In a recent survey conducted by Wiser of Walmart, Target, Best Buy, and Costco stores, shoppers were asked to consider price, quality, and features in order to provide their perceived value of Sony, Samsung, and LG televisions.

80 percent of shoppers felt that Samsung provided good or great value, while LG came in second at 72 percent and Sony last at 57 percent.

This result is in spite of another Wiser survey question asking shoppers to rank the price of televisions versus competitors, where 48 percent of the time Samsung ranked “higher” or “much higher” in price. In contrast, Samsung’s biggest competitor in the U.S. television market, LG, was ranked least expensive, only seeing its prices marked as “high” or “much higher” than competitors by shoppers 19 percent of the time.

In order to better understand whether perceived consumer value correlates with price or possibly in-store promotion, we looked at displays, location of displays in-store, amount of promotional signage, and extent of discounting.

Television Displays and Retailer Presence

While displays for LG, Samsung, and Sony were observed in 100 percent of Best Buy locations, and in similar proportions in Costco, Sony failed to produce in-store displays in Walmart and Target, despite competitors’ strategic presence in those locations.

Generally, there weren’t any major differences in the location of displays across brands; instead, the retailer played a larger part. Two-thirds of the time, television displays are set up at the back of Best Buy, Target, and Walmart. However, in 90 percent of these cases, television display presence was at the front of Costco locations, which is unsurprising if you’ve ever walked into a Costco.

Two-thirds of the time, television displays are set up at the back of Best Buy, Target and Walmart; however, in 90% Costco locations, television display presence was at the front.

Promotional Signage Versus Competitive Set

Best Buy

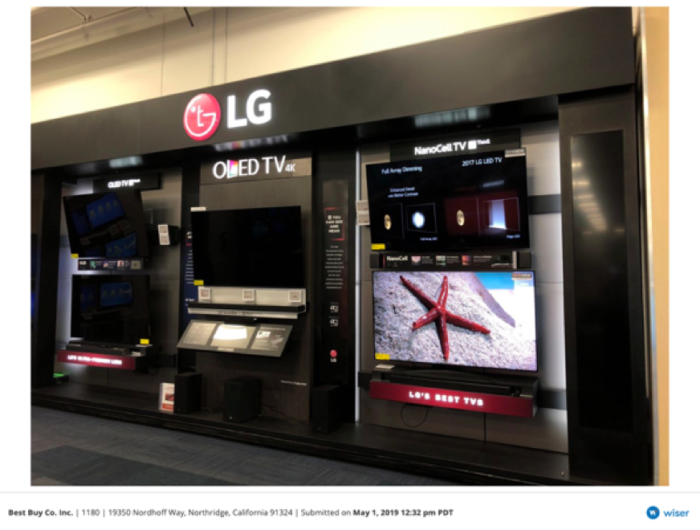

When compared to other brands, Samsung had much more promotional signage found across Best Buy retailers. In 46 percent of locations, Samsung had more or “much more” promotional material versus the other television brands. In contrast, Sony and LG had “about the same” amount of signage as competitors.

Target and Walmart

Again, Samsung had more or “much more” promotional signage than competitors 47 percent of the time in Target and 50 percent of the time in Walmart. At the same time, LG generally found itself with the same amount of promotional content as competitors.

Price and Discounting

A couple of notes regarding brands marked as “on sale” or “on promotion”:

- Sony, LG, and Samsung TVs were marked “on promotion” 80 percent of the time at Best Buy locations.

- Sony, LG, and Samsung TVs were all marked “on promotion” around 40 percent of the time at Costco locations.

- LG and Samsung TVs were marked as on promotion around 90 percent of the time in Target, and 68 percent of the time in Walmart retailers.

In general, brands fell in similar buckets regarding how often they were marked down.

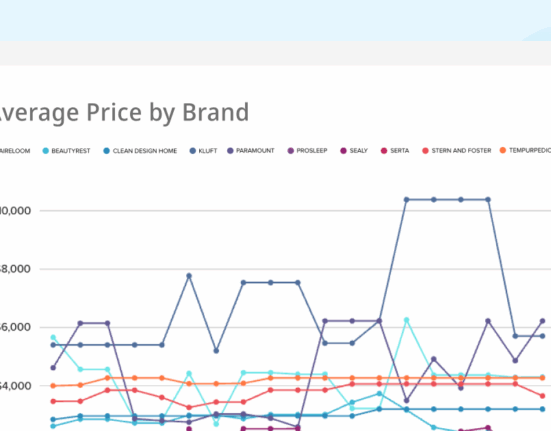

When it came to shoppers comparing television prices—in Best Buy and Costco, the retailers where Sony displays are present, Sony televisions are considered more or much more expensive versus the competition. In contrast, LG televisions are considered more expensive than competitors only 17 percent to 20 percent of the time across all four retailers. Samsung prices fell in the middle.

Samsung uniquely finds itself more expensive than competitors in the two retailers where Sony is not present, Target and Walmart. We observed that whether Samsung is considered the most expensive brand, like in Target and Walmart, or not, as in the case of Best Buy and Costco, perceived value by the customer is still the highest with Samsung.

What Is Samsung Doing Right?

At Wiser, we have seen that merchandising and display compliance rates can fall as low as 30 percent depending on the retailer. Sometimes, it’s easy to determine why compliance rates are low—improper installation, wrong placement, missing signage, or inventory. In other cases, it’s not so easy. Regardless, compliance rates relate directly to how customers experience a brand—how does he or she feel when in the presence of a brand?

What was observed over and over again, across thousands of photos provided by Wiser’s network of smartphone-enabled shoppers, was Samsung’s consistency with regard to the customer experience across all four national retail chains. When customers entered Samsung television display areas, regardless of retailer, they very rarely encountered a poorly set up display, expired signage, obscured prices, or missing inventory.

In almost every photo taken of a Samsung television section, the brand’s colors (blue and black) are used to catch the eye of the customer, empty space is maximized through the use of promotional signage and product details, and televisions form the focal point of the customer’s journey. In addition, customers are exposed to the maximum amount of merchandise. In fact, Samsung averaged 19 televisions on display in Best Buy, compared to Sony and LG’s 13, and averaged 30 televisions on display in Costco, compared to Sony’s 7 and LG’s 18. Samsung ensures its customers are surrounded by the brand and its capabilities on a continual basis.

By promoting the Samsung brand as an experience, versus a product, when it comes to offline settings, one could quite easily make the jump that this has a positive impact on shoppers’ perceived value and sales.