At a broad level, category management is simple: to improve the customer experience, drive efficiencies for businesses, and deliver quality products and services that generate profits. As we all know, this isn’t as simple as it sounds.

In reality, there is much more to category management.

Category Management Definition

First of all, what is category management? This is one of the harder retail concepts to define, as category management can mean different things to different people.

In general, category management is the process of bundling like products into a singular category, or business unit, and then addressing procurement, merchandising, sales, and other retail efforts on the category as a whole.

A central idea behind this strategy is to emphasize the benefits of the category for the consumer and remove inefficiencies and unprofitable competition among brands and suppliers within a category. For instance, this approach can help retailers lift profits on similar products in multiple ways, including by organizing procurement efforts under a single category instead of by individual brand or supplier.

Category management is the process of bundling like products into a singular category, or business unit, and then addressing procurement, merchandising, sales, and other retail efforts on the category as a whole.

Category Management Examples

What does category management look like in real life? This concept gives category managers multiple options to solve retail challenges.

For starters, an organization can procure goods on a category level, not a product, brand, or store level. This can centralize procurement under one person or team. That can simplify negotiations with suppliers and save the business time and money.

Category management can also be used to improve the customer experience. In grocery, for example, most stores are organized by category (dairy, produce, meat, and more) which makes it easy to navigate stores and find specific products. Furthermore, management can make changes at the category-level. They can launch new promotions, planograms, and much more across a single business unit.

Category Management in Practice

How a company approaches this strategic concept really depends on the organization in question. For some, it’s all about procurement: purchasing the right products and services for that category that will generate the most sales and profit for the business.

For others, it’s also about the category on the shelf. How the planograms look, which displays and promotions drive the most sales, and which products are most desirable for consumers. Beyond that, this type of category role also includes in-depth analysis. Managers need to know the data behind their category—what is working, what isn’t, and what can be done to improve.

With that in mind, a category manager job could easily involve:

- Defining the category

- Analyzing procurement and spend

- Understanding the market and consumer behavior

- Planning changes and improvements to the category

- Implementing the plan and measuring the results

Tools for Category Managers

Effective category management can then rely on a wide range of tools and resources in the retail industry. Professionals need to know what is going on at the shelf-level. Therefore, they need accurate, real-time store insights on their categories.

This can be data on planogram compliance, out-of-stocks, display compliance, facings, adjacencies, and much more.

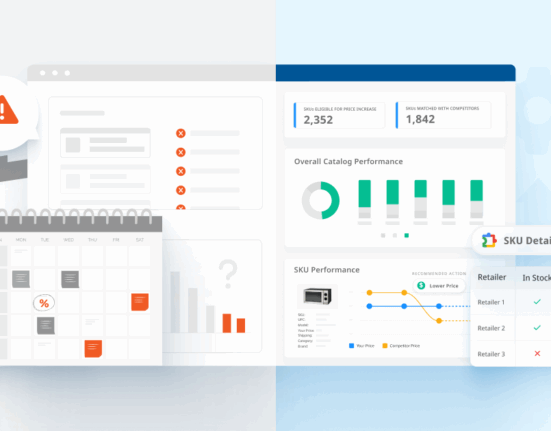

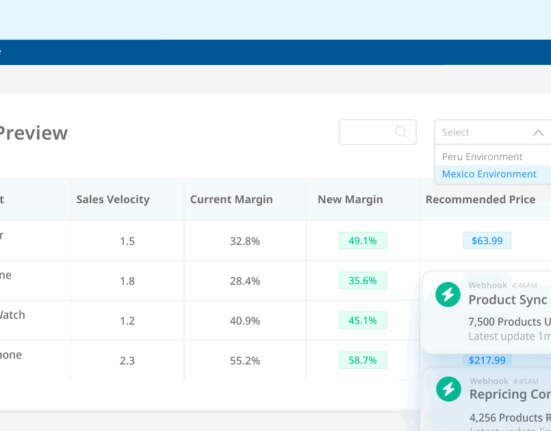

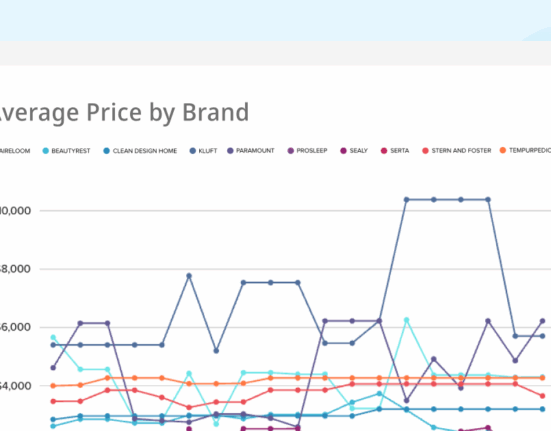

Stakeholders will also want to monitor prices on the products in their categories. Category tactics will often include price changes, so it’s necessary to know how other products are priced, what other stores are doing, and what the market trends and consumer expectations are when it comes to price. This way, category managers can provide the most value to both their customers and their companies.

Lastly, it’s a must to have high-quality insights into shopper behavior. Which products resonate with consumers? Which promotions and displays are most effective? What do they consider good value for a product in this category? Brands and retailers need to survey shoppers regularly to find out or turn to data providers to gather information on consumer behavior and buying trends.

Effective category managers need data on planogram compliance, out-of-stocks, display compliance, facings, adjacencies, and much more.

Your Strategic Approach to Category Management

All in all, category management is what you make of it. Depending on who you ask, this concept can be defined, approached, and completed in different ways.

That means you can create your own strategic approach that fits your needs. You could focus on purchasing, assortment, visual merchandising, pricing, inventory management, promotions, or something else! Perhaps you focus on all of these items.

No matter what, effective category management requires actionable data to support and guide your business decisions. Thankfully, there are plenty of tools you can leverage to take control of your category management program and set your business up for success.