The pandemic has presented every organization with unique challenges. While the CPG industry generally benefited from increased demand for essential items, supply chains were stretched to the brink, and market share shifted towards brands that could keep products flowing to shelves.

Whether you are looking to maintain your advantage in the new year or are working overtime to make up lost ground, here are three tips to help you to enhance your category insights strategy and improve your retail execution:

Tip No. 1: Implement a Precision Distribution Management Process

Maintaining the right number of products on shelves with the right facings is critical for maximizing your sales. Planograms and commitments from retailers are a great start, but things hardly ever go according to plan. That’s why, when it comes to product placement strategies, the Cold War proverb “trust but verify” is applicable.

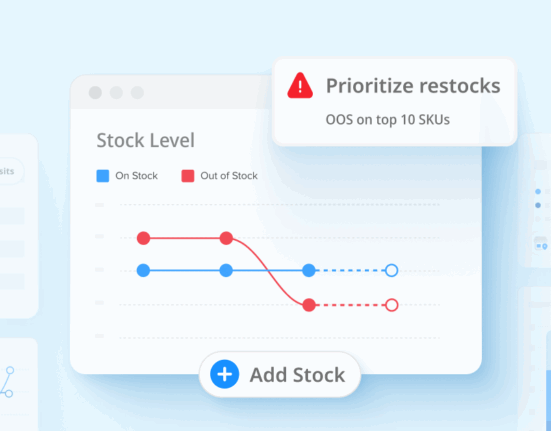

There are many reasons retailers fall out of compliance with commitments, but the effects are the same. If you don’t know where or how many of your products are actually on shelves, significant revenue opportunities can be lost. Voids and Out of Stocks (OOS) equate to lost sales, which is bad for both the retailer and the supplier.

When you have a system for monitoring compliance, the inverse is true. Over time, you can optimize to make sure you have the right SKUs in the right place at the right time to maximize sales. But tracking compliance across stores, down to individual sets can be very challenging.

That is why Wiser Solutions helps our customers create reporting and data management processes. Our team provides a combination of industry insight, technology to manage distribution down to whatever level the retailer offers, and data collection to power custom dashboards.

Whether you decide to work with a vendor or develop a management process on your own, the improved visibility into product distribution will position you to defend or recover shelf space and optimize your sales.

Tip No. 2: Track Changes in Physical Share

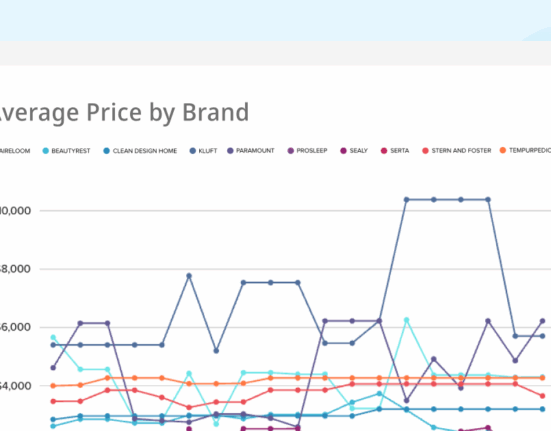

There aren’t many crystal balls that can predict the future in the retail industry, but for CPG organizations Physical Share (or Share of Shelf) comes pretty close. Physical Share is a measurement of the percentage of available shelf space your products occupy in a given shelf set. Why is tracking changes to this metric important?

In our experience, Physical Share is a leading indicator of Dollar Share within each category. Typically, there is a six to twelve-month lag between Physical Share and Dollar Share changes, but the adjustment inevitably occurs. In other words, tracking changes to your Physical Share today will help you know what to expect financially several months in the future.

Getting the right items on the right shelves isn’t the only thing that matters. With many shoppers making buying decisions in the aisle, the visibility of your product is essential. The more facings your brand has, the larger your Physical Share and the more sales you will make.

Managing Physical Share with a focus to grow your share of items within the category at a specific retailer and location can quickly promote your dollar share. At a minimum, this requires ensuring that all authorized items are in place. Sometimes by being proactive, you can even get more than your share of SKUs or facings.

Wiser helps CPG customers manage this process. Our team works to capture data from reps (direct or broker), POS, syndicated, and other sources, creating dashboards that measure progress and link physical share to dollar share over time. This data can be used to determine where business initiatives are working and where adjustments need to be made to maximize sales.

As the new normal continues to take shape, organizations with greater visibility into how and when their products appear will have the advantage.

Tip No. 3: Analyze Your Display Effectiveness

If you are like many CPG manufacturers, trade promotions are likely your largest marketing expenditure, and with good reason. In-store displays and other promotions have the potential to drive tremendous ROI. But according to a study by Nielsen, 67 percent of these initiatives fail to break even. This is why it is critical to make sure you are asking the right questions when analyzing the effectiveness of your campaigns. For example:

Are You Getting What You Paid For?

Earlier, we discussed the importance of monitoring product distribution and POG compliance. A similar process is necessary for in-store displays and other promotions. If you pay for a certain size display in a specific location, you need to ensure retailers hold up their end of the deal. Mistakes and simple oversight can often impact the results of your campaign.

Do You Know Which Displays Work Best For Your Various Brands?

Knowing what size of display and mix of items will promote the best sell-through is a great place to start. It is also essential to be able to quantify the success of past promotions down to the individual locations as you develop future display programs.

Do You Know What Locations In-Store Promote The Greatest Lift?

For example, end aisle, front of store, back of store, and cross merchandised with complementary products, can all produce different results in terms of display effectiveness. Managing these attributes can have a huge impact on your long-term sales growth and ROI.

These are simple questions, but answering them without guesswork is a daunting task. This is why Wiser helps customers with all of these things by quantifying placements and integrating demand data to measure results. With our support, our customers often invest in designing, delivering, and managing their assets and displays in stores to control placement and compliance based on their brand goals.

Conclusion

We have been living through unprecedented times. For months retail shelves have been the wild west. As the new normal continues to take shape, organizations with greater visibility into how and when their products appear will have the advantage. We hope that implementing the tips in this post will help you optimize your retail execution strategy so that your firm emerges on top once all of the dust settles.

Editor’s Note: This blog was originally published by RW3. RW3 was acquired by Wiser Solutions in early 2022 and this blog has been revised and repurposed for a global audience.