The back-to-school season signals change and growth for students and presents a significant sales opportunity for retailers. It’s not just about selling basic school supplies anymore.

The emergence of eCommerce has transformed traditional shopping habits, with a growing number of parents and students turning to online platforms to fulfill their annual back-to-school shopping needs. This transition, coupled with the ongoing impact of the global pandemic, has necessitated a re-evaluation of strategies and approaches for businesses seeking to thrive in this evolving market.

Understanding these changes and adapting effectively is crucial for retailers who aim to capitalize on this annual shopping event. The convenience, variety, and value offered by online platforms presents a compelling proposition for consumers.

Wiser Solutions provides vital tools and insights to help you navigate the complexities of online retail. As we move forward, it is essential for retailers to remain agile, leveraging data and analytics to better understand customer behavior, anticipate trends, and make informed decisions. Here’s what happened in the 2023 school year.

Understanding the Shift to Online Shopping for Back-to-School Items

The surge in online shopping for school supplies can be attributed to a combination of factors.

First and foremost, the digital transformation sweeping across various sectors has made its way into the education system, making online shopping a go-to solution due to its convenience and variety. Parents and students alike can browse and compare a vast array of products at their leisure from the comfort of their homes.

Furthermore, the COVID-19 pandemic has played a significant role in this shift, with safety concerns prompting many to avoid crowded department stores.

Lastly, eCommerce platforms have made strides in their services, offering fast shipping, hassle-free returns, and competitive prices, further cementing online shopping as an attractive option as consumers plan their back-to-school preparations.

What Back-to-School Items Are a Must for Most Students?

According to the National Retail Federation, electronics were one of the most essential items on everyone’s back-to-school shopping list this year. Shoppers reported that 52 percent of their spending on electronics was influenced by classroom lists or school requirements, similar to the 52 percent of college students who said the same.

One-fourth of consumers also reported that they planned to spend more on back-to-school shopping this year due to their need for bigger-ticket items such as computers, phones, calculators, or furniture.

Back-to-School Retail Trends According to Wiser

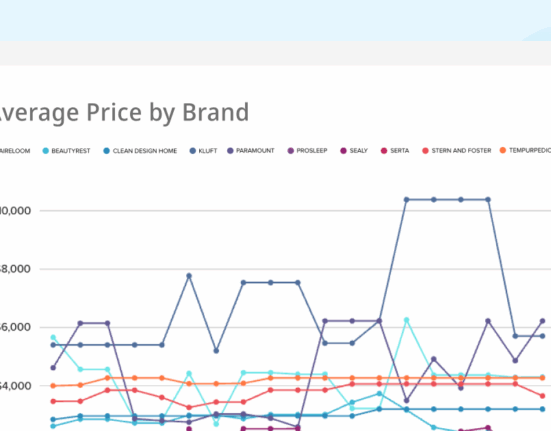

Wiser analyzed pricing, availability, promotions, and ratings & reviews across three categories of school supplies over the 2023 back-to-school period: stationary, electronics, and backpacks.

Availability

Product availability is crucial for retail sales success. If products are unavailable, shoppers will choose competitors, which is why it’s vital for retailers to track their out-of-stock rates.

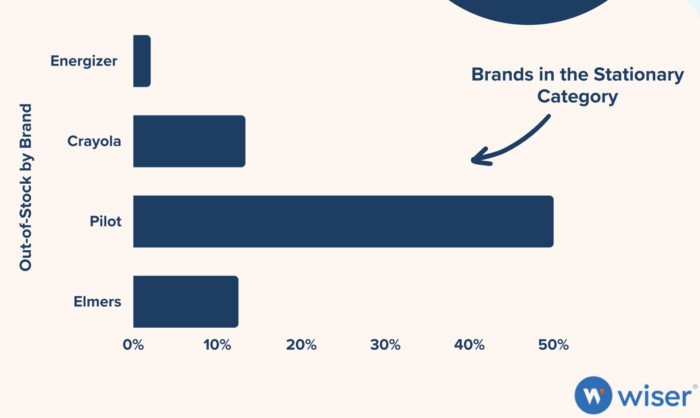

Check out the average out-of-stock rate in the stationary category across the following retailers:

Wiser data found that Pilot holds the highest out-of-stock rate in the stationary category at 50 percent, while Energizer holds the lowest rate at less than 5 percent.

Promotions

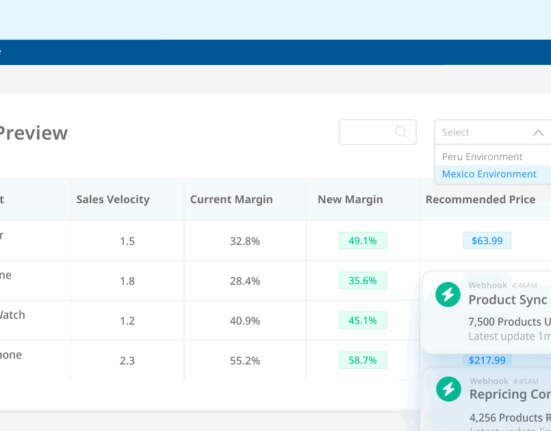

Boosting sales involves identifying competitors, tracking market newcomers, and monitoring partner pricing and discounts.

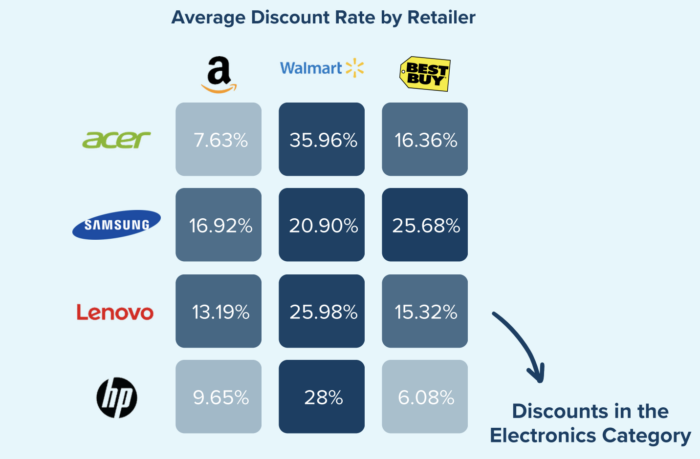

Within the Electronics category, Walmart leads the pack with a sizable 25.54 percent average discount, closely followed by Best Buy and Amazon.

Ratings and Reviews

Online sentiments influence purchasing decisions. Ratings and reviews are a key piece of the puzzle and show popularity and value. Tracking this feedback, both yours and your competitors, is crucial.

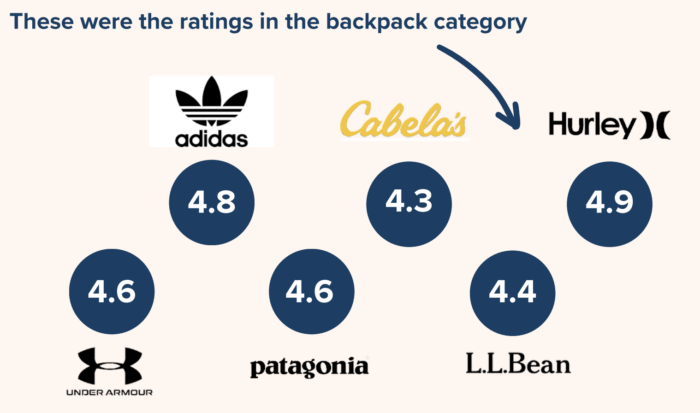

When looking at the Wiser data, we can see that 4.4 is the average rating across all products and resellers in the backpack category, with the highest rating belonging to Hurley and the lowest rating belonging to Cabela’s.

What We Can Learn From the 2023 Data

From the Wiser data, we can glean significant insights that can drive retailers’ strategies for the next back-to-school season.

Product availability, for instance, is a crucial factor in determining sales success. Retailers with high out-of-stock rates, like Pilot in the stationary category, risk losing customers to competitors. Therefore, keeping an eye on stock levels and ensuring availability could be a critical strategy for retailers looking to retain their customer base and improve sales with school shoppers.

Promotion strategies also play an important role in the competitive retail landscape. Walmart’s leadership in the electronics category, owing to an aggressive discount strategy, proves the effectiveness of promotions in driving customer engagement and boosting sales. Retailers should focus on devising compelling sales and promotions to attract and retain customers.

Furthermore, ratings and reviews significantly influence purchasing decisions. Tracking customer feedback, for both your own and competitor’s products, is crucial to understanding market sentiments. Products with high ratings, like Hurley in the backpack category, demonstrate popularity and value. Thus, investing in improving product quality and customer experience could lead to higher ratings, increased customer trust, and ultimately, greater sales.

Staying Ahead with Online Shopping Trends

In conclusion, the rise of eCommerce has revolutionized the back-to-school shopping season, leading to a shift in consumer spending patterns. Retailers must adapt their strategies to meet these changing customer needs and expectations.

Insights gleaned from the Wiser data can help retailers in strategizing for the upcoming seasons. Ensuring product availability, offering compelling promotions, and monitoring customer feedback are key factors that can influence sales success.

Retailers that leverage these insights to improve their strategies will be better equipped to navigate the evolving online retail landscape and drive customer engagement, ultimately enhancing their sales and building a loyal customer base. As the market continues to evolve, these insights will become increasingly crucial in helping retailers stay ahead of the game and prosper in the online retail space.