Michael Kors is a global luxury brand that designs, markets, and distributes apparel and accessories for two main collections: the Michael Kors luxury collection and the MICHAEL Michael Kors accessible luxury collection. Recent developments in the company’s competitive landscape have had a lasting impact on the retail industry and will, in turn, affect luxury fashion retailers profoundly.

Many developments have forced luxury fashion companies to rethink their go-to-market strategies. These include weakening mall traffic in North America, a growing preference for digital shopping, increasing demand for smaller handbags, and changing industry dynamics for wholesale distribution. Given that backdrop, Michael Kors has implemented a number of strategic initiatives to counter these structural changes. Specifically, the company revamped its wholesale channel strategy, focused its promotional activities, scaled its digital presence, and launched a new men’s business—all in response to this new retail environment.

Shift in Wholesale Strategy

Michael Kors has made a concerted effort to better manage its North American wholesale inventory amidst a weakening wholesale channel. John Idol, CEO of Michael Kors, commented on the changing nature of the company’s department store strategy: “The department store business in North America is suffering some of the same challenges that we’ve seen in terms of the traffic in shopping malls. That’s got us taking a more prudent approach to how much inventory we actually have sitting in stores.”

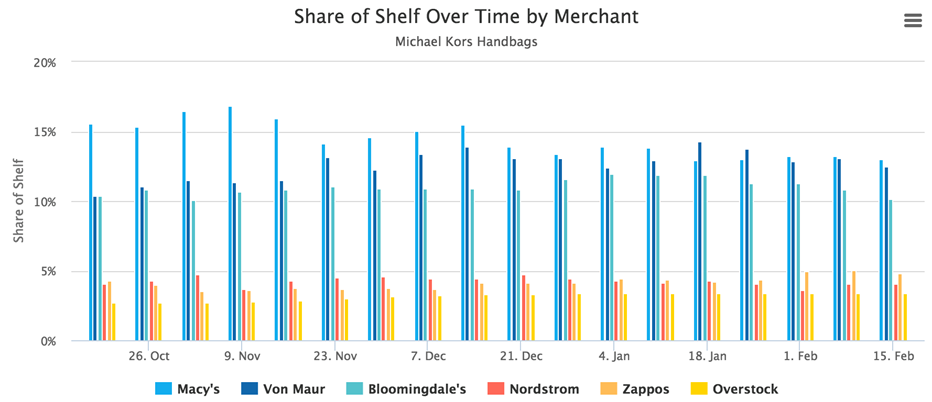

A decreasing share of shelf across Michael Kors’ major wholesale partners, including Macy’s and Bloomingdale’s, reflects this change in strategy, as shown below for the past five months.

From Promotional Activity to New Assortments

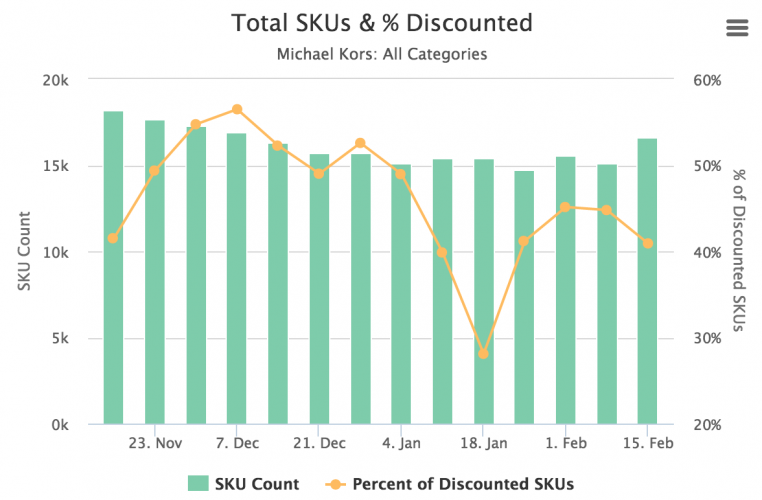

Michael Kors pursued an aggressive promotional strategy in the fourth quarter of 2015 to counter unseasonably warm weather and changing consumer preferences. The first quarter of 2016 marked a clean start for the company as it transitioned away from aggressive promotional tactics to focus on replenishing new merchandise assortments for the spring season.

In addition, the new wholesale channel strategy already mentioned will have significant impact on the company’s promotional activities going forward. Specifically, lower wholesale inventory will mean less promotional activity needed. Also, with a clearer focus on eCommerce and its own stores, Michael Kors should be able to crystallize its promotional messaging. It won’t be offering promotions at different levels across the value chain, which was often an aggravation to shoppers.

Growing Digital Presence

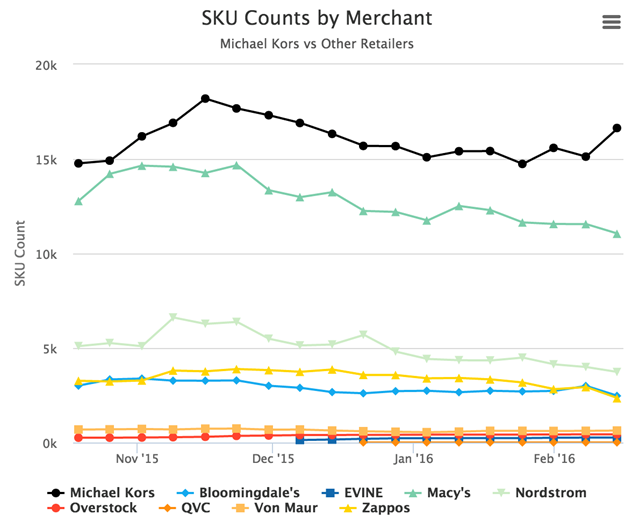

The company’s increasing online footprint represents a significant opportunity to capitalize on the generational shift to online shopping. With its strong online presence, the company can offer a much greater assortment of products than is currently available in their own stores or through their wholesale partners. Indeed, as shown below, Michael Kors’ online store dwarfs the majority of its wholesale partners in breadth of assortment offered. With a lift in eCommerce comes a new set of insights that can provide valuable intelligence into the correct product assortment for its physical stores.

For example, according to its most recent earnings call, the company noticed a significant uplift in footwear via its online channel. As a result, the company plans to expand its footwear assortment in its physical stores. This type of insight benefits the company in two ways. First, it allows for a smarter product assortment driven by consumer preferences that are communicated directly through this channel. Secondly, it enables the company to drive traffic and improve conversion rates at their physical locations.

Expansion into Men’s Products

The emergence of Michael Kors’ men’s lines marks a significant development for the company as it pursues adjacent markets that can significantly boost its revenue growth. According to John Idol, the men’s business represents a billion-dollar opportunity for the company. With plans to roll out 75 shop-in-shops in North America this year in concert with their wholesale partners, menswear is poised to be a significant growth driver for the company going forward. The successful roll-out of the men’s business is already evident, with a prominent assortment at several major wholesale partners including Bloomingdale’s, Macy’s, and Nordstrom, as shown below.

Contributing Writer: Michael Gilson