Earlier this year, we predicted that retailers would be investing more in improving the omni-channel experience for consumers. One of the biggest challenges with trying to provide a great shopping experience is providing a seamless integration between online and offline channels. But where does pricing fit in? How can retailers manage customer expectations across channels and maximize growth, while protecting their margins?

Many retailers already have difficulty optimizing pricing and promotions, and capitalizing on pricing opportunities—add more channels and it gets even more challenging. The top four challenges of omni-channel pricing are understanding the customer, differentiating from competitors, understanding the quirks of each channel and how they impact your pricing strategy, and actually executing pricing changes across channels. Here’s how to tackle these challenges.

1. Consumers

How should you price across channels? It doesn’t matter whether it’s online, mobile or brick-and-mortar, 49 percent of consumers expect prices to be the same across channels. And even though retailers are worried about showrooming (when a shopper goes to a store to check out an item in person before purchasing online, often for cheaper) cutting into their profits, according to a Harris Poll, 69 percent of people webroom (the opposite of showrooming—when a consumer views the item online before buying in store) while only 46 percent showroom. In general, there are three main pricing strategies you can follow:

- Channel-specific: Pricing based on channel. This method of pricing worked well before the digital age. Customers went directly from seeing the price to purchasing if they were interested. But today, it doesn’t take much to discover the different prices between channels, which can lead customers to have a negative view of the retailer.

- Omni-channel: All channels have the same price (or they should). This makes everything easier for the consumer and removes the distinction between purchasing online and in person.

- Hybrid: Takes the best from the previous methods, the consistent prices of omni-channel and the lowered prices from channel-specific. This strategy maintains consistent pricing across channels but allows exceptions for restricted discounts based on time or personalized markdowns.

2. Competitors

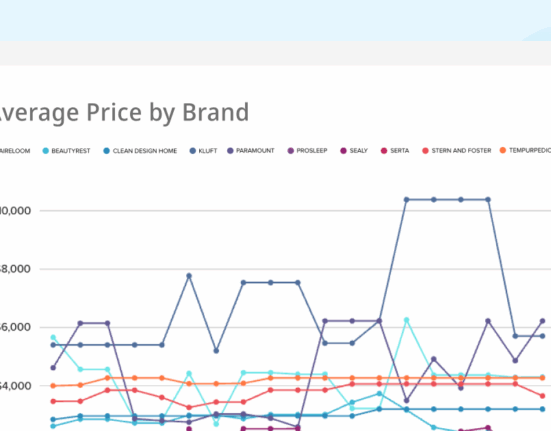

Are you keeping track of competitor pricing across all your channels? Do you know how to react when competitors drop prices, especially since they’re only a click away? Monitoring their pricing allows you to stay ahead of the game and properly optimize your own pricing. Your biggest competitor in brick-and-mortar may be very different from your biggest competitor in the Amazon marketplace. Make sure all are on your radar.

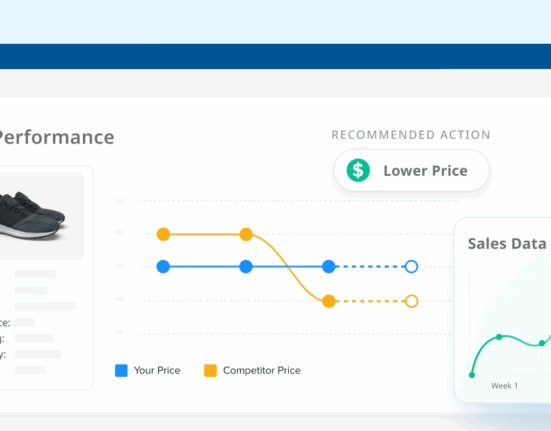

Competitive monitoring allows you to see which categories your competitors are focusing on and which ones they’re phasing out seasonal promotions, and other discounting activity that may vary across channels. Ultimately, the name of the game is to prevent price deterioration, capitalize on any pricing opportunities, and manage your price position relative to the competition.

One important caveat to note: you don’t want to ignore your competitors, but you also don’t want their pricing to dictate yours. Competitor pricing should be a factor in your strategy, but not the only variable. Set clear guidelines on when to match in price, in what channels, and under what conditions it makes sense to have inconsistent pricing across channels, if ever.

3. Channels

Operating in multiple channels requires more sophisticated pricing models that incorporate factors like price and shipping costs, inventory levels, and cost economies of each channel. Be careful with managing customer expectations across channels—each one may require a unique strategy. Here are a few factors you should consider that may be different across channels:

Consumer behavior across various product categories: One important note is that your pricing strategy may differ between categories of products. Some categories may be less likely to be shopped or price compared across multiple channels. So, find opportunities where you can capture more margin for products where multichannel shopping is less likely. Some categories may be primarily driven by in-store sales versus a mix of online research and in-store buying versus a true split between physical and online channels. Price sensitivity and price transparency will vary across channels—use that to your advantage.

Price elasticity and price testing: What about marketplaces like Amazon? Are you priced competitively enough in channels where the competition is more fierce? Do you have sufficient data on differences in price elasticity across channels? A price that’s working well on your web store may not be competitive enough if you’re selling the same product on a marketplace. Keep track of cross-channel sales and how prices impact sales on each one. Also keep in mind that while historical data can be a good indictor of future results, the market is dynamic and things can change in an instant. Remember to incorporate periodic price testing to make sure you are continuously optimizing your strategy to be most effective.

Be careful with managing customer expectations across channels—each one may require a unique strategy.

Operating costs: Does your pricing take into account differences in operating margins in-store versus online? For example, online stores will have shipping costs to take into account, whereas a physical store will have overhead like rent. While drastic price differences across channels doesn’t usually make sense, a small degree of variance is something to consider when devising your strategy.

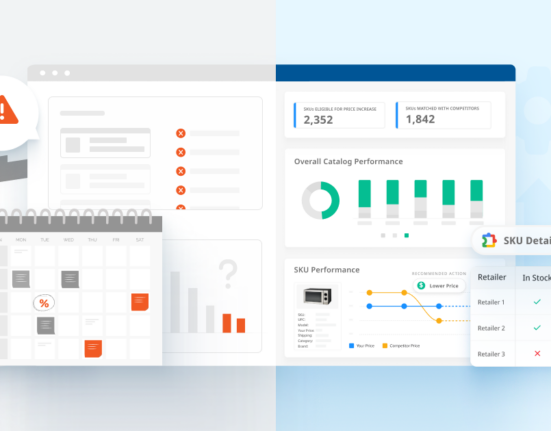

4. Managing Price Changes

Having a variety of channels to keep track of can get hectic. Regardless of what pricing strategy you ultimately choose to follow, whether keeping all your prices the same across channels or managing the slight differences in pricing between them, the complexity can make anyone’s head spin. Managing pricing for a large number of SKUs manually can be incredibly inefficient and tedious. Need to add more channels? The complications will multiply.

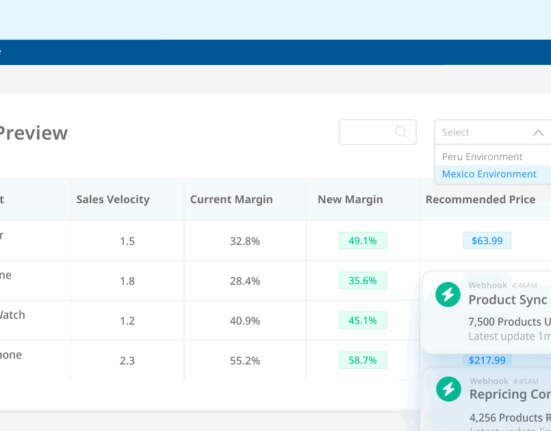

The allocation of time when following a manual process is heavily weighted on the data collection side rather than the actual analysis and strategic decision-making process, when it should really be the opposite. Whether you choose to build an internal system or invest in a third-party pricing optimization solution to automate some of these processes, having a scalable system in place is essential to managing pricing and the omni-channel challenges in the long run.

Omni-channel is only going to grow with time. Forrester predicts this year the amount of online and web-influenced retail sales will hit $1.8 trillion, up from $1.3 trillion in 2013. Omni-channel retail can definitely complicate pricing, and perhaps it’s too early to say if anyone has mastered it just yet. But if you do your due diligence and arm yourself with the proper resources and data, you’ll be well prepared to tackle the challenges head-on and win against the competition.

Contributing Writer: Matt Chow