The world of retail is incredibly transparent for shoppers today—it’s easy to browse competitive prices, a wide selection of products, and ratings and reviews, from either the store aisle or the comfort of home.

But is life as transparent inside the companies behind retail? The answer is likely no, especially if your workplace is typical. One specific area where a breakdown in communication can cause big problems is between a pricing analyst and a category manager. These two professionals have to work together in order to get the right price on the right product at the right time.

A slip-up here can mean that the consumer shopping experience suffers, and that can only hurt the company’s bottom line. To help, we’ve put together a guide on how you can work with your category managers to get buy-in earlier and make it easier for them to understand and back your price recommendations.

The CatMan/Pricing Analyst Relationship

The communication path between your team of pricing analysts and the category managers is complicated, even beyond the simple collaboration issues that affect any organization.

For instance, shopper behavior is constantly changing, as we alluded to above. Control is in the consumers’ hands, as they can make more informed decisions and have easier access to a wider range of brands and retailers. That simplicity in shopping also has shortened shoppers’ patience—they want to know what products are available, when they’ll ship, how much they’ll cost, and many other details as quickly as possible.

This puts a lot of pressure on you to build, test, and implement pricing strategies that align with consumer expectations. Of course, there’s another role in the works: the category manager. Category managers own their categories, naturally, and often have the final say over price. That means a common relationship is the pricing analyst recommending the price, and the category manager deciding whether to implement that price.

This is the point of friction we want to address—how can you convince category managers to take your price recommendations?

3 Steps For Pricing Analysts

Thankfully, there are a few (relatively) simple options at your disposal. Here are the three we think can have the most positive impact on your relationships with category managers:

Overshare Information

Problems often arise inside companies when information is siloed between departments, or even between individual team members. You don’t want your conversations with category managers to feel brief and transactional. Instead, overshare information. Be open and honest about what you’re seeing from the market and how those insights are affecting your decisions. It’s obvious that everyone is busy, but it’s worth the time and effort to have detailed conversations with category managers.

Test Strategies, Don’t Set Them

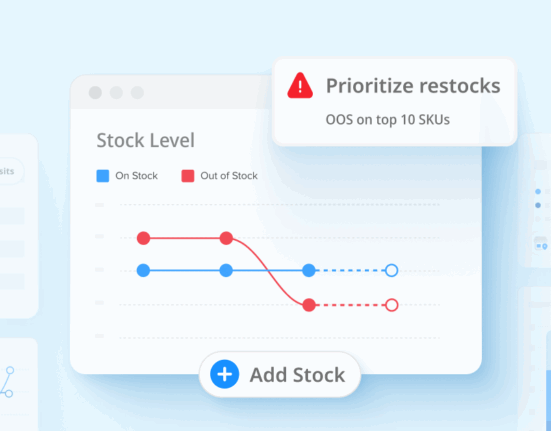

You can also get buy-in for your price recommendations by leaning into the idea of testing. This frames your price recommendations as trial-and-error, not a set-in-stone strategy. This has several benefits. For starters, category managers can feel more comfortable knowing that you will be using real-world data to make your decisions. Plus, it ensures that if the price isn’t working, there are no hard feelings or egos preventing you from changing it. Finally, testing opens up the possibility of running different prices at the same time, which can be a more nuanced and effective way of pricing compared to more rigid strategies.

Explain How You Calculated Your Prices

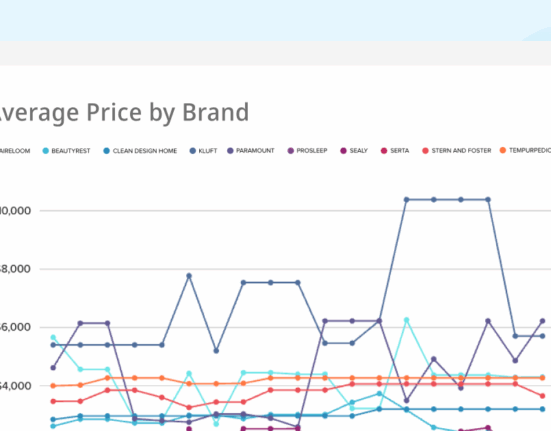

The third tip is to always explain how you came to your price recommendations. The more details here, the better. Put yourself in category managers’ shoes—it’s a little unnerving to hear a price recommendation without understanding the logic behind it. Is it based on competitor prices? Market trends? A brand strategy? Something else? Not knowing doesn’t inspire confidence, and it can make them more hesitant to get on board.

Instead, provide a detailed write-up of why you settled on that price. Walk through the reasoning and explain how you vetted the strategy for potential issues. Clearly show which SKUs will be affected or whether there are any upper or lower price bounds (hint: there should be). This step of the process is so important that we built it into our Price Optimization platform. It’s called Live Preview, and it simulates a pricing strategy before it goes live. It’s quickly become a critical support function for pricing analysts prior to rolling out any high-impact pricing changes to their assortments.

Better working relationships are always a win, but even more so when it’s pricing analysts and category managers who are working in harmony. Make your life a lot easier—and optimize your pricing strategies along the way—by improving your communication with category managers.