Related:

- 8 Simple Tactics to Increase Market Basket Size

- How Consumers Compare Prices to Make Purchase Decisions

- How Buy One, Get One Can Improve Your Sales

What’s in your tool kit for capturing consumer insights? Odds are, the methods at your disposal haven’t changed much in years. You have focus groups, surveys, panels, and the like. But are these options the best for truly understanding shopper insights and behavior? Or is there another option out there—in-store audits?

In-store audits vs. focus groups is a good conversation to have inside your company. Both tools can provide actionable insights, but they have different purposes. They can also be misunderstood and misused.

When we first discussed this topic way back in 2016, Raj Rajaratnam, then the VP of Consumer Insights at Clorox, was saying that “focus groups are probably the most misused tool in our tool kit. What people say and what they mean are two different things.”

Was he right? Let’s dive into the difference between focus groups and in-store audits.

What’s the Point of a Focus Group?

If focus groups are so misused, what’s the actual reason for holding one?

The intention of a focus group is to gain insights into the motivations of consumers and what drives them to purchase a particular product, make decisions about the direction of production of a product, and how to market a product to increase sales.

However, it is very rare that participants in focus groups will say something negative about the brand, which limits the amount of insightful feedback. This leads to ineffective marketing efforts and can be detrimental to company sales. Focus groups can definitely be used to get in front of a small audience of your shoppers. They can be face-to-face meetings with target audiences. They’re also useful if you want to test something—such as whether this messaging resonates, or these visuals have the intended impact.

Just don’t rely on focus groups alone. As noted above, they can be unreliable and a bit biased, and the results don’t necessarily scale up to a large segment of the population.

What’s the Point of In-Store Audits?

On the other, what’s the deal with in-store audits?

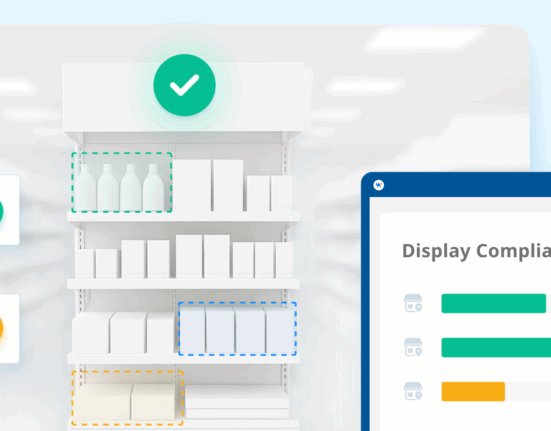

In-store audits are in the realm of field teams, merchandisers, brokers, and mystery shoppers. Many brands and retailers use these audits to build customizable surveys, then sending their teams (or groups of shoppers) into stores to capture feedback.

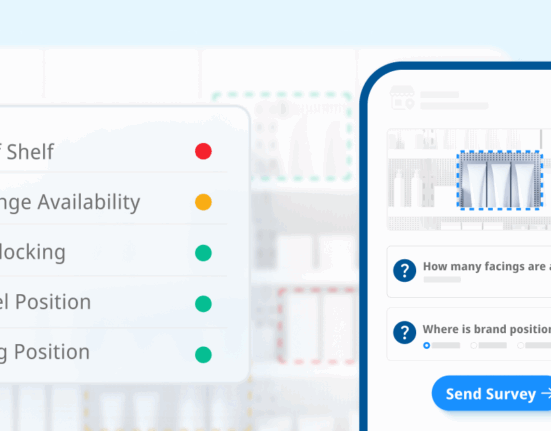

Audits can capture a variety of data points, including shelf intelligence, promotional compliance, in-store experiences, field team execution, and more. If you want to use audits for similar goals to focus groups, you’ll need to turn to mystery shoppers. One advantage of audits over focus groups is that a mystery shopping company (like Wiser) provides a layer of anonymity between the shopper and your brand.

For example, say you have a list of questions you want to ask about your brand’s shelf presence. You can hold a focus group and present your brand’s merchandising to the attendees. Or, you can use Wiser to send out your survey via our in-store shopper app. The consumers interact with Wiser, not with your brand, making them more likely to provide honest, accurate results.

More Pros and Cons of Focus Groups and In-Store Audits

Being able to use a mystery shopping company as a buffer between your brand and the consumer is just one perk of in-store audits. There are pros and cons of both audits and focus groups. Here are a few more to help you decide which one is right for you.

Why In-Store Audits Are Useful

Audit pros include:

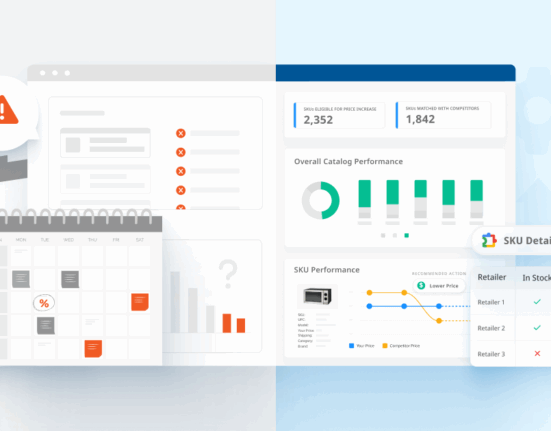

- Access to a larger sample size of shoppers across your target market.

- Can be more cost-effective at scale.

- Faster insights as data can be captured in near real-time.

- Supplemental data that can answer who, what, where, when, and why questions.

- Ability to layer in more business intelligence and other data points, including in-store images.

In-store audits might not be ideal if you’re looking for a more personal touch or want to talk directly to shoppers. They may also not work great if you need data in a region not served by the mystery shopping company, as these tools rely on mobile crowdsourcing, app users, and available internet or cell service. Data may not be as robust as you need in low-population or rural areas.

Being able to use a mystery shopping company as a buffer between your brand and the consumer is just one perk of in-store audits.

Why Focus Groups Are Useful

Pros of focus groups include:

- Hands-on questioning that allows for follow-up questions.

- Smaller groups for more personal, interactive sessions.

- More natural conversations and collaboration.

- A good test environment to play with ideas among a dedicated group of shoppers.

Focus groups may not be ideal for the reasons that in-store audits are useful—when you need larger sample sizes, faster access to data, or different types of data points to supplement other information you’ve captured. The important thing to keep in mind here is that focus groups are not always representative of your entire target audience, and lessons learned shouldn’t be used to make broad assumptions.

Ready to Choose Audits or Focus Groups?

Hopefully, you have a better sense of which data collection method is best for your business. If you’re interested in in-store audits, Wiser’s mobile crowdsourcing app can get customized audits in front of larger groups of shoppers in the U.S. and Canada, helping you track compliance, analyze marketing displays, and ask subjective questions of potential consumers.

Using the Wiser in-store shopper app relieves the pressure on consumers to please your brand and creates an environment in which users will not change their answers. Wiser is the supplement to research such as focus groups and ensures that each insightful data point that is gained will benefit your business.

Let us know if you want to learn more about how our platform helps you gain effective, actionable consumer insights.

Editor’s Note: Contributing writers are Gabrielle Winant and Min-Jee Hwang. This post was originally published in September 2016 and has since been updated and refreshed for readability and accuracy.