cons of Price Matching?

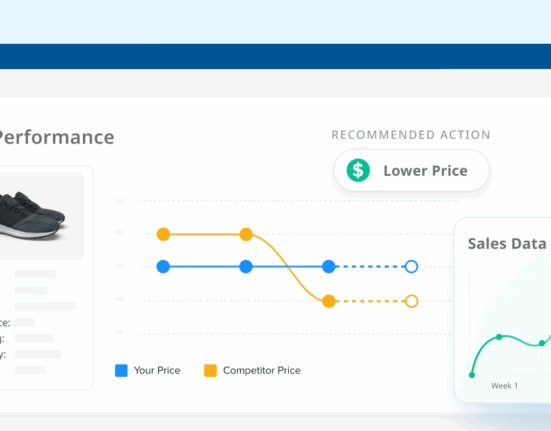

While price matching does have its benefits, not all consider this strategy to be worthwhile. For example, Amazon doesn’t offer price matching at all, instead leaning on aggressive repricing to remain competitive in the marketplace.

And Amazon isn’t alone. So, why do many retailers not want this as a part of their businesses? Here are some cons of this strategy.

Degraded Margins

Your margins can be your entire business; are you in the green or in the black? Concerns over margin degradation are some of the biggest reasons against price matching.

For example, you price your products competitively, but at a price point that provides you with a large enough margin to make a profit, cover operating expenses, and so on. A shopper comes in and says I see that product at a lower price from a competitor. You match that price, decrease your margin, and eat into your profits.

That’s not a great scenario. Different retailers have different costs, so what’s profitable for one may not be profitable for another. Instead, you can protect your margins by controlling your prices without matching what your competitors are doing at point-of-sale. You decide what your margins are, not your competitors.

You want your prices to be competitive, but you also want to turn a profit and not have your business be considered cheap or low-quality.

You want your prices to be competitive, but you also want to turn a profit and not have your business be considered cheap or low-quality.

Possibilities of Price Wars

A price match policy can also lead to an ominous-sounding price war. Price wars occur when retailers get into a back-and-forth struggle to always be the lowest possible price. You match your competitor, and they undercut you by dropping prices some more. You match again, and the cycle continues. Price wars have similar cons to price matching, including degraded margins and other concerns, such as reduced services and lower quality items.

These negatives should be avoided if possible. You want your prices to be competitive, but you also want to turn a profit and not have your business be considered cheap or low-quality, two descriptors that shoppers often place on low-priced retailers.

On the contrary, price competitively but know your limits. Don’t go lower than you’re willing and don’t give in to outside pricing pressure if it’s not in the best interests of your business.

Encouraged Competitor Shopping

Finally, one of the biggest cons of price matching is that it inherently encourages shoppers to visit your competitors. One goal of any retailer is to obviously get shoppers in their doors—not their competitors.

Price matching prompts shoppers to do the exact opposite. You’re telling your consumers to go check out that other guy. Perhaps they have better prices! If so, we’ll match. But what if shoppers like what they see over there? You run the risk of them not coming back.

This is just a fact of life with price matching, which requires shoppers to present evidence of lower prices. That’s why price matching works for some retailers and not all. It can be good for Walmart, which has such a large market share it’s not worried about competitors stealing customers thanks to price matching. That could be a different story for a mom-and-pop retailer, though.

The Fine Print Around Price Match Guarantee

Finding a workaround for these negative effects and ensuring your business is balancing its profits with its customer satisfaction is key.

For example, Target will price match only if:

- The customer brings their receipt and proof of a competitor’s advertised price for the exact same item.

- The item is still in stock.

- And the competitor is within the same market.

Target also only matches a few select websites, and it must be within seven days. Similarly, Best Buy’s policy excludes multiple purchases of the same item, all clearance items and purchases made on Black Friday. And JC Penney won’t price match unless the advertised lower price is at a brick-and-mortar store—it won’t match against any online retailers.

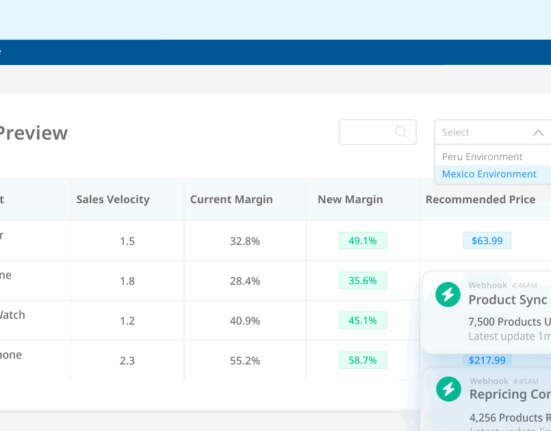

Many leading retail organizations are creating more customer-friendly price matching solutions that will ensure the customer that they will get the lowest price at their store. They have integrated competitive pricing data into their strategies and policies, to automate the price matching process right on their shoppers’ smartphones, to ease the minds of their shoppers that they are getting the best deal.

To help decrease the chance of degraded margins, Morrison’s, a major supermarket in the UK, will automatically check the items a customer buys against a database of products from their competitors: both brand name and own label. If there is a similar item offered for less elsewhere, the customer will earn points back and will be awarded a coupon for every 5,000 points accumulated. They are hoping to neutralize prices and offer the best value.

Know Your Price Matching Pros and Cons

This brings us to our final point: price matching is a case-by-case strategy. You can learn whether it’s right for you by looking at your required margins, your profits and losses, your competitors, and your overall size. These factors and others can help decide whether price matching is a good or bad idea.

Now that you’ve read the pros and cons, where do you fall on price matching? Will this be a strategy found in your retail business soon?

Editor’s Note: Contributing writer is Alexandria Flores. This post was originally published in November 2018 and has since been updated and refreshed for readability and accuracy.