One of the clearest signs that a brand is growing is when it can release new products, new variations on the old favorites, and entirely new product lines from the brand.

Being in a position to release new products is great, but as your assortment grows, so too does the complexity of your inventory management processes. Keeping track of product performance, profitability, sales volume, and other key metrics become vastly more difficult.

This is where SKU rationalization, a means of analyzing your SKUs to ensure you’re only carrying your most successful products, comes in.

In this article, we’ll look at what SKUs are, what “SKU rationalization” means, and some things you can do to get the most out of your SKU rationalization processes.

What are SKUs?

SKU stands for Stock Keeping Unit. It’s an alphanumeric code affixed to a product to identify and collect information about that product as it makes its way through the supply chain. The information contained in a SKU includes price, variations, and manufacturer.

SKU’s differ from universal product codes (UPCs) in that they are manufacturer-specific. Each retailer will have its own SKUs that go with its merchandise. This allows the manufacturer to group similar SKUs together and analyze their performance.

SKU rationalization is the process through which a brand or manufacturer determines if a product should be kept for sale or if it should be discontinued.

What is SKU Rationalization?

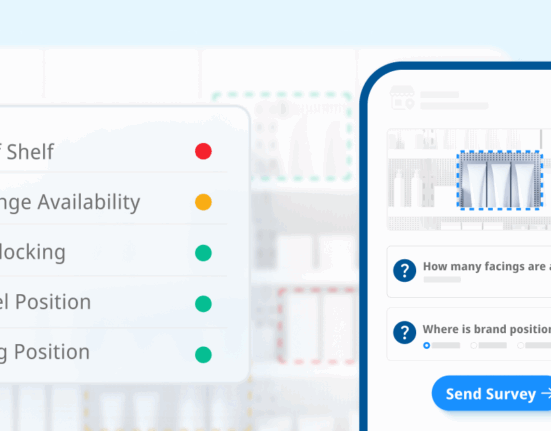

Using SKUs to analyze your product selection in general and for specific product lines is an essential task, but the rapid expansion of the number of SKUs retailers have to manage has made getting actionable data out of them extremely difficult.

Consumer tastes are always changing, and brands have met those demands by offering variations on existing products to cater to specific tastes. Think of something as basic as cheese at the grocery store. A major cheese brand will have its core product, a shredded version, a sliced version, low-fat, non-dairy, no artificial sweeteners, and so on.

The need to keep up with the demands of the market has led to SKU proliferation. Tracking, monitoring, and analyzing data for a rapidly expanding number of SKUs makes it harder to make good decisions with that data. That’s where SKU rationalization comes in.

SKU rationalization is the process through which a brand or manufacturer determines if a product should be kept for sale or if it should be discontinued. Using sales data at the SKU level, a merchant can drive SKU optimization, engage in demand planning, detect cannibalization between SKUs, track eCommerce vs in-store metrics, and several other key tasks.

SKUs are vital for inventory and sales tracking. They are a primary source of information about which products are selling well and which aren’t, when products need to be restocked, what products should be eliminated, and so on. By understanding which products are costing the business money in the form of carrying costs, brands and manufacturers can reduce inventory costs by discontinuing them without negatively impacting revenue.

Essentially, if you’re carrying inventory with no insight into how it’s performing, you’re making business-critical decisions on the basis of bad data, while incurring inflated warehousing, shipping, and labor costs. SKU rationalization ensures your entire product portfolio is analyzed regularly so it’s always geared toward customer satisfaction and an improved bottom line.

Best Practices for SKU Rationalization

SKU rationalization is a key part of inventory management, merchandising, developing new products, improving your product variety, and so on. Getting it right can be the difference between hitting and missing profitability goals. In this section, we’ll look at some ways to improve your SKU rationalization process.

Use Price Intelligence Data

How can you determine how profitable specific SKUs are? How about an entire category or your whole product mix?

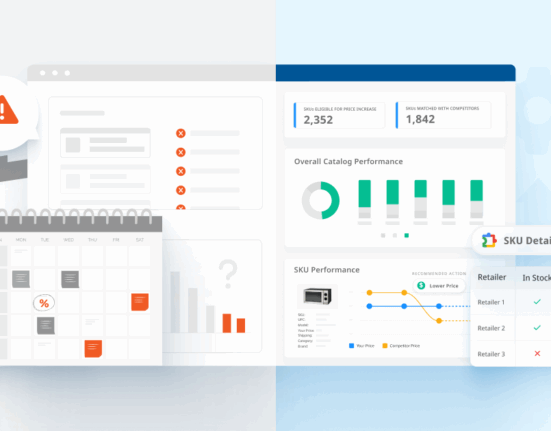

One way brands and retailers do so is through price intelligence data that shows them SKU profitability. That data is then used to compare metrics like dollars per store per week, units per store per week, and assortment vs. assortment comparisons. This is key for assortment optimization and SKU rationalization.

It all goes back to data quality. Price intelligence software solves the problem of collecting accurate pricing data at scale and organizing it in a way that facilitates analysis.

Understand Your SKUs in Their Competitive Contexts

As you analyze your price intelligence data, one thing you should examine closely is your competitors’ performance on similar products and product lines. Are they running promotions, thereby attracting consumers to their items over yours? Have they lowered the price of their products to gain market share?

As you analyze your SKUs, be sure you’re running some comparisons between you and your competitors, particularly around pricing. This can have a noticeable effect on sales, and the appropriate action to take may not be to discontinue a weak performer, but rather to experiment with pricing.

Take Marketing Efforts Into Account

If you’re analyzing SKUs and trying to sort out the winners and losers, it’s not enough to only look at profitability or sales. You have to understand the role marketing plays in driving those results.

For example, say you’re doing SKU rationalization and you find a SKU that seems like a clear winner. You’re about to continue with it, but when you check the promotions that were run for it, you realize that the reason it stands out is that significant promotional efforts went toward that SKU.

Likewise, if you find a SKU that seems ripe for discontinuation, check to see if the problem is insufficient promotion. Don’t be too quick to judge your SKUs until you have the marketing context behind it.

Watch for Product Cannibalization

In retail, product cannibalization is when you lose sales volume or revenue when you launch a new SKU that takes sales away from your existing SKUs, rather than your competitors’.

As you launch new SKUs, they may be similar enough in the mind of your customer that they end up competing against each other. This can result in low sales volume for one or both SKUs. Through SKU rationalization, you should be on the lookout for SKUs that are eating into the profitability of other product lines. You can either discontinue one, or find a way to reposition one or the other.

Cannibalization isn’t always a bad thing, at least not in retail! If your new SKUs allow you to enter new markets with a spin on your existing products, it can sometimes be worth a degree of cannibalization. Consider how Coca-Cola has regular Coke, Coke Zero, Diet Coke, Cherry Coke, and Vanilla Coke. These may compete with each other to some extent, but they also allow Coca-Cola to appeal to a wider base of consumers.

Test and Iterate on Product Decisions

Your rationalization processes should result in meaningful decisions about new products to rollout, products to eliminate, new pricing, and promotions. But SKU rationalization alone doesn’t result in perfect next steps. You have to execute on those decisions to know if they can truly benefit your business.

That’s why it’s best to test any new SKU decisions on a small scale before expanding across all of your retailers. For example, if you’re trying to shore up the performance of a weak SKU, try some targeted promotions in a few markets to see if that helps. If it does, you can build on those efforts. If not, you haven’t wasted resources trying to make drastic changes across your whole network.