In the competitive world of retail, shoppers are always on the lookout for that elusive “too good to be true” deal. But what about from the perspective of brand manufacturers and retailers? Should they be equally eager to offer such enticing prices?

This is where the concept of loss leader pricing comes into play. By strategically setting prices lower than the cost of production or acquisition, businesses can attract customers and generate foot traffic. When executed effectively, loss leader pricing can serve as a profitable business strategy, allowing companies to build customer loyalty and increase overall sales.

However, it’s important to tread carefully. If implemented poorly, loss leader pricing can backfire, leading to customer dissatisfaction and even legal repercussions. Businesses must carefully evaluate their financial position, considering factors such as profit margins, customer acquisition costs, and long-term sustainability.

So, how can you determine if loss leader pricing is the right choice for your own business model? It requires a thorough analysis of your target market, competition, and overall business goals. By weighing the potential benefits and risks, you can make an informed decision that aligns with your company’s objectives.

Understanding Loss Leader Pricing

Loss leader pricing is a strategy where products are priced below market cost to stimulate other, more profitable sales. This tactic is a cornerstone of many successful retail and eCommerce strategies. By offering a product at a loss, retailers draw traffic to their stores or websites. Customers enticed by the low-priced item often end up purchasing other items at regular prices, driving up profits.

Implementing loss leader pricing involves careful selection of the product to be discounted. This product should be popular and in high demand, to ensure customer interest. It’s also crucial to have a diverse range of profitable products available to upsell alongside the loss leader. The strategy’s success hinges on the subsequent sales compensating for the initial loss, so a well-managed inventory and an attractive product portfolio are key.

Is Loss Leader Pricing Right for You?

Unsurprisingly, there are a number of pros and cons to selling products at a loss.

Pro No. 1: Increased Basket Sizes

The first positive for loss leaders is in consumer buying behavior—shoppers who feel like they’re getting a deal on one product are more likely to buy other items.

This is a basic component of turning loss leader items into a profitable strategy. The idea is that the product sold at a very attractive price will tempt shoppers into spending more. This is great for retailers, as they’re getting a cut of all those sales.

It’s a little trickier for brands. What many do if they’re asking their resellers to price an item as a loss leader is to focus on captive products to turn a profit. A few good examples are electric toothbrushes and manual razors. Toothbrushes can be priced at a loss, while replacement toothbrush heads are marked up slightly. Same with razors, as you can keep the handle and swap out the blades.

Pro No. 2: Opportunity to Launch a New Product or Penetrate the Market

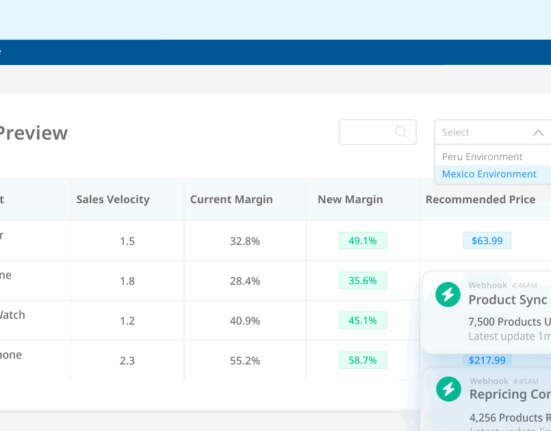

Low prices are a big incentive for shoppers to buy, which makes loss leader pricing a possible strategy if you’re looking to launch a new product or enter a new market. For example, you might want to generate some interest quickly and get a few wins. So, you price a brand-new product at a loss so more people are willing to take a chance on an unknown item.

Or, you want to expand your business in a new region. You have a tried and trusted product in your home market, but it’s an unknown quantity in a different country. So, you price it low to build up trust here before switching pricing strategies once you’re more established.

In either case, loss leaders can build their own advantage by pricing lower than their competitors might be willing to go.

Pro No. 3: Optimized Store Layout

In a boost for retailers, loss leader pricing can actually help you design the layout of your store (or store layout can help you decide which items to price at a loss). The concept here is that items priced in the way back of the store are the loss leaders. Shoppers will be hunting for that deal and will become familiar with that section of your store.

The benefit for you is that they have to walk by all the other items to get there. That’s when you price the profitable products in their footpaths, as most consumers will add to their baskets on the way to the loss leader. This is big in grocery, where many stores put the daily staples like dairy in the back, past some more tempting categories.

Con No. 1: You Set a Price Perception

You might argue that this one could be a pro or a con, but for many businesses, the lack of flexibility can become problematic. What are we talking about? When you commit to a loss leader pricing strategy, you create an expectation with shoppers that your brand is the “cheapest brand.” This perception can be hard to shake, even if you really want to switch up your pricing strategies in the future.

Consumers tend to have good memories when it comes to prices, so it’ll be a jarring move to go from a really good deal to a pretty common price—or worse, to the expensive option. It’s definitely possible, but you need to be smart in when and how you employ loss leader pricing. You can use it only during holidays, only for limited-time products, or spend on marketing when you’re ready to make the change.

What you don’t want to do is make the change with little notice and give your customers a bad surprise.

Con No. 2: Not Cost Sustainable for Smaller Businesses

You have to pay the bills somewhere, and loss leaders typically absorb the manufacturing, warehousing, or distribution costs in order to pass savings on to their consumers. This is easier said than done for some companies.

For example, small-to-medium-sized businesses might have a harder time finding the cash to cover those expenses compared to larger corporations. At some point, you’ll have to do the planning to figure out whether you can afford those up-front expenses in order to roll out a loss leader strategy. The answer will differ for many companies, based on your size, profits, sales numbers, and other metrics.

The success of loss leader pricing largely hinges on a business’s capacity to balance the initial reduction in profits with long-term customer retention and increased sales volume.

Con No. 3: It Can Be Illegal!

Forgive us for burying the lede a little bit, but loss leader pricing might not exactly be legal in your area. Like with many aspects of business, consult with your legal counsel before using a loss leader pricing strategy in the real world.

According to the U.S. Federal Trade Commission, loss leader pricing is 100 percent legal in only 10 U.S. states, while a number have partial bans on the strategy, depending on how it’s used. The rest have a general ban on this tactic. It is also banned in many European countries.

The nuances come down to how predatory the pricing strategy is from a consumer perspective. As noted above, some larger companies can use this to force smaller stores to close, as they’re unable to front the costs. On the other hand, it can be beneficial for shoppers, as it can draw them into new stores and introduce them to a variety of products they might not be familiar with.

Strategies for Implementing Loss Leader Pricing

Loss leader pricing is a strategy that can be highly effective in attracting customers and increasing sales volume. However, it’s crucial to implement it carefully to maximize benefits and avoid potential pitfalls. Here are some strategies businesses can consider:

- Identify Suitable Products: Choose products that are popular and have a broad appeal. Customers drawn in by these loss leaders are likely to purchase other items at regular prices.

- Avoid Overuse: Using loss leaders too frequently can lead to customers expecting reduced prices all the time. Balance is essential; use this strategy sparingly to maintain its impact.

- Bundle Products: Pair a loss leader with complementary products. This encourages buyers to spend more than they initially planned, helping to offset the reduced profit from the loss leader.

- Limit quantities: Restrict the number of loss leader items a customer can purchase. This prevents customers from stocking up on the discounted item without buying anything else.

- Leverage Supplier Support: Work with suppliers to secure better prices on loss leader items. This can help to minimize losses and make the strategy more sustainable.

Implementing loss leader pricing requires careful planning and execution, but when done right, it can be a powerful tool for driving sales and customer loyalty.

Real-Life Example of a Successfully Implemented Loss Leader Pricing Strategy

Gillette, a renowned name in the personal grooming industry, has brilliantly leveraged the loss leader pricing strategy to capture a substantial market share. By selling their razors at a considerably low, often below-cost price, Gillette effectively attracts a large consumer base. The genius of their approach lies in the understanding that once consumers have purchased the inexpensive razor, they will need to buy the accompanying blades, which are priced much higher. This strategy, while initially appearing to make a loss, ensures a recurring revenue stream as consumers continue to buy the high-margin blades.

Moreover, this approach creates a psychological lock-in effect. The customers, having initially invested in the razor handle, are more likely to continue purchasing the respective blades rather than switching to a different brand and starting the process over. As a result, Gillette successfully retains customers over a significant period, ensuring consistent sales. The success of this strategy is apparent in Gillette’s robust market position and wide customer base globally.

Leveraging Loss Leader Pricing for Success

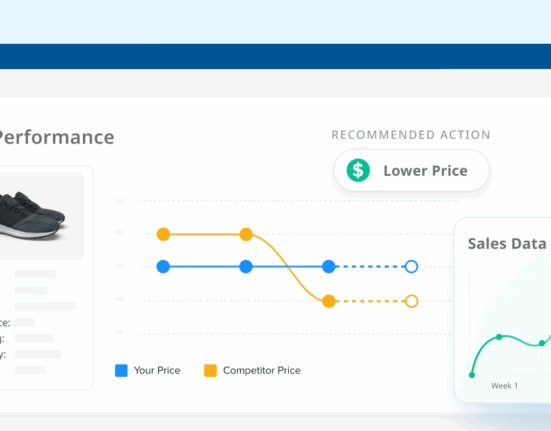

Loss leader pricing can be a highly effective retail strategy, potentially driving customer traffic, promoting higher overall spend, and enhancing customer loyalty. This tactic, when employed judiciously, can be a powerful tool for retailers to edge out competition and increase their market share. However, its implementation requires careful consideration of factors such as product selection, customer behavior, and overall financial implications.

The success of loss leader pricing largely hinges on a business’s capacity to balance the initial reduction in profits with long-term customer retention and increased sales volume. Hence, it is crucial for retailers to track and analyze the results of their loss-leader initiatives. This will ensure they are delivering the expected benefits and contributing positively to the company’s bottom line.

To learn more about price management, visit Wiser.com today.

Editor’s Note: Contributing writer is Matt Ellsworth. This post was originally published in November 2021 and has since been updated and refreshed for readability and accuracy.