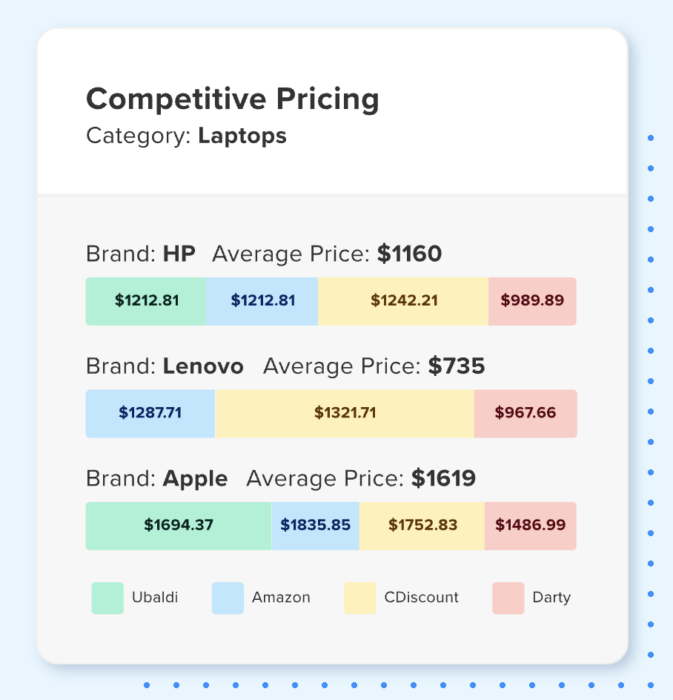

Wiser Solutions’ Digital Shelf Intelligence (DSI) serves as a powerful tool for brand manufacturers navigating the dynamic landscape of eCommerce. This product offers a wealth of actionable insights, arming businesses with the necessary data to make informed decisions and stay competitive. One of its standout features is its capacity to provide competitive pricing and promotions intelligence.

Competitive pricing is a crucial element for anyone in retail. With DSI, brands gain near real-time visibility into competitor pricing strategies. This tool delivers comprehensive and accurate pricing data from eCommerce websites, with insights into price positions, historical pricing trends, and more.

Equally important is DSI’s ability to offer in-depth analysis of promotional activities across the digital space. It identifies and tracks the promotional strategies employed by competitors, including sales, discounts, and special offers. Thus, businesses can anticipate market trends, tailor their own promotional activities accordingly, and ensure they consistently provide value for their customers.

These features of Wiser’s DSI collectively contribute to a robust digital strategy. Armed with the insights it offers, businesses can stay ahead of the curve in competitive pricing and promotional strategies, ultimately bolstering their market presence and driving growth.

Here are some examples of how that has been accomplished already by Wiser’s customers:

No. 1: Major Appliances and Electronics

On the Amazon marketplace, price reductions are frequently initiated by third-party sellers, compelling retailers to match prices to remain competitive and ensure a chance to win the “Buy Box.” In essence, smaller third-party sellers or independent retailers trigger pricing conflicts for products, including for one of Wiser’s major appliance and electronics manufacturer customers. They rely on Wiser data to proactively track price movements and avert pricing wars.

No. 2: Home Improvement

Wiser’s insights revealed to a leading manufacturer of windows and doors that Home Depot, one of their crucial retail partners, had inadvertently discounted one of their products by 45 percent across all regions. Swift action prevented further revenue loss.

No. 3: Domestic Appliances

Product and category managers at a global domestic appliance brand analyze historical pricing for their products to determine average prices at which their products are being sold relative to their competition. Using characteristics, they also benchmark their products against similar competitor products to better understand the competitive landscape. This analysis informs their pricing decisions, allowing them to strategically adjust prices to bolster their position as a premium brand in the industry.

No. 4: Smart Phones #1

The sales team at a global phone manufacturer uses category pricing to evaluate the comparative performance of their prices versus competitors over time. This data is used to justify requests for additional funding to support local discounts. The data is subsequently shared with the Global Leadership team.

No. 5: Smart Phones #2

Another leading phone manufacturer tracks competitors’ promotions and discounts to evaluate changes in their promotional strategies. For example, they observed a shift from deeper price discounts last year to cash-back-oriented promotions this year. This data is then utilized to assess its impact on market share and to influence future promotions.

No. 6: Home Appliances

A multinational home appliances manufacturer closely monitors whether retail partners adhere to recommended retail prices. Strict enforcement isn’t required, but visibility into the integrity of partnerships highlights where trade spend and promotional partnerships make the most sense, how exclusivity arrangements are decided, and how inventory is shared. In addition to reseller intelligence, the customer uses Wiser data to ensure price alignment across retailers within the same channel to prevent partnership friction.

No. 7: Outdoors and Camping

A manufacturer specializing in outdoor and camping closely tracks the price KPI to prevent retailers from offering discounts on their products, particularly during Memorial Day and Father’s Day. This is based on historical data that indicates strong sales during these periods, and the brand aims to safeguard profit margins.

No. 8: Home Improvement

Pricing data plays a pivotal role in shaping discussions between National Account Managers at a leading manufacturer of windows and doors and retail partners, such as Lowe’s and Home Depot. Alongside sales metrics, pricing data empowers them to advocate for increased sales of their brands’ products, both when a retailer has a presence but isn’t actively selling their products, and to highlight performance of their own offering versus competitors.

Furthermore, armed with competitive insights, sales teams can adopt a consultative approach by advising on strategies to boost category sales, thus expanding their market share. For example, Sales may propose that a retailer replaces a slow-selling product with their own brand’s more cost-effective alternatives.

No. 9: Major Appliances and Electronics

A major appliance and electronics manufacturer operates in a competitive market with frequent price changes. They often encounter retailer “pricing runs,” where price adjustments occur rapidly across multiple retailers.

For instance, in the UK, (1) Currys.com updates prices nightly, (2) AO.com changes prices 3 times a day, (3) Argos changes prices twice daily.

When competitors lower their prices, retailers contact the brand for sales support via Sales Out Allowance (SOA). SOA, funded by the brand, helps retailers maintain their margins by reducing the price charged by the seller due to product-related issues, such as quality, short shipments, or incorrect pricing. This adjustment is made after the initial billing to the buyer but before the buyer makes the payment. When a retailer requests this cost reduction, the brand evaluates historical price increases to determine if the retailer is seeking a cost reduction despite already offering discounts. In essence, they assess if the retailer initiated the “price war” they’re now complaining about.

The Role of Digital Shelf Intelligence in Pricing and Promotions

Wiser’s Digital Shelf Intelligence enables brands to gain a competitive edge in their fast-paced and highly competitive markets. This product equips brands with real-time insights into their pricing and promotions compared to competitors, ensuring that they are always one step ahead. This data-driven approach allows for smart decision-making, promotes profitability, and ensures a more robust market presence.

Market dynamics are continuously changing, and brands need to adapt their strategies accordingly. Wiser’s DSI tool enables this flexibility. It provides relevant information at the fingertips of decision-makers, ensuring that brands can modify their pricing and promotional strategies and keep up with the market. This adaptability is crucial for staying competitive and maintaining a significant market share.

Overall, Wiser’s Digital Shelf Intelligence is a game-changer for brands, giving them the power to take control of their pricing and promotions. By leveraging this innovative tool, brands can remain agile, respond promptly to market changes, and ensure their strategies are relevant and effective. It’s an investment in the future success of a brand.