Ahh, the age-old problem for your brand—how to win more share of shelf. It’s common knowledge that optimizing shelf space at your top-performing retailers (and edging out the competitors in your category) is a core part of increasing sales.

What’s not always common knowledge? That there are easier ways out there to convince stores to give you better placements on the shelf. That’s right. It is possible to increase your share of shelf smarter, not harder.

Here’s how.

Does the Old Way Still Cut It?

How does your brand convince retailers to give you more share of shelf? Does the conversation go something like this?

“Hey, uh, our brand is really great. Shoppers will love it. You should totally give us a few more facings.”

Does that still work? Has that ever worked?

The old way of pitching your brand to retailers doesn’t cut it anymore. One reason why is that there are more brands than ever, especially in consumer goods. Stores are getting a lot of pitches about how great a product is, and how it’ll totally be a hit with shoppers, and so on. It’s all a familiar story.

Plus, retailers have more data than ever before. Odds are, stores know what sells and what doesn’t. They’ve got their own sales goals and projections, and your brand might not easily fit into that plan. As a result, you’ve got to take a similar approach in order to win shelf space instead of banking on personal relationships and a good elevator pitch.

A Fresher Approach to Winning Share of Shelf

Thankfully, you can be much smarter about your entire process, from auditing stores and collecting shelf data to having conversations with retailers, merchandisers, brokers, field teams, and everyone else involved.

The first step to being smarter is to use all the tools at your disposal. Tools such as in-store intelligence, sales data, image recognition, and planograms can all help you build a stronger argument for increased share of shelf. The goal here is to have a fact-based report you can share with retailers. What does that look like? Here’s one process we’ve seen work:

First, you can take the most common planogram across your retailers by channel. Perhaps this is the common planogram for grocery, drug, and convenience.

Then, you can supplement those planograms with channel data to determine current space to sales. This is crucial because it’s factual, historical evidence. It’s not an elevator pitch or a best guess.

Then, you can revise your planograms according to that analysis. Add in any new products you want to be included on the shelf. Reallocate space for better brand blocking, price flow, and overall shopability.

Finally, present your findings to major retailers for their input and feedback. Ideally, this in-depth analysis will provide a compelling argument in favor of increased shelf space.

Get the Right Technology for the Job

The above strategy can work regardless of your tech stack. However, there is one feature that we’ve seen become a valuable tool in your fight for more share of shelf: image recognition.

What is image recognition? Check out our article on the topic for more details. How can image recognition help you win share of shelf smarter, not harder? That’s a great question. Here are four ways we’re seeing it work with our customers:

No. 1: Better Time Management

A big reason why image recognition even exists is to save time. Good tools can cut the amount of time it takes to capture data by a fair margin. Think about it from the other perspective: How often does a field rep not collect data to save time? Give them an app with image recognition and they won’t have to choose between Task A and Task B. They can do it all because image recognition layers insights on top of images from the aisle.

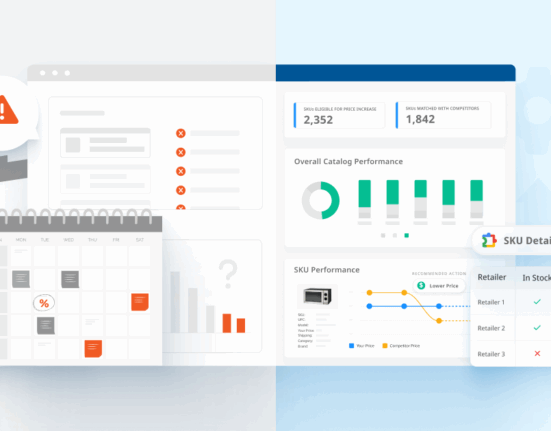

No. 2: Better Data, Better Conversations

Another common scenario in a store is when the rep has to convince the store manager to remove the other brand’s SKUs and replace them with theirs. With image recognition, the rep will have more sales data and actionable insights at their disposal to make that conversation smarter, not harder. For example, they can come prepared with a count of facings over time, trends for competitor brands, scan data, sales velocity, and more.

The old way of pitching your brand to retailers doesn’t cut it anymore.

No. 3: Powerful Stories for Key Accounts

Up a level from the individual stores are the account managers and buyers. Image recognition starts with pictures of the stores taken by your field teams. The technology will layer added insights on top of those images, stitch together entire shelf views, and otherwise call out important points in favor of your argument for more shelf space. Meetings with buyers now involve these improved analytics, and that’s a more powerful story compared to one without pictures of the shelves

No: 4: More Data for Other Departments

Think back to the challenge field reps have with collecting data—sometimes, it’s better to not capture some information in order to get through a long checklist. Using image recognition, time is saved and more data is collected. That information can then be shared with other departments inside your company. Analytics teams, pricing teams, category managers—they can all benefit from shelf-level insights. Who knows what opportunities can be uncovered?

Image recognition or not, there’s a better way to win share of shelf than the old way. It starts with having better conversations between the reps and their stores. Yes, more space is the goal, but supporting your teams with actionable insights has many positives. It improves team efficiency. It supports other departments. It trickles up the ladder to higher-ups. It makes you more agile during challenging times, like the COVID-19 pandemic.

Once You Win, It’s Time to Measure

Shelf space is a lot like the game of Monopoly. Do you have enough real estate? Is it Park Place and Boardwalk or Marvin Gardens? Is someone parked on your property? You need to know if you’re in the best position for maximum sales, if your product is stocked and whether you’re getting the share of shelf you deserve.

Now that you’re able to win more share of shelf, it comes time to measure your presence inside stores. There is no exact science for how to measure share of shelf but there are several methods that can help, and each has their own pros and cons:

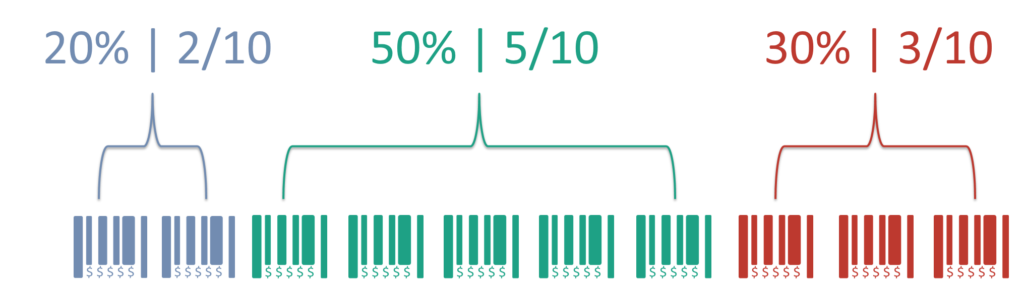

Method 1: Calculate the Facings

One of the most precise approaches is to measure the total SKUs on the shelf—yours and your competitors’—and divide by the number of yours. Of course, this takes time and may limit the other activities of sales reps. Chances are if you have a retailer who has been consistent with your agreement for shelf space you can use one of the less time-consuming methods.

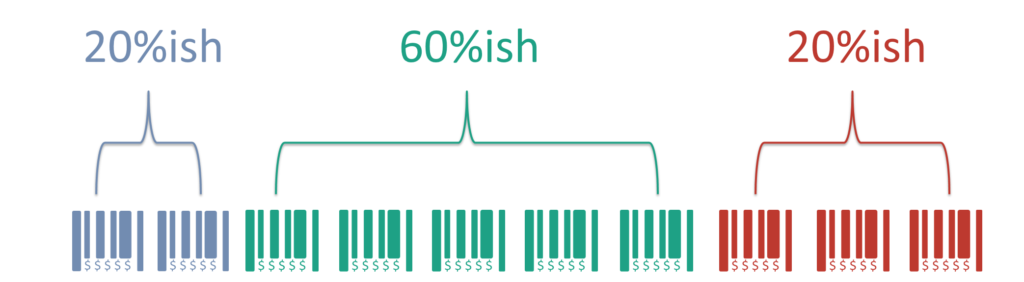

Method 2: Eyeballing the SKUs

This is the fastest way to gauge shelf space, but obviously, you can make mistakes. If you’re going to use the eyeball strategy, you need to make sure to use consistent increments—25, 50, 75 or 15, 30, 45 and so on.

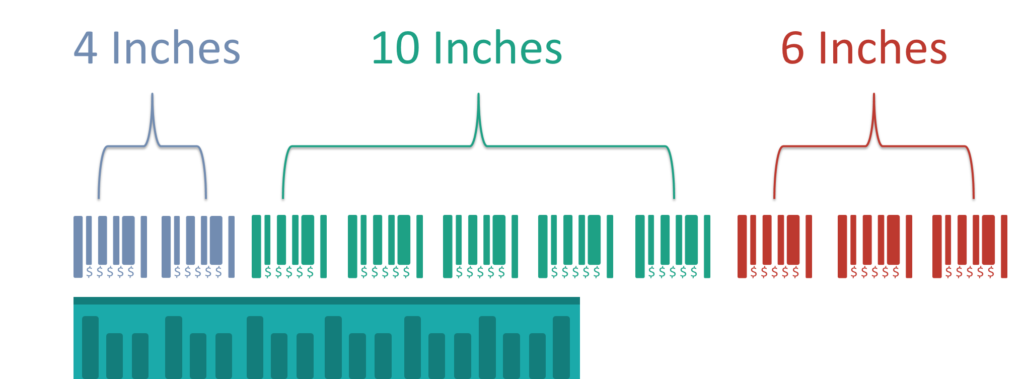

Method 3: Measure the Shelf

Get out your tape measure and figure out what percentage of the actual length of the shelf is taken by your products. This is the most time-consuming but also the most accurate as it allows you to account for varying sizes of packaging. Again, whether you use this depends on how big a problem or priority shelf space is for you and whether it hinders other activities.

Be Consistent, Whatever Method You Select

The important thing is to be consistent in how you measure so that you can track performance over time. The information you get from measuring share of shelf should also be used in determining shelf space profitability:

How do various items perform relative to competitors and how does the share of shelf seem to impact that?

Can you see any parallels between having a larger share, for example, which may communicate to shoppers that yours is the prominent brand?

Does having a smaller share of shelf imply exclusivity?

Obviously other considerations factor in: Are you in the best position for your product? Products at the end of the aisle might prompt more impulse buys but can also get passed over because of shopper congestion at the end of the aisle. Are you next to your biggest competitor or are you a few competitors away? Are you high enough on the shelf for shoppers to see you or do they have to work to find your product and get it in their baskets?

It’s Not an Exact Science and It Doesn’t Have to Be

Measuring share of shelf is not an exact science but the more data you can gather, the more likely you are to make strategic decisions that will not only help you sell more product but shore up relationships with retailers who like to see products leave the shelves too.