One of the biggest challenges for retailers is deciding on—and implementing—a pricing strategy that will increase profits and drive customer loyalty.

It can be tough when you’re pricing new products. Set your prices too high and you can miss out on possible sales. Set your prices too low and you might miss out on profits. It’s all a balancing game to find the right price.

But it doesn’t have to feel like such a shot in the dark.

There are many different pricing strategies already out there that can be beneficial to your business. Some to help you draw in shoppers quickly, and others that can help establish your products in the market.

Read more about these different strategies to decide which one is right for you.

Competitive Pricing

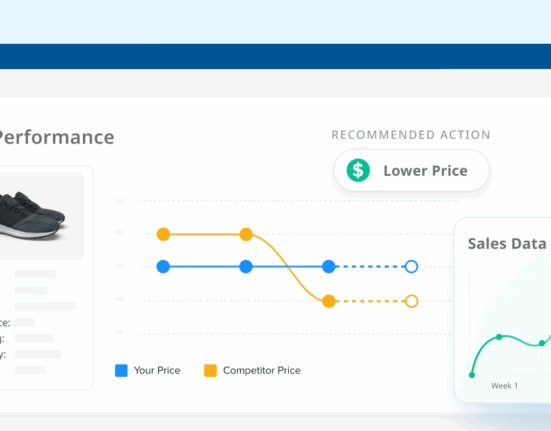

Competitive pricing is, as it sounds, based on your competition.

When a new product enters the market, retailers will take a look at competitors selling the same or similar products and see what their prices are. This will largely determine the products’ starting price regardless of things like product costs or consumer demand.

This strategy can work particularly well for products that are competing in a highly saturated market where just a couple cents difference might make or break a sale. With competitive pricing, you can purposely choose to price a little lower than your competition. A few cents, or even dollar, loss might not matter if you’re selling more.

However, because this strategy is competition-based, this means that your competitors may respond with even lower prices than yours. This is called a price war and can affect your business negatively.

Continuously cutting your prices lower and lower may increase your sales temporarily, but it will certainly lose you profits. Plus, once consumers notice that your products have decreased heavily in price, they may perceive this as your products losing quality or value. This could lead to fewer purchases, and a negative impact on your brand image.

There is another type of competitive pricing called premium pricing, where you set a higher price than your competition to insinuate higher quality. For some customers, this is more likely to drive a sale than a low price. This strategy can have the same negative effects, so price wisely.

Demand Pricing

Rather than basing your prices on your competition, this strategy is consumer-based and uses shopper demand for products and services as the main factor when setting prices.

As customer demand for certain products goes up or down, prices will often lower or rise to follow these trends. There are many factors that can go into consumer demand, like weather conditions or holidays.

For example, airline ticket prices go up during holidays or when flying to certain locations, like Orlando, Florida (Walt Disney World). Coats and sweater prices go down during summer months when the weather is warm there isn’t as much need for them.

The demand-based pricing strategy capitalizes on the fluctuating amount that customers are willing to pay at any given time.

Penetration Pricing

This pricing strategy uses low prices to entice customers to new products or services entering the market.

The lower prices not only pull customers in, but also deters competition from coming out with similar products because they would have to price-match.

Usually, once the new products or services have become established in the market with a full customer-base, you’ll raise your prices subtly until you have reached a price point that is better suited to long-term revenue growth.

While penetration pricing can be extremely lucrative in the right situations, there are a few negative effects that your company should be aware of.

- You will likely lose out on revenue at first while your products are underpriced.

- You may lose some of your customer base once you raise your prices later on.

Despite these cons, penetration pricing is often viewed as a great strategy for newer products, as long as you have a plan in place for earning long-term revenue down the line.

Since every business comes with its own set of goals and needs, finding the right pricing strategy is not one-size-fits-all.

Price Skimming

The direct opposite of penetrative pricing, this strategy initially sets new products at a high price in order to gain as much initial revenue as possible. The idea is that you are “skimming” the top sales off the market.

This way, retailers are able to receive an immediate return on productions costs before any competitor products enter the market. After receiving their initial revenue and satisfying buyers, you should then start gradually lowering your prices to stay competitive and pull in the more price-sensitive shoppers.

The strategy works best for new or different products that are initially entering the market because it allows businesses to profit early before the market becomes saturated with competitor products.

The effectiveness of a price skimming strategy depends on what kind of market you want to target.

Psychological Pricing

This pricing strategy relies on influencing a shopper’s emotions in order to get them to make a purchase, rather than logic or research. It utilizes the psychological impulses behind making purchases as a means of increasing sales.

This strategy is extremely common among businesses because these price changes don’t have a great influence on a retailer’s revenue, but they do have a big impact on a shopper’s perception of a product.

For example, a product that is priced at $29.95 can be viewed as much cheaper than one that’s priced at $30. Realistically, this is only a five cent loss for the retailer, but those cents can be the deciding factor that influences a consumer’s purchase.

There are other ways to utilize this pricing strategy, like BOGO deals, limited-time-only sales, or 50 percent off your next purchase coupons. All of these can make the shopper perceive that they are getting a better deal, but realistically the retailer does not lose out on much revenue.

Psychological pricing can have a great effect on a business’s sales, but there are some possible negative effects as well.

Some people view this strategy as a type of predatory pricing because it relies on manipulating a shopper’s emotions. This can lead to a loss in loyal customers and can even negatively affect your brand’s image if they think you are being unfair or manipulative towards your shoppers. So, make sure to tread carefully.

Bundle Pricing

This pricing strategy offers customers a lower price for a group of products if they “bundle” them together and buy them all at once, rather than purchasing them separately.

This packages multiple items together for sale at a single price, and usually, the customer would have been buying these products together anyway, which makes them feel like it’s a great deal.

For example, a grocery store may bundle bread, cheese, and sandwich meat together as a type of meal deal.

There are two types of bundle pricing: pure bundles and mixed bundles. Pure bundling only gives shoppers the option to buy the products as a complete package. Mixed bundles are items that can be bought as either a package or separately as individual products.

This pricing strategy can be great for quickly selling a large number of products, especially if any of the products within the bundle weren’t being bought often enough to keep up with the rest.

Bundle pricing works best for companies that sell many complimentary products, so that the bundles feel natural and appeal to the customer’s sense for a good deal.

Dynamic Pricing

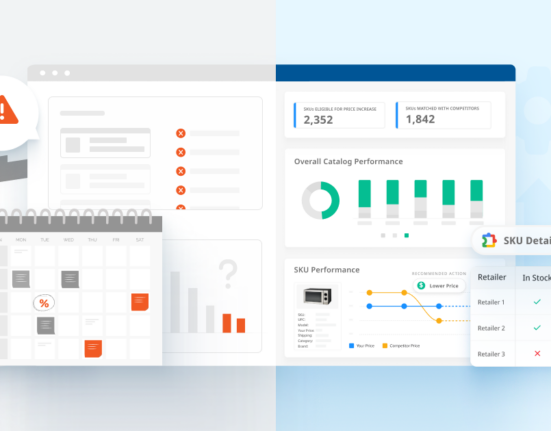

Perhaps one of the most flexible strategies, dynamic pricing uses varied prices rather than keeping prices fixed. This allows prices to be adjusted in real-time based on the fluctuations of the market and consumer demand.

There are two main goals when using dynamic pricing:

- Companies want to optimize their prices in order to fit product margins.

- Companies want to increase their chances of making more sales by appealing to the current market.

Often, companies will utilize some type of automated pricing software that will reprice products independently using up-to-date data to find the optimum price point at any given moment. Dynamic pricing looks at your products and services’ current value and adjusts their prices accordingly.

This strategy can sometimes be confused with price discrimination if not done correctly.

Price discrimination, sometimes called differential pricing, refers to charging different customers different prices for identical products. This is seen as taking advantage of shoppers and can hurt a brand’s reputation.

However, dynamic pricing is based on current market data, while price discrimination preys on the different characteristics of customers. This distinction is important to remember to ensure you are pricing fairly for all shoppers.

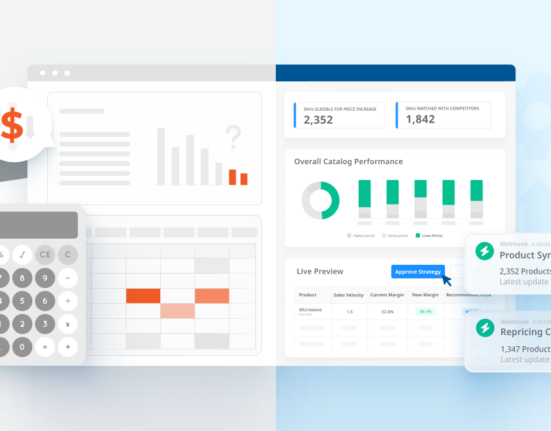

Experimental Pricing

Since every business comes with its own set of goals and needs, finding the right pricing strategy is not one-size-fits-all. This means that it may take some trial-and-error to find the strategy that works for you—and your customers!

Experimental pricing involves trying out different strategies until one is able to meet your businesses’ needs. However, most businesses’ needs continue to grow and change, requiring different strategies. Some can be used in tandem or have better results when used with certain products rather than others.

Though this list is not an exhaustive representation of all pricing strategies, these are some of the ones most commonly used by all kinds of retailers for different situations.

The secret to a long-term successful company is utilizing your ability to change and adjust your strategies as you need to. A static company cannot hope to stay competitive in an ever-evolving market.

Which strategy is right for you?