New tariffs, old playbooks

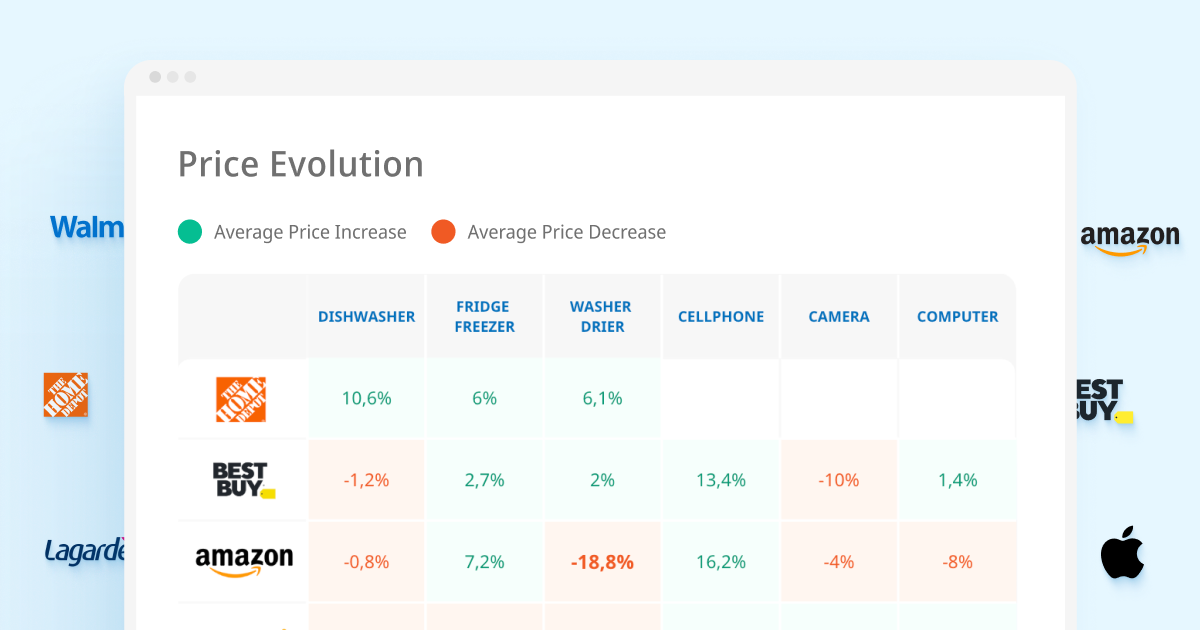

With 2025 ushering in reinstated tariffs on steel and aluminum and new duties on Chinese electronics, many expected a clear surge in prices. But the reality is far more strategic than straightforward. Categories like smartphones have seen visible price hikes, while appliances and computers are behaving more cautiously, some even getting cheaper.

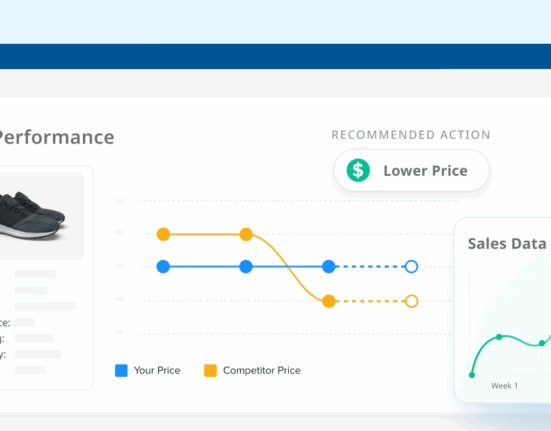

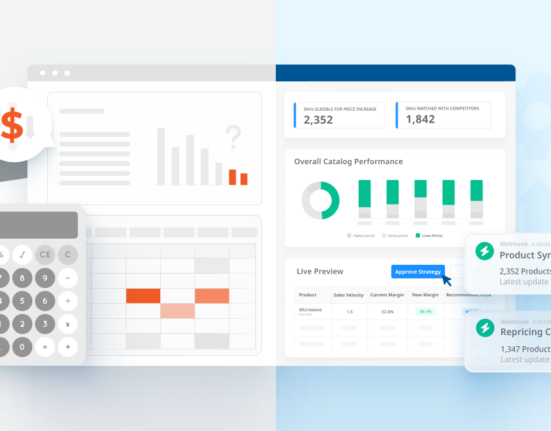

This divergence points to a key takeaway: tariffs are being managed, not just absorbed. Retailers are leaning on old inventory, recalibrating pricing thresholds, and responding differently depending on the elasticity of each category. Shopper sensitivity seems to be driving the strategy.

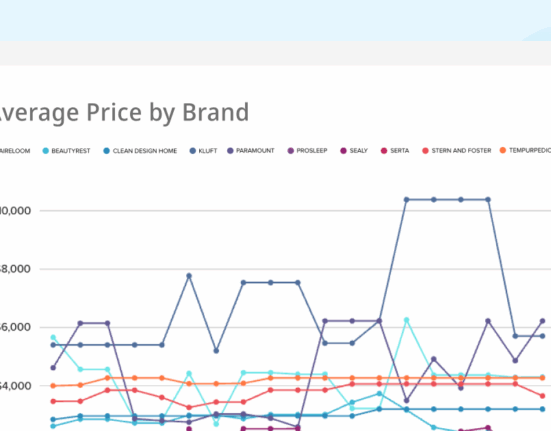

Price stability or pressure cooker? Every category responds differently

In cell phones, price hikes are clear and consistent: Walmart alone saw a 34% jump. With high demand and limited promotions, this category is shouldering tariff costs head-on. Meanwhile, computers have held surprisingly steady. Some brands are even lowering prices to stay competitive, tapping into pre-tariff stock and delaying cost transmission.

In the appliances space, the picture splits further. Premium dishwasher and refrigerator brands like Miele and KitchenAid are raising prices strategically, while value-tier players are holding the line. Retailers like Home Depot are gradually passing through costs, but Amazon and Walmart are using older inventory as a buffer, especially in washer-dryers, where sharp price cuts suggest a fight for volume over margin.

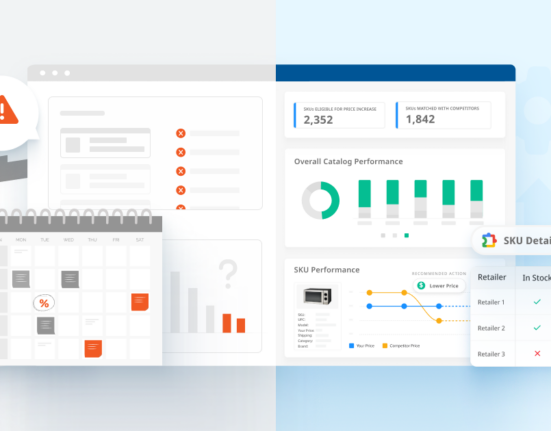

The warning signs are here… what happens next?

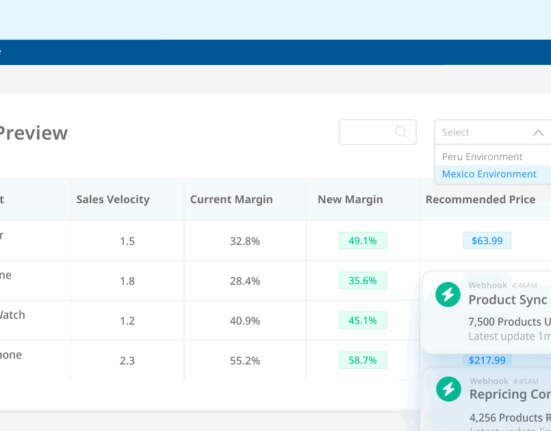

Tariffs may not be showing up at the shelf in every category yet, but that doesn’t mean the pressure isn’t building. Inventory buffers are finite. And as costlier stock makes its way online, brands and retailers will need to decide quickly: raise prices, sacrifice margin, or restructure assortments.

The signals are already in motion. Some brands are using tariff-driven inflation to reposition; others are holding out. And with new semiconductor tariffs on the horizon, pricing strategy will only get more complex from here.

Want to know where prices are moving next… and how to stay ahead of the curve?