Comprender la posición de su producto en el mercado es crucial para el éxito, especialmente cuando se trata del precio. Pero, ¿qué es exactamente el posicionamiento del precio y cómo influye en el éxito de un producto en el mercado?

El posicionamiento de precios se refiere al proceso de determinar dónde encaja un producto o servicio en relación con otras ofertas del mercado, basándose en su precio. Se trata de seleccionar estratégicamente un punto de precio que comunique un determinado valor a los consumidores, influyendo así en su percepción del producto o servicio.

En la batalla por la cuota de mercado, el posicionamiento de precios puede ser una herramienta poderosa. Si se hace correctamente, puede ayudar a las marcas a diferenciarse, atraer al público objetivo adecuado y, en última instancia, impulsar las ventas.

Pero, ¿qué es el posicionamiento de precios?

El posicionamiento de precios es una estrategia de marketing que consiste en fijar el precio de un producto o servicio de forma que atraiga a un segmento específico del mercado. Este enfoque tiene en cuenta el valor percibido del producto o servicio por el cliente, así como su comparación con ofertas similares de la competencia. El objetivo es posicionar el producto o servicio de tal manera que parezca ofrecer el mejor valor por su precio, convirtiéndolo así en una opción atractiva para el segmento de mercado objetivo.

La forma de utilizar el posicionamiento de precios puede variar mucho en función de la industria, el producto o servicio en cuestión y el segmento de mercado específico al que se dirija. Por ejemplo, una marca de lujo puede utilizar un posicionamiento de precios alto para transmitir la exclusividad y la alta calidad de sus productos. Por otro lado, un minorista de descuento puede utilizar un posicionamiento de precios bajos para atraer a consumidores preocupados por su presupuesto que buscan la mejor oferta.

Independientemente de la estrategia concreta que se utilice, la clave del éxito del posicionamiento de precios es garantizar que el precio refleje el valor percibido del producto o servicio por el mercado objetivo. Esto implica comprender el mercado, la competencia y las necesidades y expectativas del cliente. Cuando se hace con eficacia, el posicionamiento de precios puede ayudar a una empresa a atraer a su mercado objetivo, diferenciar su oferta de la de sus competidores y, en última instancia, impulsar las ventas y la rentabilidad.

Tipos de posicionamiento de precios

El posicionamiento de precios es un aspecto crucial de la estrategia de marketing y fijación de precios de un producto, que influye significativamente en cómo se percibe el producto en el mercado. Existen principalmente tres tipos de posicionamiento de precios:

- Precio Premium: Es cuando un producto tiene un precio superior al de sus competidores. Las empresas utilizan los precios premium cuando tienen un producto único o un alto valor de marca, y quieren posicionar su producto como de alta calidad o de lujo.

- Precios competitivos: Con la fijación de precios competitiva, los productos tienen un precio similar al de los competidores. Esta estrategia suele utilizarse cuando las características del producto son similares a las de otros productos del mercado y las empresas quieren competir directamente en precio.

- Precios económicos: Esta estrategia consiste en fijar un precio inferior al de la competencia. Las empresas utilizan la fijación de precios económicos para atraer a clientes preocupados por el precio y posicionar su producto como una opción asequible en el mercado. Suelen utilizarla las empresas que pueden mantener unos costes de producción bajos para mantener la rentabilidad a precios más bajos.

Factores que influyen en el posicionamiento de precios

El posicionamiento del precio de un producto o servicio puede verse influido por diversos factores. Por ejemplo:

Percepción del consumidor

La percepción del valor de un producto por parte de los consumidores influye enormemente en su posicionamiento de precios. Si un producto o una marca se perciben como de alta calidad, únicos o con una imagen de marca prestigiosa, los consumidores pueden estar dispuestos a pagar un precio más alto.

Por el contrario, si un producto se considera indiferenciado o de menor calidad, su precio debería ser más bajo para atraer a compradores potenciales. La percepción del cliente suele estar determinada por los esfuerzos de marketing, la reputación de la marca y la experiencia personal del cliente.

Al comprender la intrincada relación entre el precio y el comportamiento del consumidor, las empresas pueden posicionar estratégicamente sus productos para maximizar las ventas y la rentabilidad.

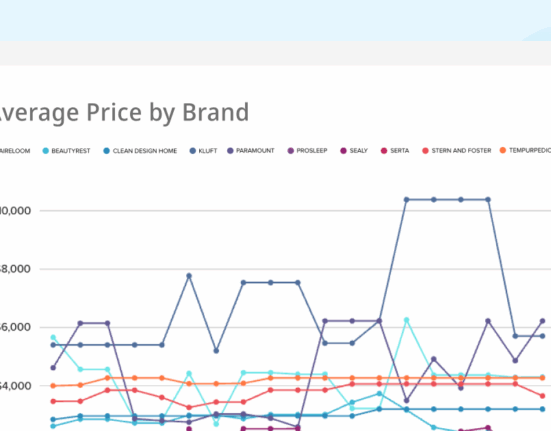

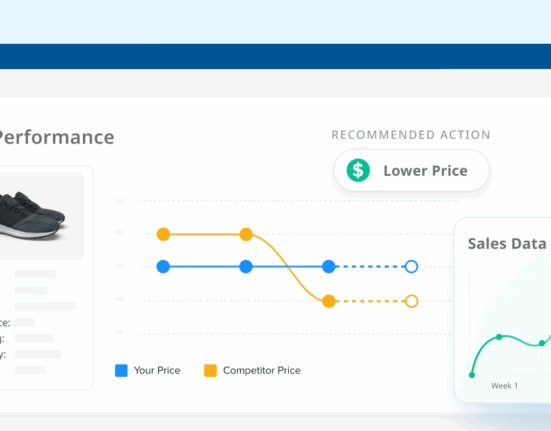

Precios de la competencia

El posicionamiento de los precios también se ve afectado de forma significativa por las estrategias de fijación de precios de las marcas o productos de la competencia. Las empresas suelen analizar los precios de las ofertas de la competencia para identificar una gama adecuada para sus propios productos.

Si el precio de la competencia es inferior, una empresa puede tener que justificar un precio más alto con características únicas o una calidad superior. Por otro lado, si un producto tiene características y calidad similares a las de la competencia pero su precio es más elevado, puede tener dificultades para atraer clientes.

Es importante seguir de cerca las estrategias de fijación de precios de la competencia y las respuestas del mercado a las mismas para garantizar un posicionamiento óptimo del precio de su producto.

Condiciones del mercado

El estado actual del mercado es otro factor crucial que puede influir en el posicionamiento de los precios.

En un mercado con mucha demanda y poca oferta, los precios pueden situarse más altos, ya que los consumidores están más dispuestos a pagar. Por el contrario, en un mercado con poca demanda y mucha oferta, puede ser necesario bajar los precios para atraer a los clientes.

Las tendencias del mercado, las condiciones económicas y el poder adquisitivo de los consumidores también desempeñan un papel importante en la configuración de las estrategias de posicionamiento de precios. En épocas de recesión económica, los consumidores suelen buscar opciones más baratas, lo que obliga a ajustar el posicionamiento de precios.

Ciclo de vida del producto

La fase del ciclo de vida de un producto puede influir mucho en su posicionamiento de precios.

En la fase de introducción, una empresa puede fijar un precio más alto para recuperar los costes de investigación y desarrollo, sobre todo si el producto es innovador y tiene pocos competidores. Durante la fase de crecimiento, los precios pueden permanecer estables o disminuir ligeramente a medida que aumenta la competencia. En la fase de madurez, los precios suelen disminuir a medida que la competencia se intensifica y el mercado se satura.

Por último, en la fase de declive, las empresas pueden reducir considerablemente los precios para liquidar las existencias restantes.

El impacto del posicionamiento de precios en el comportamiento del consumidor

El posicionamiento de precios desempeña un papel importante a la hora de influir en el comportamiento de los consumidores. Puede utilizarse como herramienta estratégica para configurar la percepción que tienen los consumidores de un producto o servicio, afectando así a sus decisiones de compra. Este fenómeno, a menudo denominado "heurística precio-calidad", es un sesgo común en los procesos de toma de decisiones de los consumidores.

Sin embargo, es esencial tener en cuenta que no siempre es así. Dependiendo del mercado y del tipo de producto, algunos consumidores pueden buscar opciones más baratas, por considerarlas más rentables u ofrecer una mejor relación calidad-precio. Por ejemplo, en mercados muy competitivos con poca diferenciación entre los distintos productos o servicios, los consumidores pueden ser más sensibles al precio e inclinarse por opciones con precios más competitivos.

El posicionamiento de los precios también influye en la imagen y la reputación de la marca. Tanto los precios más altos como los más bajos pueden tener éxito, pero atraen a distintos tipos de consumidores y crean imágenes de marca divergentes.

Lo más importante es que el posicionamiento de precios no es una estrategia universal. Las empresas deben tener en cuenta su público objetivo, la oferta de productos, la competencia del mercado y la imagen general de la marca a la hora de decidir su estrategia de posicionamiento de precios. Al comprender la intrincada relación entre el precio y el comportamiento del consumidor, las empresas pueden posicionar estratégicamente sus productos para maximizar las ventas y la rentabilidad.