Cacolac, a well-known French FMCG brand, has been delighting consumers with its iconic chocolate milk for 70 years. As the company prepares for a new era under the leadership of Christian Maviel in 2015, Cacolac is focusing on revitalizing its brand and expanding its presence, particularly in the Drive circuit—a crucial distribution channel for French grocery retail.

Like other family-focused brands, Cacolac recognized the importance of making its products easily accessible to busy families through the Drive circuit. In an interview with Mathieu Hauguel, Senior Vice President of Retail at Cacolac, we explore how Wiser’s solution helped them overcome key challenges and achieve significant growth.

For readers outside of France, the Drive circuit functions similarly to Walmart’s curbside pickup or Kroger’s ClickList in the U.S., where customers order groceries online and pick them up at a local store. This service is particularly popular in France among families looking for convenience.

The Role of E-Commerce and Drive in Cacolac’s Strategy

As consumer shopping behaviors evolved, so did Cacolac’s focus on digital retail. Starting in 2019, Cacolac recognized the Drive channel as a major strategic opportunity to reach their primary customer base—families with children who prioritize convenient shopping experiences. “Our products are family staples, so making them available in the Drive circuit was essential,” says Hauguel.

However, expanding into Drive came with challenges, especially for a smaller brand like Cacolac, which has a limited but strong-performing product range. Their flagship products, such as their iconic glass bottle chocolate milk, account for 50% of revenue, meaning any gaps in availability directly impact sales.

Challenges Before Wiser

Before using Wiser, Cacolac faced two major hurdles: limited visibility into product availability and manual, time-consuming tracking across Drive locations.

According to Hauguel, “We lacked the tools to efficiently monitor our SKUs in the Drive circuit. We were manually checking each location to ensure our flagship products were listed and available. It was not only tedious but led to missed opportunities when stockouts or pricing discrepancies went unnoticed.”

This need for rigorous monitoring, especially as their distribution network expanded, pushed Cacolac to search for a smarter, more efficient solution.

Turning to Wiser for a Solution

Cacolac found its answer in Wiser’s solution, which provided them with real-time data on product availability, pricing, and promotions across their Drive locations. Hauguel notes, “Wiser’s tool gave us the visibility we needed to act quickly and address issues that could have cost us sales. We were able to prioritize our best-selling SKUs and ensure their availability.”

In one instance, Wiser helped Cacolac avert a major issue. A technical error had delisted one of their flagship products, the 6x25cl cans, from 280 Drive locations. Without Wiser’s data, this could have gone unnoticed for weeks. “Wiser allowed us to identify and correct the delisting almost immediately, avoiding what would have been a significant sales loss,” says Hauguel.

Key Benefits of Wiser’s Solution

- Real-Time Product Availability

Wiser’s data allowed Cacolac to monitor their product availability across various Drive locations, ensuring that SKUs were correctly listed and stocked. With real-time insights, Cacolac could react swiftly to any discrepancies. As Hauguel explains, “Being able to see our availability at a glance and act immediately is a game-changer.”

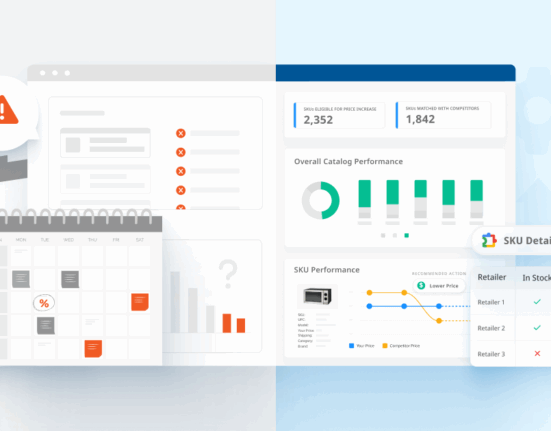

- Pricing and Promotion Insights

With Wiser, Cacolac could also track how their promotions were being implemented and if their pricing aligned with target markets. This was crucial for ensuring competitive positioning, especially since distributors have flexibility in setting their prices. “The ability to observe price variations across different Drive locations helped us understand product performance better and adjust our strategy accordingly,” says Hauguel.

- Time Savings and Improved Efficiency

Before Wiser, Cacolac’s team spent considerable time manually checking product listings and stock levels. Wiser’s automated data collection streamlined this process, freeing up resources. “We now use snapshots to analyze drives and prioritize SKUs,” Hauguel shares. This time-saving efficiency has allowed Cacolac to focus more on expanding their product range and enhancing promotional efforts.

Strong Results and Continued Growth

The results speak for themselves. Since integrating Wiser, Cacolac has achieved over 70% growth in turnover over the past seven years. The Drive channel now accounts for more than 9% of Cacolac’s total revenue, and its importance continues to grow as sales increase year over year.

With daily updates from Wiser’s data, Cacolac can quickly identify stockouts, a persistent issue in Drive. This level of responsiveness has helped the company mitigate revenue losses and maintain consistent product availability across locations. Hauguel adds, “By identifying stockouts in real time, we’ve been able to react faster, keeping our products visible and available.”

Optimizing Sales with Better Data

Cacolac has also used Wiser’s insights to maximize the effectiveness of their promotions and pricing strategies. The team regularly shares Wiser data with retail partners through personalized newsletters, offering assortment recommendations and revenue potential analyses to help them optimize their own efforts. By focusing on their two best-performing SKUs—which represent 70% of their revenue—Cacolac has reinforced its market position and expanded its presence in key retail partners.

Conclusion: A Strategic Partnership for the Future

For Cacolac, partnering with Wiser has been a turning point. By automating their data collection and leveraging real-time insights on product availability, pricing, and promotions, the company has not only strengthened its presence in the Drive circuit but has also made key strategic decisions to ensure future growth.

As they continue to expand, Wiser’s solution will remain an integral part of Cacolac’s strategy, helping them navigate the complexities of the evolving Drive landscape while focusing on what they do best delivering their beloved chocolate milk to families across France.