El panorama de la venta minorista en línea lo abarca todo, desde el envío directo y la venta al por mayor hasta la suscripción y la marca blanca, lo que permite a los empresarios elegir el modelo de negocio óptimo para alinearse con la visión y las capacidades de su marca.

Elegir el modelo de negocio de comercio electrónico adecuado puede influir significativamente en el éxito de una marca, y requiere una comprensión exhaustiva de los matices de cada modelo. Entre los factores clave que hay que tener en cuenta figuran el público objetivo de la marca, la oferta de productos, la estrategia de precios y la escalabilidad. El modelo elegido debe alinearse con la estrategia de crecimiento a largo plazo de la marca y los objetivos de satisfacción del cliente.

Esta guía pretende profundizar en los entresijos de los distintos modelos de negocio de comercio electrónico, arrojando luz sobre sus pros y sus contras. El objetivo es dotar a las marcas de los conocimientos necesarios para tomar una decisión informada que impulse el éxito de su tienda online y fomente un crecimiento sostenible.

Fundamentos de los modelos de negocio de comercio electrónico

Un modelo de negocio de comercio electrónico es un plan de negocio estratégico que describe cómo una empresa en línea generará ingresos, identificará el segmento de clientes objetivo y ofrecerá valor a dichos clientes. Lo engloba todo, desde el tipo de productos o servicios vendidos hasta la estrategia de precios y las tácticas de marketing empleadas.

El papel de los modelos de comercio electrónico en las empresas en línea es polifacético. En primer lugar, proporcionan un marco que orienta las operaciones empresariales, la toma de decisiones y el establecimiento de objetivos.

Por no mencionar que un modelo de negocio bien definido ayuda a atraer inversores y partes interesadas al ofrecer una descripción clara de cómo la empresa pretende obtener beneficios y crecer con el tiempo. Los modelos de negocio de comercio electrónico ayudan a establecer una base de clientes sólida y a fomentar la fidelidad al identificar claramente el mercado objetivo y cómo satisfacer sus necesidades.

Tipos de modelos de negocio de comercio electrónico

En el panorama digital actual prevalecen varios modelos de negocio de comercio electrónico. A continuación, profundizaremos en los detalles de cada modelo, destacando sus características únicas, ventajas e inconvenientes.

- B2C (empresa a consumidor): Este es el modelo más común en el que las empresas venden productos o servicios directamente a los consumidores. Por ejemplo, Amazon y eBay.

- Características principales: Marketing personalizado, interacción directa con los clientes, diversa oferta de productos.

- Ventajas: Amplia base de clientes, mayor volumen de ventas, mayor cuota de mercado.

- Contras: Competencia intensa, altos costes de captación de clientes, necesidad de innovación continua.

- B2B (empresa a empresa): En este modelo, una empresa vende productos o servicios a otra. Un ejemplo sería una empresa de software que vende herramientas empresariales a otras empresas.

- Características principales: Basado en relaciones, pedidos al por mayor, precios basados en contratos.

- Pros: Beneficios estables gracias a contratos a largo plazo, valores medios de los pedidos más elevados, negocio repetido.

- Contras: Ciclos de venta más largos, proceso de toma de decisiones complejo, variabilidad de la demanda.

- C2C (Consumidor a Consumidor): Aquí, los consumidores venden productos o servicios a otros consumidores. Plataformas como eBay y Craigslist facilitan estas transacciones.

- Características principales: Transacciones entre iguales bienes de uso frecuente, basadas en la comunidad.

- Ventajas: Oportunidad de obtener beneficios para los particulares, amplia gama de productos, precios flexibles.

- Contras: Difícil de regular, posibilidad de fraude, falta de servicio al cliente.

- C2B (consumidor a empresa): En este modelo inverso, los consumidores ofrecen bienes o servicios a las empresas. Un ejemplo sería un autónomo que vende sus habilidades a las empresas.

- Características principales: Trabajo centrado en el individuo y basado en proyectos, licitación competitiva.

- Ventajas: Flexibilidad para los consumidores, acceso a una reserva mundial de talentos para las empresas, rentabilidad.

- Desventajas: Problemas de control de calidad, incoherencia, posibilidad de impago.

- D2C (Directo al consumidor): Las marcas o los fabricantes venden directamente a los consumidores, sin intermediarios. Marcas como Warby Parker y Everlane funcionan con este modelo.

- Características principales: Control sobre la marca, el precio y la experiencia del cliente, opiniones directas de los clientes, sin márgenes del minorista.

- Ventajas: Mayores márgenes de beneficio, relación directa con los clientes, tiempo de comercialización más rápido.

- Contras: Importante inversión en marketing, logística y atención al cliente, intensa competencia, gestión de la reputación de la marca.

Comprender estos modelos de comercio electrónico es clave para quienes desean aventurarse en el ámbito de los negocios en línea, ya que cada uno de ellos conlleva su propio conjunto de retos y oportunidades.

Cómo elegir el modelo de negocio de comercio electrónico adecuado

A la hora de elegir el modelo de negocio de comercio electrónico adecuado para su empresa, hay que tener en cuenta varios factores. Empiece por realizar un análisis exhaustivo del mercado para calibrar la demanda y la competencia en el nicho elegido. Conocer a su público objetivo y comprender sus necesidades puede guiarle a la hora de decidir por qué modelo decantarse.

A continuación, considere su tipo de producto o servicio. Si vende productos físicos, un modelo de venta al por menor o al por mayor puede ser adecuado, mientras que los productos o servicios digitales pueden ajustarse mejor a un modelo de suscripción o publicidad. La elección del producto o servicio también influye en si debe optar por un modelo de envío directo, que minimiza los costes de inventario, o por un modelo de marca blanca, que mejora el reconocimiento de la marca.

Otro factor determinante es tu presupuesto: recursos . Establecer un modelo de mercado, por ejemplo, requeriría una inversión inicial considerable en comparación con los modelos de marketing de afiliación o de venta directa. También es esencial calibrar la complejidad operativa y la escalabilidad de cada modelo, teniendo en cuenta tus capacidades y aspiraciones de crecimiento.

Por último, es fundamental adaptar el modelo de comercio electrónico a sus objetivos empresariales. Si su objetivo es una expansión rápida y una alta rentabilidad, un modelo B2C con estrategias agresivas de marketing digital podría serle útil. Por el contrario, si su objetivo es establecer relaciones a largo plazo con los clientes y un crecimiento constante, un modelo B2B podría ser más adecuado. Se trata de encontrar un equilibrio entre sus objetivos empresariales, las realidades del mercado y las ventajas y limitaciones inherentes a cada modelo de comercio electrónico.

Impacto de las nuevas tendencias en los modelos de negocio del comercio electrónico

Es innegable que la llegada de la tecnología ha moldeado el panorama del comercio electrónico, impregnando todos los aspectos del sector, desde el procesamiento de las transacciones hasta el servicio al cliente.

Los chatbots con IA, por ejemplo, pueden encargarse de un sinfín de tareas de atención al cliente, lo que permite ofrecer asistencia las 24 horas del día y una respuesta instantánea a las consultas de los clientes. Mientras tanto, la tecnología blockchain promete una mayor seguridad y transparencia en las transacciones en línea, reforzando la confianza de los consumidores en las plataformas de comercio electrónico.

Paralelamente, el comportamiento de los consumidores también está evolucionando en respuesta a estos avances tecnológicos. El comprador moderno no sólo tiene conocimientos digitales, sino que también valora la comodidad y la personalización. Este cambio ha hecho necesario que las empresas de comercio electrónico adapten sus modelos y estrategias de negocio a estas preferencias.

Las empresas innovan continuamente para satisfacer las necesidades y expectativas cambiantes de sus clientes, desde la oferta de una gama más amplia de opciones de pago, como los monederos móviles y el sistema "compre ahora y pague después", hasta el aprovechamiento del análisis de datos para el marketing personalizado. Esta interacción dinámica entre la tecnología y el comportamiento de los consumidores sigue impulsando la evolución de los modelos de negocio del comercio electrónico.

Cómo puede ayudarle la solución de conocimiento del mercado de Wiser

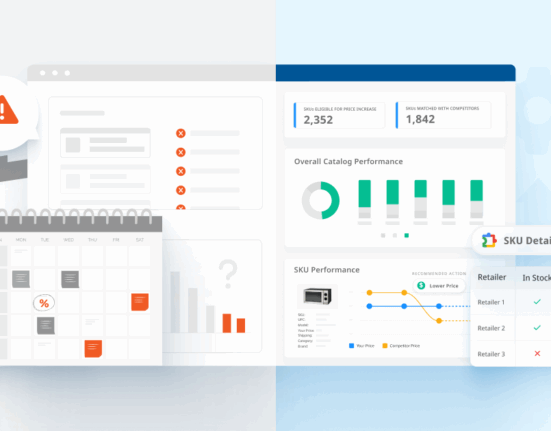

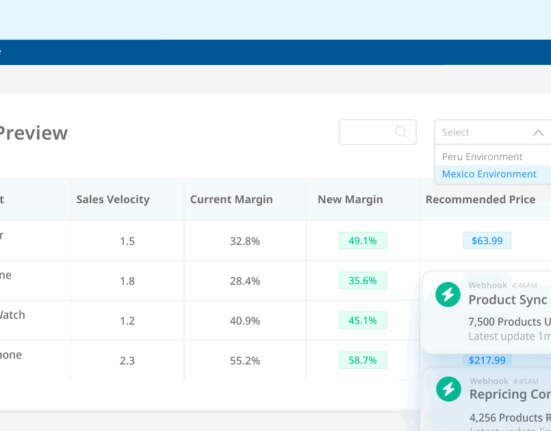

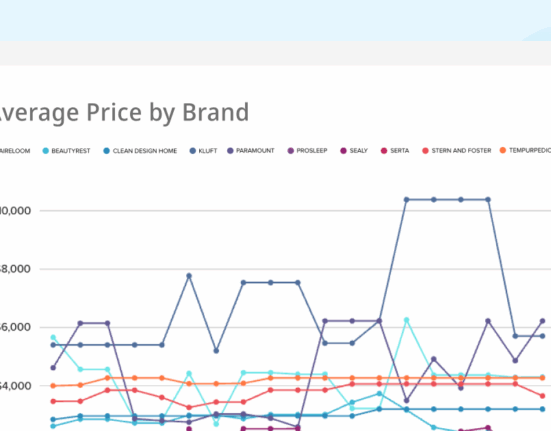

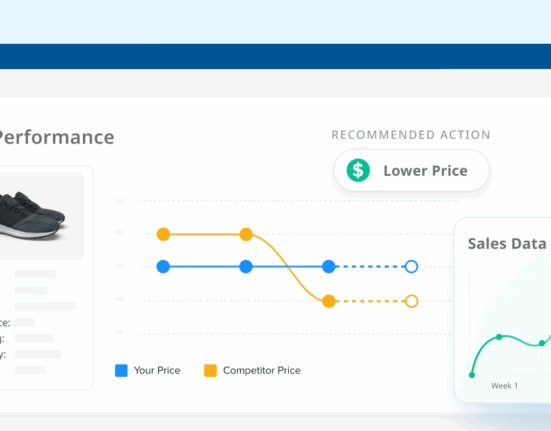

La solución Market Awareness de Wiser cambia las reglas del juego para las empresas que buscan obtener una ventaja competitiva en el dinámico mundo del comercio electrónico. Con esta solución, las empresas pueden analizar las tendencias del mercado, realizar un seguimiento de la actividad de la competencia y comprender el comportamiento de los consumidores en tiempo real, optimizando así sus modelos de negocio de comercio electrónico.

Esta herramienta no sólo revela lo que funciona para los competidores, sino que también identifica oportunidades de diferenciación, lo que permite a las empresas hacerse un hueco único en el mercado. La solución Market Awareness de Wiser proporciona información sobre muchos aspectos diferentes de la competencia, entre ellos:

- Indexación de precios: Vea cómo se comparan sus precios con los de la competencia y las categorías que le interesan con un mapa de calor visual.

- Inteligencia de catálogo: Compare su catálogo con el de la competencia a nivel de SKU con un panel configurable.

- Precios competitivos: Mejore su comprensión del mercado con matrices que destacan precios, promociones, valoraciones y reseñas.

- Comprobación de precios en directo: Comprenda claramente el panorama de su mercado y las actividades en las páginas de los minoristas con un complemento intuitivo y fácil de usar.

No dejes que la falta de datos de comercio electrónico te impida vender más y aumentar tus márgenes de beneficio. En su lugar, utiliza el panel de control de Wiser para supervisar tu catálogo de productos, comparar precios con la competencia, crear filtros personalizados y mucho más.

Los modelos de negocio de comercio electrónico ayudan a establecer una sólida base de clientes y a fomentar la fidelidad identificando claramente el mercado objetivo y cómo satisfacer sus necesidades.

Modelos de negocio de comercio electrónico

Elegir el modelo de negocio de comercio electrónico adecuado es un paso esencial para cualquier empresa que quiera triunfar en el mercado digital. El modelo elegido debe estar en consonancia con la estrategia general de la empresa, el público objetivo y el tipo de producto. Ya sea B2C, B2B, C2C o un modelo híbrido, cada uno tiene sus características y ventajas únicas que pueden ayudar a una empresa a prosperar en un entorno competitivo.

Optar por un modelo de negocio adecuado no sólo garantiza la rentabilidad, sino que también mejora la experiencia general del cliente. En última instancia, esto puede conducir a una fidelización sostenida de los clientes, una mayor cuota de mercado y un mayor crecimiento a largo plazo. Recuerde que el comercio electrónico no consiste solo en transacciones, sino en crear relaciones duraderas con los clientes.

A medida que las empresas evolucionan y crecen, también deben hacerlo sus modelos de negocio. Adaptarse a las tendencias cambiantes del mercado, a las preferencias de los clientes y a los avances tecnológicos puede garantizar la relevancia y el éxito de una empresa. Un enfoque flexible e informado de los modelos de negocio de comercio electrónico puede allanar el camino hacia un futuro digital próspero.