The retail market has become increasingly crowded, but an optimized assortment could be the solution to winning share of wallet. Consumers have a wide variety of retailers to choose from, whether online or in-store. Because of this freedom, retailers should carefully select what to stock. Identifying white spaces, otherwise known as gaps in assortment, opens new opportunities for retailers by giving them the insight needed to optimize their assortment and get ahead of their competition.

Types of White Space that Retailers Should Monitor

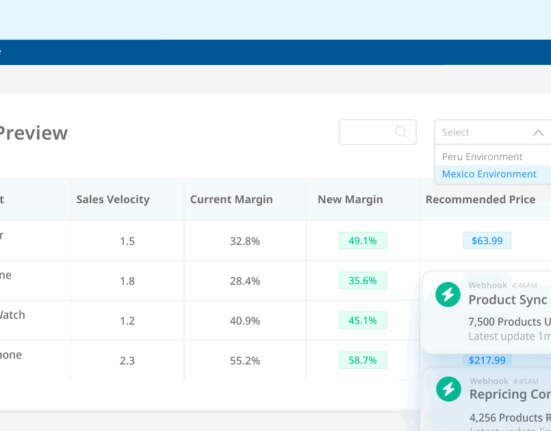

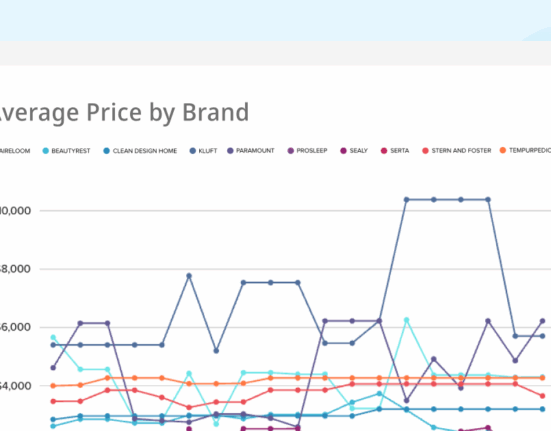

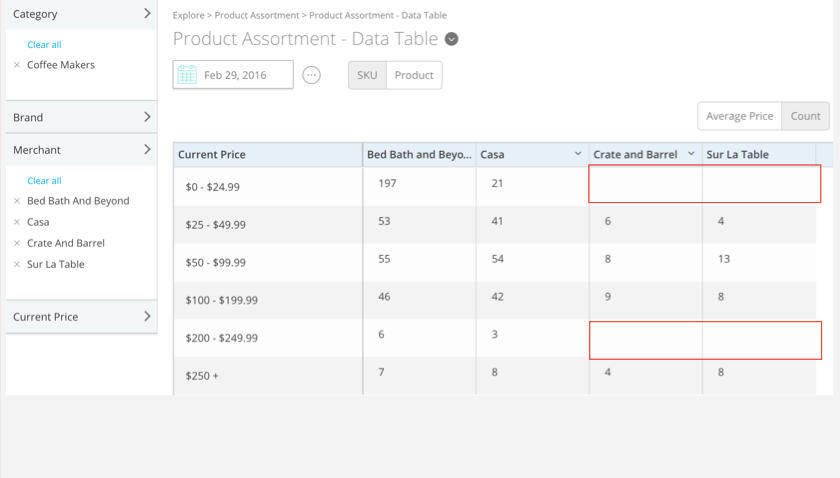

Pricing: One thing to look for is a price range that your competitors aren’t serving in a particular category. For example, AOC serves the low-price market for computer monitors, with a selection of products aimed at consumers on a tight budget. The next tier up consists of companies like ASUS and Dell, with a selection aimed at the average consumer in the middle-tier market. Finally, at the highest tier are companies like BenQ producing specialized monitors for hardcore gamers. If there is a tier in your market being neglected, consider entering that tier with your own products to fill the gap.

Category/subcategory: Another area to focus on is whether an underserved category or subcategory exists in the market, or if your competitors have significantly better coverage of a particular category. Walmart has been working on strengthening its weaknesses in certain categories by acquiring other companies that specialize in those segments. Recently it acquired Moosejaw, which is a well-known outdoor retailer that sells online.

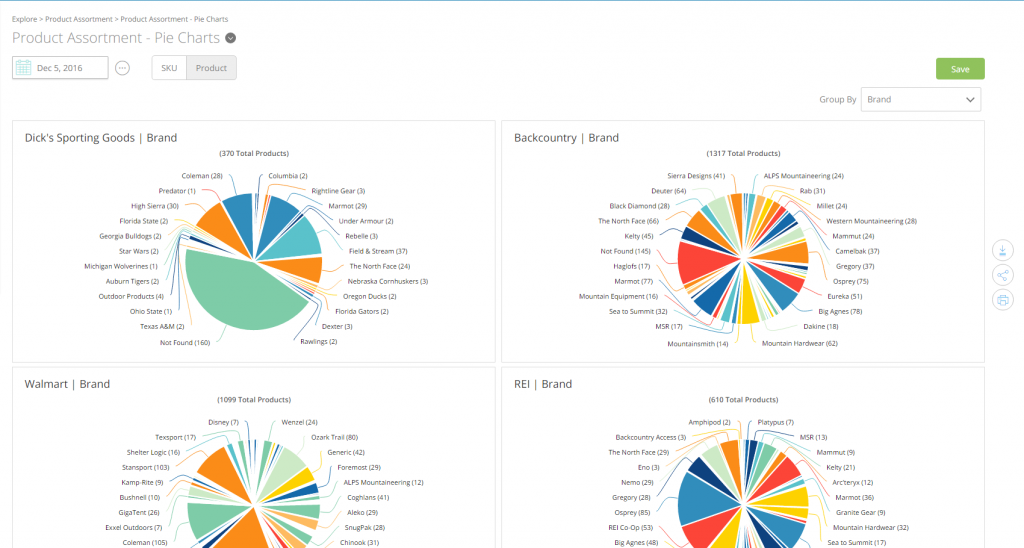

Brand: One final question to ask is whether there’s a unique brand you can carry or make an exclusive deal with. Amazon has recently made deals with certain brands to sell their goods online only through Amazon Exclusives. This means they won’t sell to any other retailer, granting the brands a vast distribution network and reach, while Amazon offers these products as the only online source and available specifically to its Prime members.

How to Act on White Space Data

Prepare properly: When you complete a white space analysis, use it to make decisions that support your broader business goals. Just because there’s a gap doesn’t mean it always should be filled.

For example, Target saw an opportunity to go north of the border and move into the Canadian market. It expanded rapidly and opened 124 stores in just 10 months. Yet such a speedy entry into the market didn’t allow for proper supply chains to be set up, which resulted in empty shelves. Take the time to gather all the relevant information to clarify what you sell, and focus on what you do well. By now you should know your customers and understand their needs and wants. At the same time, you must also realize that you can’t be everything to everyone.

Run a beta test: Taking a page out of Amazon’s book, run small-scale tests to ensure success in the future. Amazon stealthily released new apparel brands under various names without tying them to itself. They kept the successful brands and used what worked in new lines while removing failures without any damage to the Amazon brand image. Similarly, you can run a small campaign with a handful of products to test a price range or category.

Keep monitoring: Things can change in an instant. Competitors may start carrying things in previously identified white spaces, their pricing can change often, or their price position can shift suddenly. There are no set rules that ensure the market will remain a certain way. Just as you’re looking to move into a white space, your competitors can do the same. Regular surveillance of the competition keeps you informed and allows you to maintain your advantage with ease.

Wrap up

In the end, you want to ensure a competitive advantage is maintained proactively, not just reactively. Stay on top of the market by diligently monitoring your competitors and making informed decisions backed by reliable data. Wiser can help provide the insights needed to quickly pinpoint white spaces, giving you the opportunities your business needs.

Editor’s Note: Contributing writer is Matt Chow. This post was originally published in March 2017 and has since been updated and refreshed for readability and accuracy.