There’s the price you pay. And then there’s your price.

Dynamic Pricing is when prices change based on variables that are not related to the customer. Variables like these include the time of day, the temperature outside, the available supply and the competitor’s prices. In dynamic pricing, everyone sees the same price, no matter who the customer is. Dynamic pricing doesn’t care who your customer is and if they are of value to the retailer.

Personalized pricing is the opposite. The purpose of personalized pricing is that the retailer has an idea of who the customer is and incentivizes the customer based on their characteristics and actions. Historically, it’s not unusual to see a change in prices over time and across customers. Before the price tag was invented in 1861, prices had to be negotiated with the buyer. Retailers who follow this technique offer customized prices based on their own assessment of the customers’ behavior and their influence over shoppers’ in-store behavior. The idea behind personalized pricing is that highly loyal customers will receive better price offers than unknown customers who have no history with the brand. This pricing method offers unique deals to consumers who keep coming back. These deals are extended to shoppers in specific circumstances and are preferably done one-on-one.

The reason that dynamic and personalized pricing are often confused is that both pricing techniques are sophisticated, access large amounts of real-time data, and both use the same math. The only difference is the input value. However, a dynamic price is a universal price that everyone can see. A personalized price is for one particular person to see at a given time. It’s a special offer by the retailer to a specific customer based on their shopping tendencies. To break it down, personalized pricing is customer-centric and dynamic pricing is not.

But why does it matter?

Dynamic pricing and personalized pricing both achieve different outcomes for your business. Here’s a guide of the pros, cons, risks, and rewards your company can attain from utilizing either of these tactics.

Dynamic Pricing

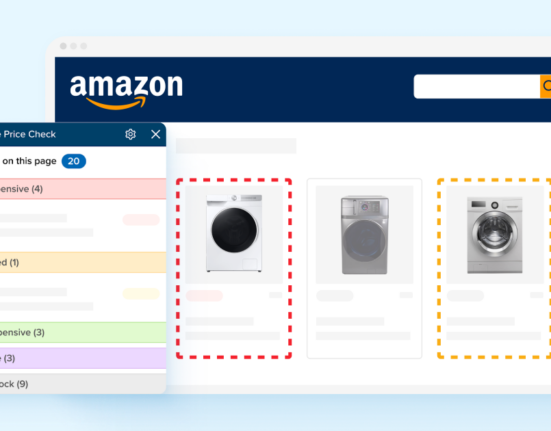

Pros: You get to choose what factors will drive your prices. Amazon’s success with dynamic pricing makes it apparent that this pricing technique is critical in e-commerce, omnichannel, and brick-and-mortar competition to drive both margin growth and earnings. All of your customers will be paying the same price for the same product and you can competitively raise or lower your prices based on the market. Airlines were one of the earliest adopters of dynamic pricing. United, Delta, American and Southwest airlines all use this pricing method to determine variables such as the cost of travel based on peak seasons and seat prices based on availability. With Uber’s surge pricing, dynamic pricing comes into play as they increased prices based on demand and time of day/week. Every year on Black Friday, Amazon changes the prices of its most competitive products multiple times throughout the day to mimic the price changes of store-based retailers. Even Walmart is capitalizing on dynamic pricing by advertising certain products on their digital signs based on the temperature outside.

Cons: Some studies seem to indicate that dynamic pricing may be on the out. In a 2016 report, 28 percent of respondents saw dynamic pricing as an opportunity. In 2017, the statistic went down to 22 percent. In addition, the retail market is a very versatile and flexible industry. Having a “one size fits all” dynamic pricing system, in which everyone is offered the same price for the same product, is nearly impossible. Monitoring dynamic pricing policies can be difficult as well. Another issue in dynamic pricing is the “black box problem”. This refers to when members of a company’s pricing staff don’t understand the logic behind the mathematical algorithm of dynamic pricing, so the staff rejects the price given by the system because they don’t trust it. Your company will have to overcome this trust barrier. One way to do this is to optimize the dynamic pricing system with pricing and category managers in mind, allowing them to override pricing recommendations.

What you’ll be risking: Because this hyper-competitive marketplace is constantly changing, dynamic pricing has situational risks such as the price of a product changing from when the customer puts it in their cart to when they are making the transaction or if you were to agree on a price match, but find out that your competitor had just raised the price before the shopper made it to checkout. It also takes concentrated effort to manage your store’s fluctuating prices online compared to the prices of your static products on the shelf.

What your reward will be: According to a study conducted by Mckinsey, dynamic pricing shows an increase in sales of 2-5 percent and an increase in margins 5-10 percent. This technique improves the shopper’s perceptions of your competitive prices which results in higher levels of customer satisfaction.

Personalized Pricing

Pros: Personalized pricing is on the rise in the retail industry. In 2016, 31 percent of respondents saw this method of pricing as a good opportunity. In 2017, 33 percent agreed on the power of personalized pricing. If a business can discreetly offer a deal to a customer with a lower willingness to pay, additional sales will be made. Some shoppers will be paying more than others, but your business will be profitable. You will also be able to customize the customers shopping experience on an individual level by using customer-level data, which may lead to greater customer satisfaction. Hotel websites such as Orbitz (whose parent company is Expedia) and Auto-dealers like Tesla utilize personalized pricing to their advantage when conducting sales with a customer. Even Uber has dabbled in personalized pricing by offering “premium pricing” to predict which users are willing to pay more to go to a certain location.

Cons: There are ethical and legal concerns with personalized pricing. It’s a fine line between differentiated pricing (based on the characteristics and behaviors of the customers) and discriminatory pricing. For example, a study conducted by ProPublica found that the Princeton Review’s strategy of using customer zip codes in deciding different price ranges resulted in Asians being twice as likely to be charged higher rates. You will have to develop a legal/ethical rationale on how to gauge different prices for different customers. Consumers may also not like the idea that other shoppers are getting better deals than are offered to them. Additionally, customizing a price for a specific person involves detailed research of customer-level data that may be expensive and/or time-consuming.

What you’ll be risking: The consumer’s reactions. Customers might not enjoy thinking that someone else is getting a better deal than them. Additionally, they may not be comfortable with your company knowing their personal shopping habits. If you’re going to customize your prices, you must be slow and thoughtful when introducing personalized pricing to your shoppers. This is the most challenging yet most crucial element to personalized pricing. You must be able to effectively explain and communicate customized pricing to your customer successfully.

What your reward will be: Personalized pricing is becoming more and more prominent in retail. Some customers are more willing to pay than others. You can capitalize on this concept by implementing techniques to predict and charge the exact amount that a certain customer will be willing to pay. This results in profit increase, customer loyalty and the customization of each shopper’s experience, which leads to higher rates of customer approval.

Every business is unique. There are many aspects to consider as you craft a pricing strategy that’s right for your customers and your company. The optimal strategy could include a mix of both dynamic and personalized pricing. It’s your decision on how to take on this fast-paced retail industry with strategic pricing techniques.