Here at Wiser Solutions, we’re keener than ever to understand the state of our market and how it’s impacting our customers. While Peloton experiences a massive surge in sales and Spotify continues to grow its paid subscription base—it’s evident that there are winners surfacing every day during the pandemic.

As I read about these “winners,” one thing was constant. I had a cup of Starbucks coffee or a mug of ginger-turmeric tea in my hand as part of my daily routine.

Although this coffee and tea category has always been a regular part of consumer daily life—perhaps it has been growing since the pandemic started?

Something else that piqued our curiosity was that we received an email from the co-founder of a well-known tea company noting that their sales have doubled since this time last year.

“We are doing more than double from last year,” said a co-founder of a tea company.

From a supply chain perspective, coffee seems to have minor impacts (although, with precaution) while tea appears to be more in jeopardy.

According to Reuters, coffee importers in some of the largest consuming countries are stockpiling, bringing forward orders by up to a month to avoid shortages if supply chains are disrupted by COVID-19 lockdowns.

With regard to tea, Reuters also reports that “five countries—China, India, Kenya, Sri Lanka, and Vietnam—account for 82 percent of global tea exports, but strict restrictions on movement to contain the coronavirus pandemic have already disrupted the key leaf-picking season, delayed some shipments by about a month and triggered a spike in prices.”

Despite these minor and major changes within the supply chain in the midst of category growth, how can both brands and retailers capitalize on this revenue opportunity? What exactly are these shifts in purchase behavior now that consumers are at home vs. on the go?

We asked over 1,000 consumers nationwide via our business-to-consumer app Mobee to find out. Each respondent completed these questions at home for a monetary reward.

Shifts in Consumption Habits

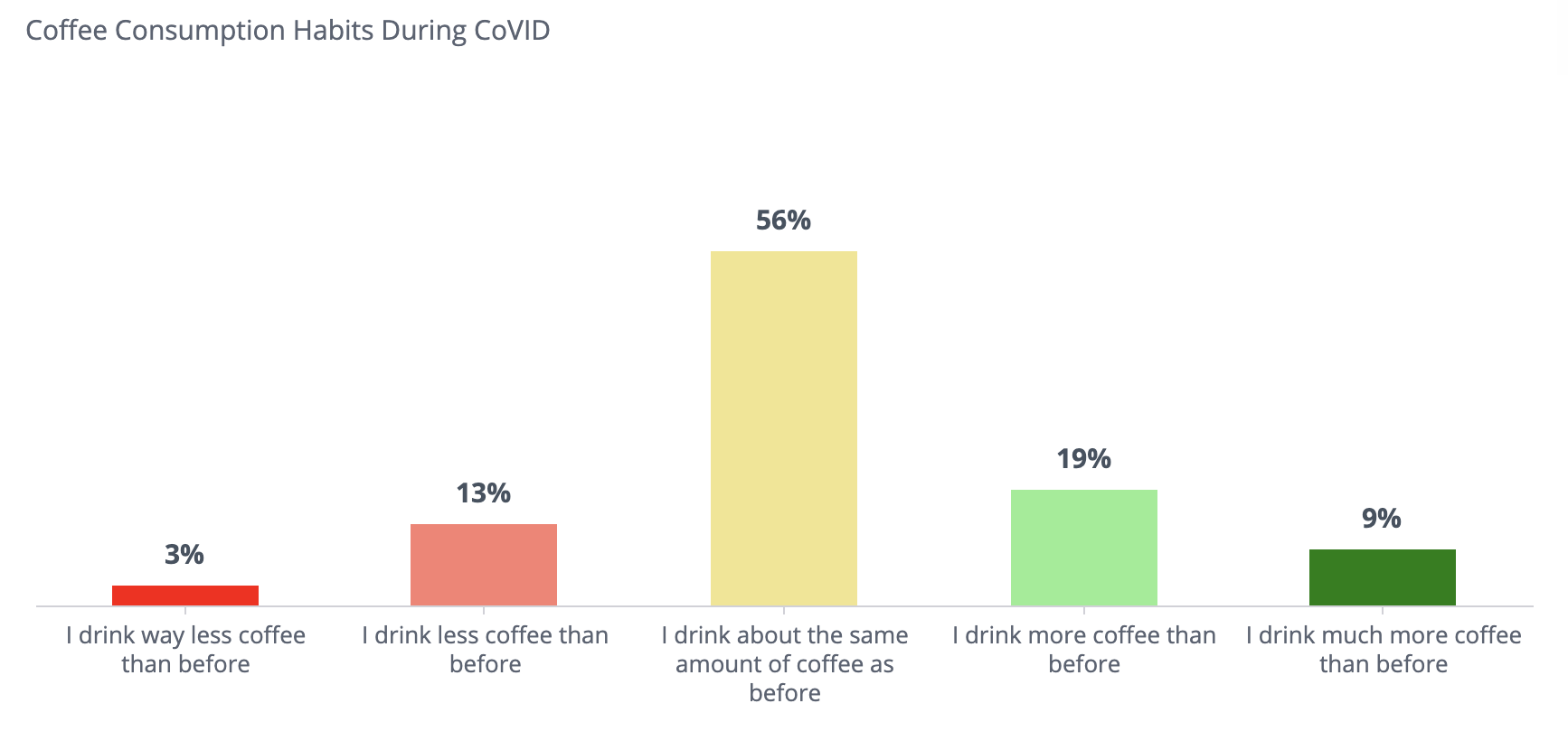

We wanted to understand whether or not consumers are drinking more or less coffee since the pandemic began.

Twenty-eight percent of consumers are drinking more coffee than before COVID-19.

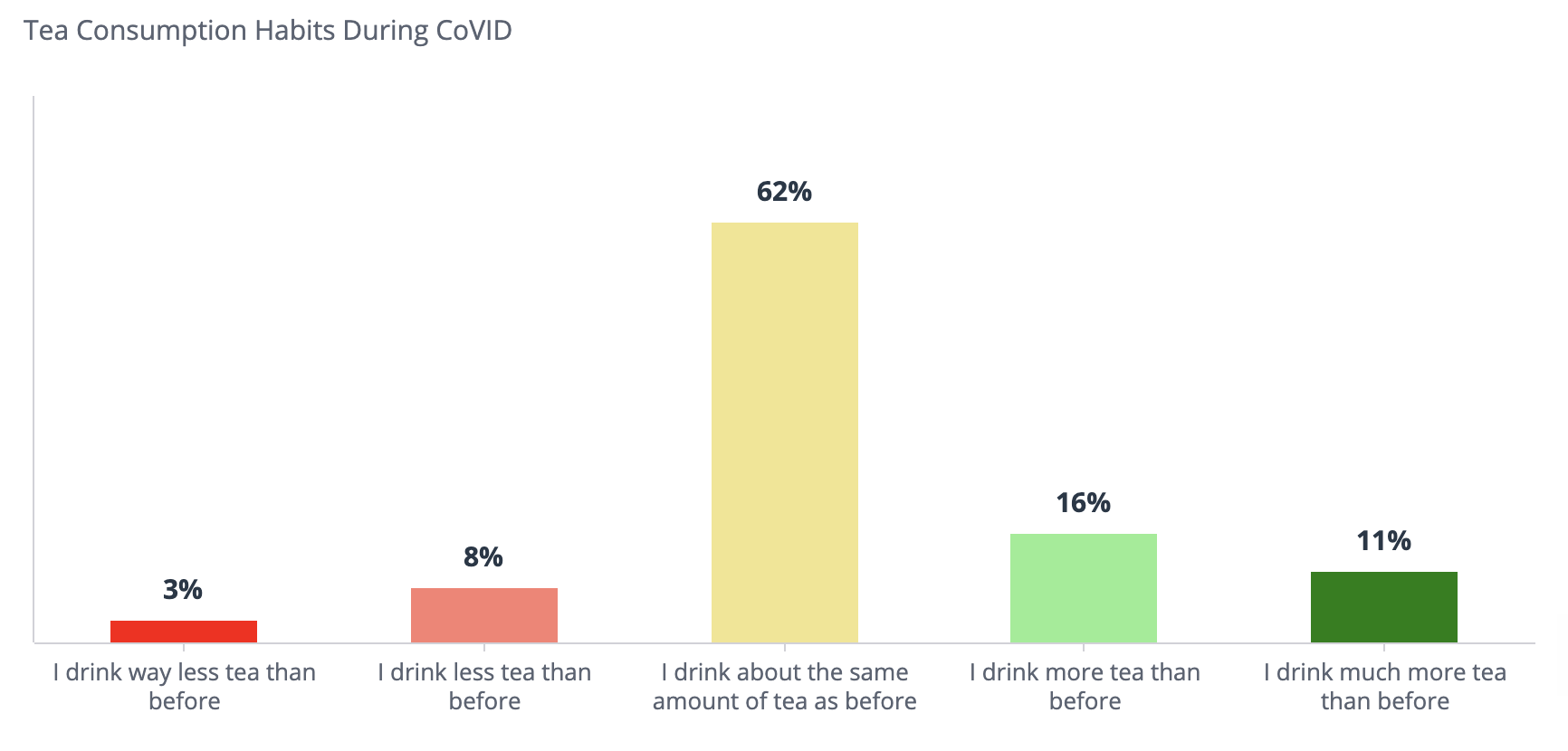

Twenty-seven percent of consumers are drinking more tea than before COVID-19.

Brand Recommendation

To capitalize on the favorable shift in consumer behavior, ensure that price and promotional efforts are optimized and product is stocked as often as possible throughout your in-store channels.

Retailer Recommendation

To optimize on the favorable shift in consumer behavior, ensure that the coffee and tea shelves are maintained and fully stocked throughout the day.

Shopping Methods

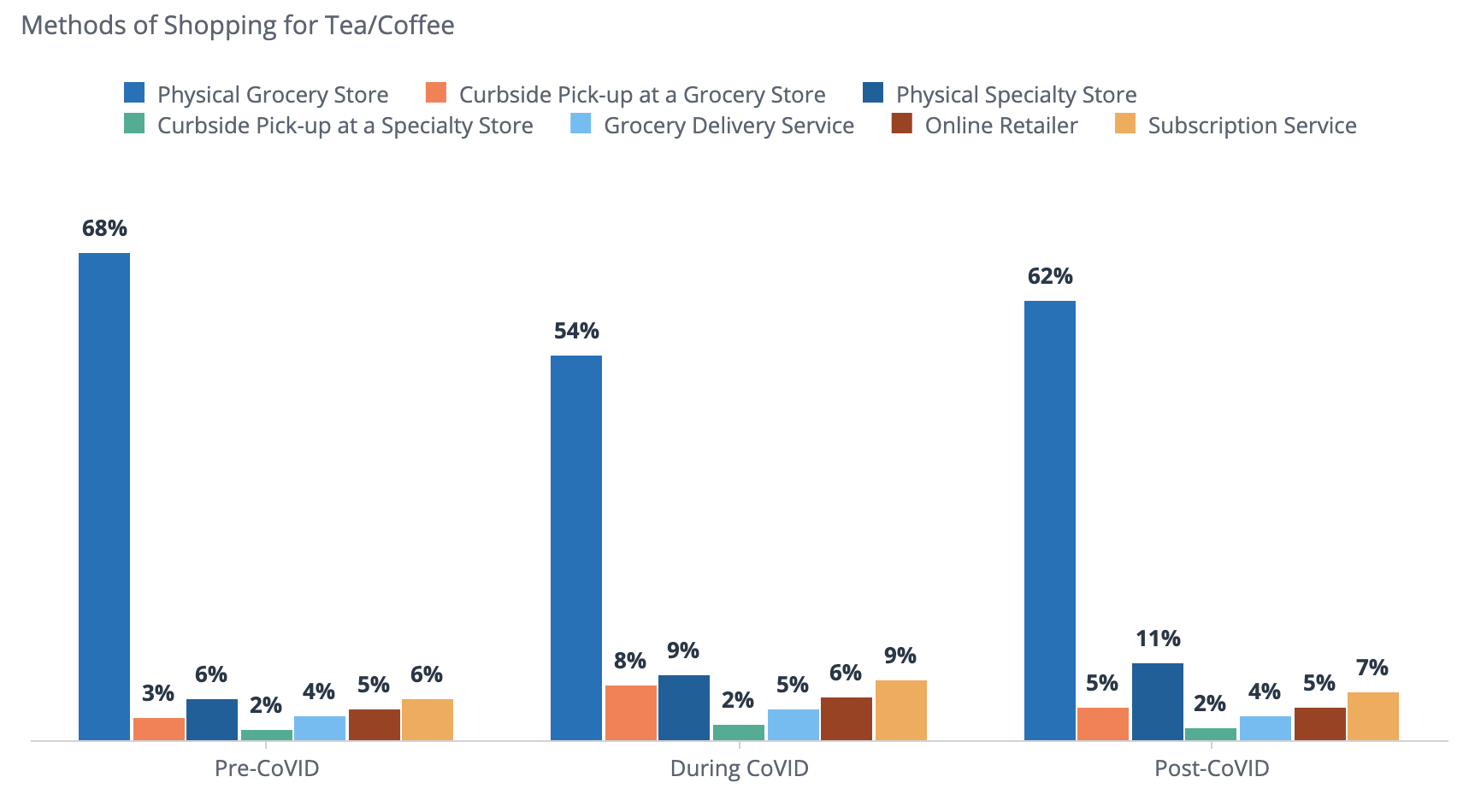

Consumers are still finding their coffee and tea in the physical grocery store setting for the most part. In-store shopping for these categories declined by only 14 percent. While curbside pick-up habits are increasing amongst consumers, it’s only by 5 percent since the pandemic began.

Brand Recommendation

Continue to invest in your in-store channels vs. focusing heavily online.

Retailer Recommendation

Continue to invest in tea and coffee orders for your brick-and-mortar locations. Ensure that these sections are easily locatable amongst consumers who enter your store.

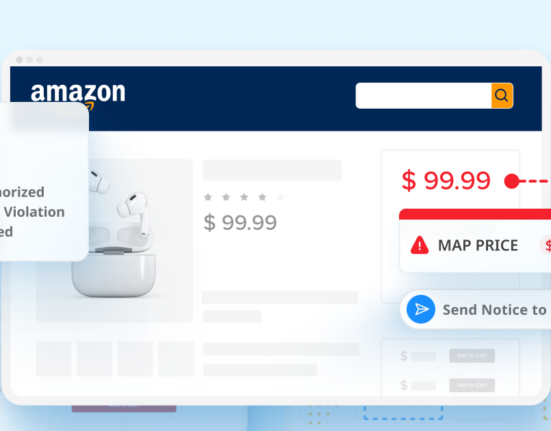

Purchase Criteria

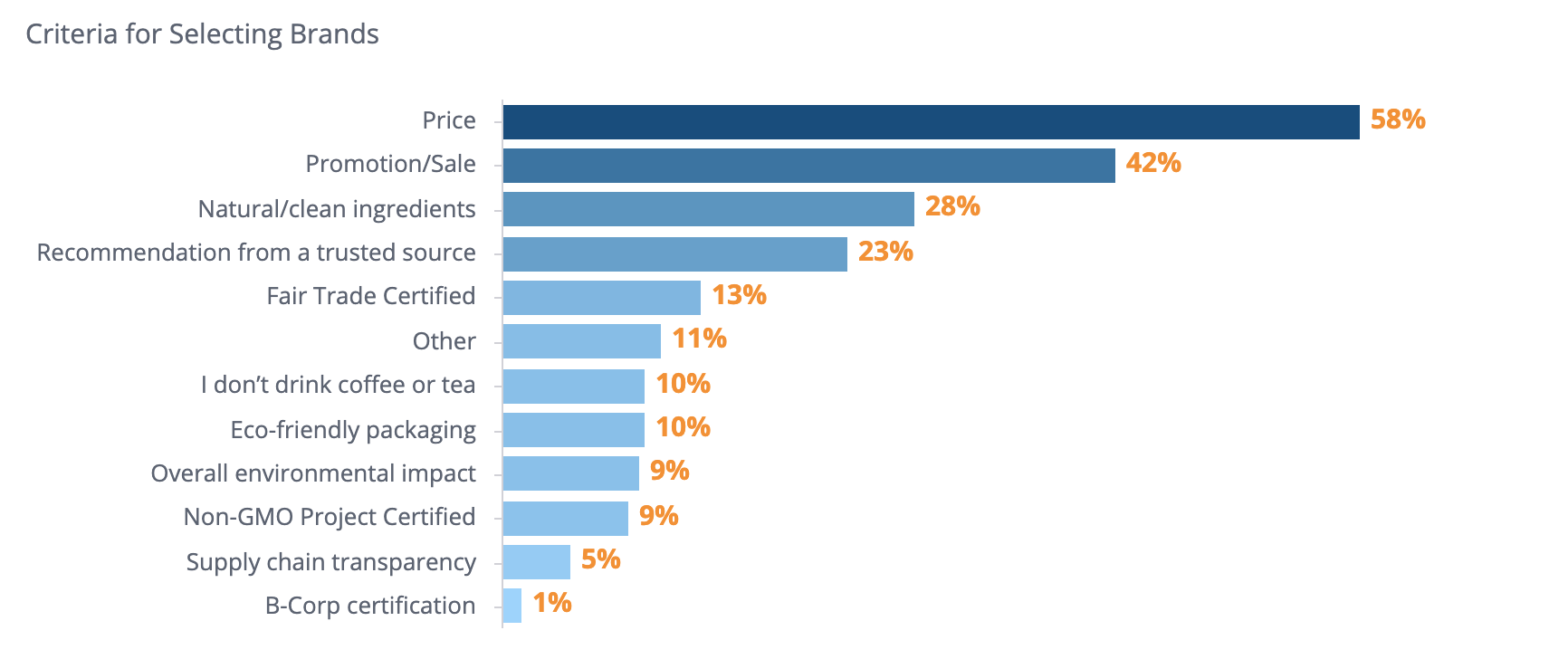

In addition to pricing, promotional offers and sales, 28 percent of consumers look to understand whether or not the brand has natural and clean ingredients. Thirteen percent of consumers tend to look at whether or not it’s fair-trade certified.

Brand Recommendation

Consider marketing your clean ingredients and Fair Trade Certification (if you have it) on social media or ensure that the label is readily visible on packaging. Test to understand if consumers notice these labels at first glance, standing in front of the shelf.

Retailer Recommendation

Consider brands with all-natural ingredients (that are easy to understand) as well as those with Fair Trade certifications and eco-friendly packaging. Consider segmenting shelf space for “Fair Trade & Eco-Friendly” labels for easy selection.

Shifts in Brewing Habits: Coffee

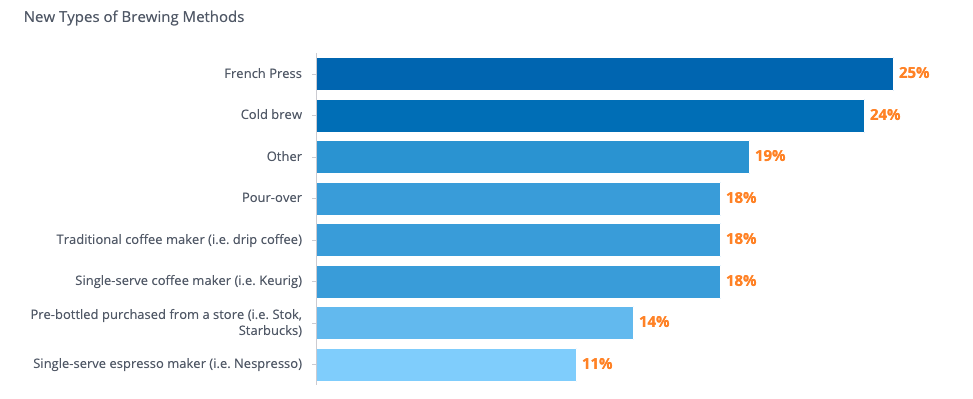

We wanted to understand how consumer brewing habits have shifted since the pandemic began: 25 percent of consumers are now brewing with their french press at home, while 24 percent of consumers are now brewing their own cold brew at home.

Brand Recommendation

Publish more social content or spend more on advertising demonstrating how to french press or make cold brew at home using your own brand.

Retailer Recommendation

Add labels such as “french press recommended” or “cold brew recommended” to coffees on the shelf to help consumers in their search.

Shifts in Brewing Habits: Tea

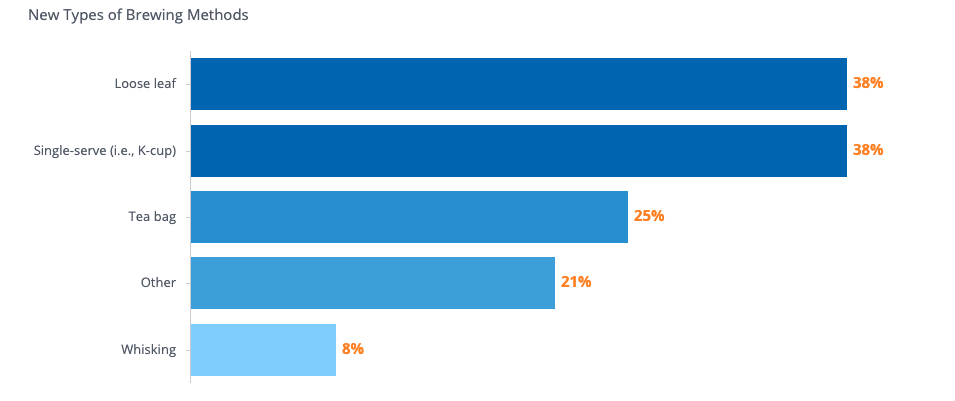

We wanted to understand how, if any, consumer brewing habits for tea were changing: 38 percent of consumers are now brewing with loose leaf tea during their time at home vs. before the pandemic.

Brand Recommendation

Consider social content or advertising spend that communicates your loose leaf offering vs. singular tea bags. Try marketing your loose-leaf offering as a sustainable alternative with less waste than a tea bag. Or, perhaps you can market the clean and natural ingredients in your loose leaf blend.

Retailer Recommendation

Consider surveying consumers to better understand if your loose leaf selection currently meets their needs. If it does not, and you uncover a need for a wider selection, try ordering new loose leaf SKUs to have on the shelf amongst top-selling brands.

What Else Are Consumers Purchasing to Meet Their Brewing Needs?

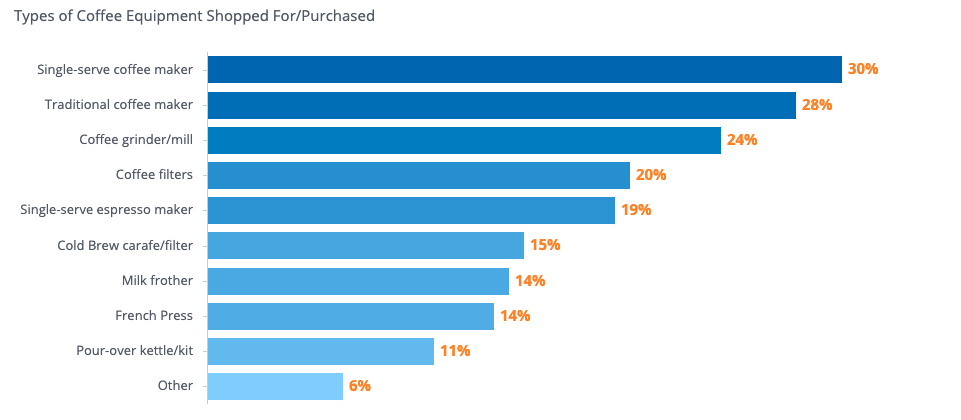

With more consumers at home, we wanted to know if they are purchasing additional appliances to meet their newfound brewing habits: 30 percent of consumers purchased a single-serve coffee machine, 28 percent of consumers purchased a traditional coffee maker, and 14 percent of consumers purchased a french press.

Brand Recommendation

One option is to pair placement and display next to a coffee maker appliance, if available in mass retail channels (i.e. Target, Walmart). Otherwise, consider partnering on social strategy with a coffee machine or french press appliance brand.

Retailer Recommendation

You can place top-selling coffee brands next to coffee maker and french press appliances if you are in mass retail (i.e. Target, Walmart). You could also add recommendation tags next to appliances letting consumers know where coffee selection can be found in-store. Or, try ordering more single-serve coffee maker SKUs than you were before the pandemic.

Key Takeaways: Brands

In conclusion, ensure that you have visibility into store settings to identify out-of-stock issues as soon as they occur, working with your field team or retailer to remediate and mutually capitalize on sales. If you are a tea brand, promote and advertise your loose-leaf offerings. Market how to use your brand with a french press, single cup coffee maker, and/or cold brew if you are a coffee brand.

Key Takeaways: Retailers

For retailers, ensure that you have loose-leaf tea (at the very minimum) on your shelves. Increase orders from natural and fair-trade certified tea and coffee brands and consider ordering additional single-serve coffee maker SKUs than you were before the pandemic.

If you’d like to gain more visibility into your store settings or would like to access consumer sentiment about your brand or current selection, please reach out to clampert@wiser.com to schedule a consultation.