Part of our work here at Wiser is researching a variety of CPG 10K Annual Reports to identify the risks that businesses are facing. Our aim is to flag those that we can help alleviate with our online and in-store solutions.

We’ve noticed one risk that is quite common, encompassing what could happen in the event of unfavorable market conditions. Companies generally predict that consumers would be more likely to purchase private label competitors with presumably lower prices. Depending on the extremity of the so-called unfavorable market conditions, the negative velocity impact could be drastic to CPG sales figures at scale.

While not surprising, Harvard Business Review demonstrates that private-label market share generally goes up when the economy is suffering and down amid stronger economic periods. Historic sales data also proves this.

“In the depth of the 1981-1982 recession, [private label market share] peaked at 17 percent of sales,” the HBR article explained.

Furthermore, private label market share grew to 25 percent in grocery during the 2008 recession, according to AdAge.

Fast forward to 2020 and private-label brand sales have grown 29 percent since the pandemic began, according to Nielsen data reported by CNN. Furthermore, at least 30 percent of consumers who tried new private label products during the pandemic crisis plan to stick with them.

Retailers are intuitively keen to offer private label for three reasons.

- When manufacturing their own private label products, their profit is much greater than purchasing branded products for resale.

- When consumers have less discretionary spending, they are more likely to purchase necessary products for a lower price, regardless of the brand.

- The private label brand specific to the retailer allows them to differentiate themselves should the consumer be retained to the private label offering in and of itself.

Multiple CPG 10Ks also insinuate that the success of private label during these strenuous economic times could invite the retailer to reconsider which brands remain on the shelf. Should private label offerings experience higher velocity, that may signal to a retailer that they should potentially allocate more shelf space for those private-label SKUs, inevitably shrinking the placement available for premium national brands that may be experiencing low velocity.

Below is a direct quote from Church & Dwight’s 2019 10K Financial Risk Section that expresses the reality of this risk.

“As consumers look for opportunities to decrease discretionary spending, our customers have discontinued or reduced distribution of some of our 14 products to encourage those consumers to purchase the customers’ less expensive and, in some cases, more profitable private label and retail-branded products.”

It’s no wonder that retailers wouldn’t up their game in the private label space if they are in fact, better meeting consumer needs who wish to spend less while increasing their own margins.

In June of this year, CVS launched a private label brand that felt quite different from the ones that we are used to seeing on the shelf. According to Path To Purchase IQ, the focus of the launch was to “expand holistic wellness offerings and create better product transparency for shoppers.”

The line, Live Better, is readily on point with consumer trends: 80 percent of the packaging is recyclable with extensive instructions on how to recycle each product on the site. Many of the SKUs are also USDA-certified organic, Non-GMO, vegan, and cruelty-free.

While the Live Better line stretches across nine categories, we were curious about consumer purchase intent among the hyper-competitive sunscreen and herbal supplement categories.

Furthermore, we wanted to help sunscreen and supplement brands sold inside of CVS better answer the following questions:

- Is my national brand potentially at risk from a velocity standpoint, given the introduction of the Live Better brand?

- Is my national brand meeting consumer criteria with regard to purchase intent, to the same or greater extent that the Live Better private label is offering?

We deployed secret shoppers across Arizona, California, and Florida. We tasked them with answering a variety of consumer sentiment questions as they shopped inside of their local CVS store. Once completed, these consumers received a monetary reward inside of our consumer-facing app Mobee.

Sunscreen

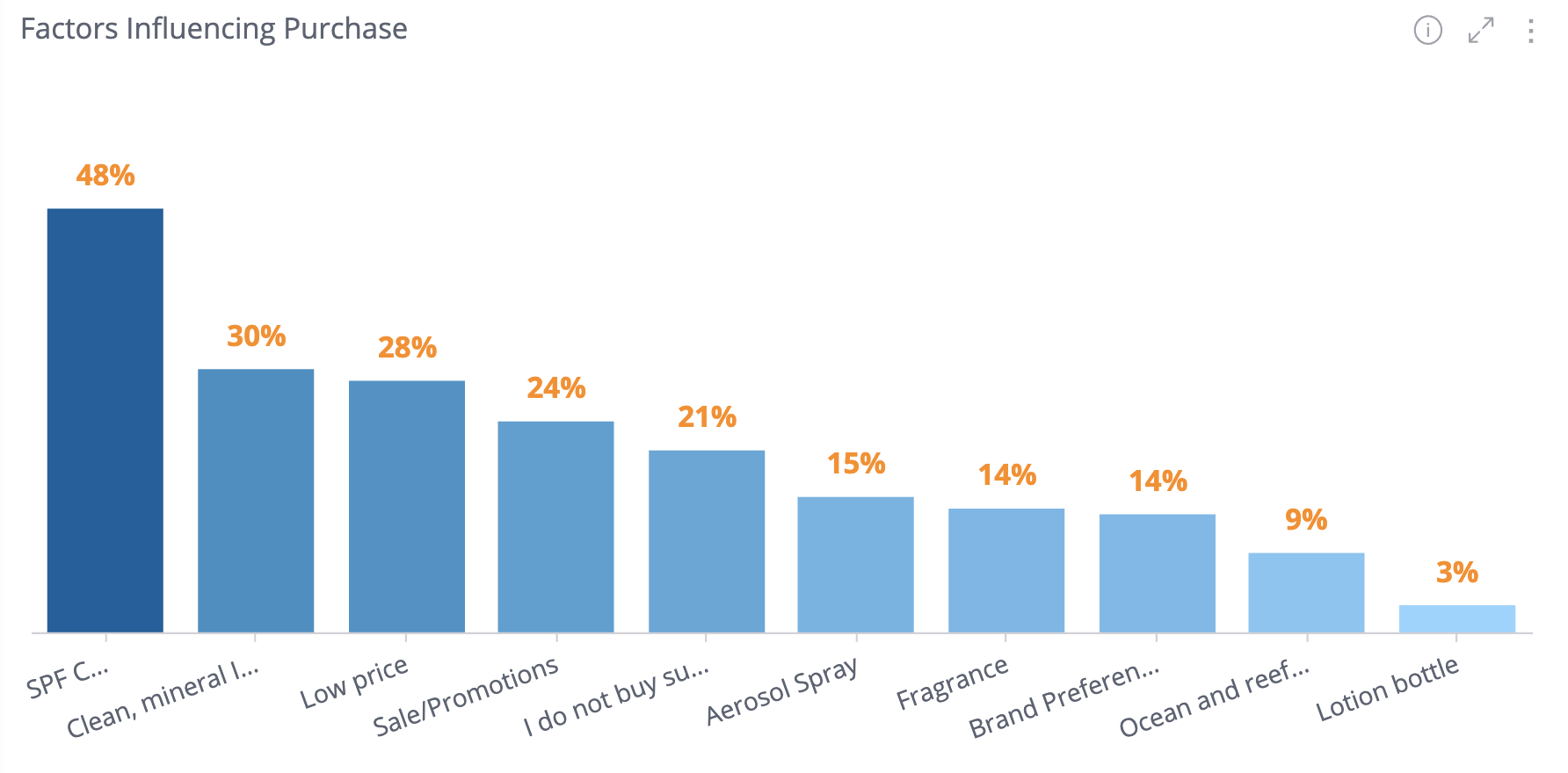

Before we dive into consumer intent with regard to Live Better, let us first explore the top reasons behind consumers’ choices of sunscreen.

While not surprising, SPF coverage was the top consideration for a sunscreen purchase. The next leading reason for a consumer’s sunscreen purchase includes the inclusion of clean and mineral ingredients.

There are two ways that a consumer can block their skin using sunscreen: either by applying chemical or mineral ingredients. In the last couple of years, consumers have been more likely to recognize the chemical Oxybenzone in their own sunscreen due to environmental and health reasons.

We can see here that 30 percent of consumers consider clean and mineral ingredients as an important criteria for their sunscreen purchase.

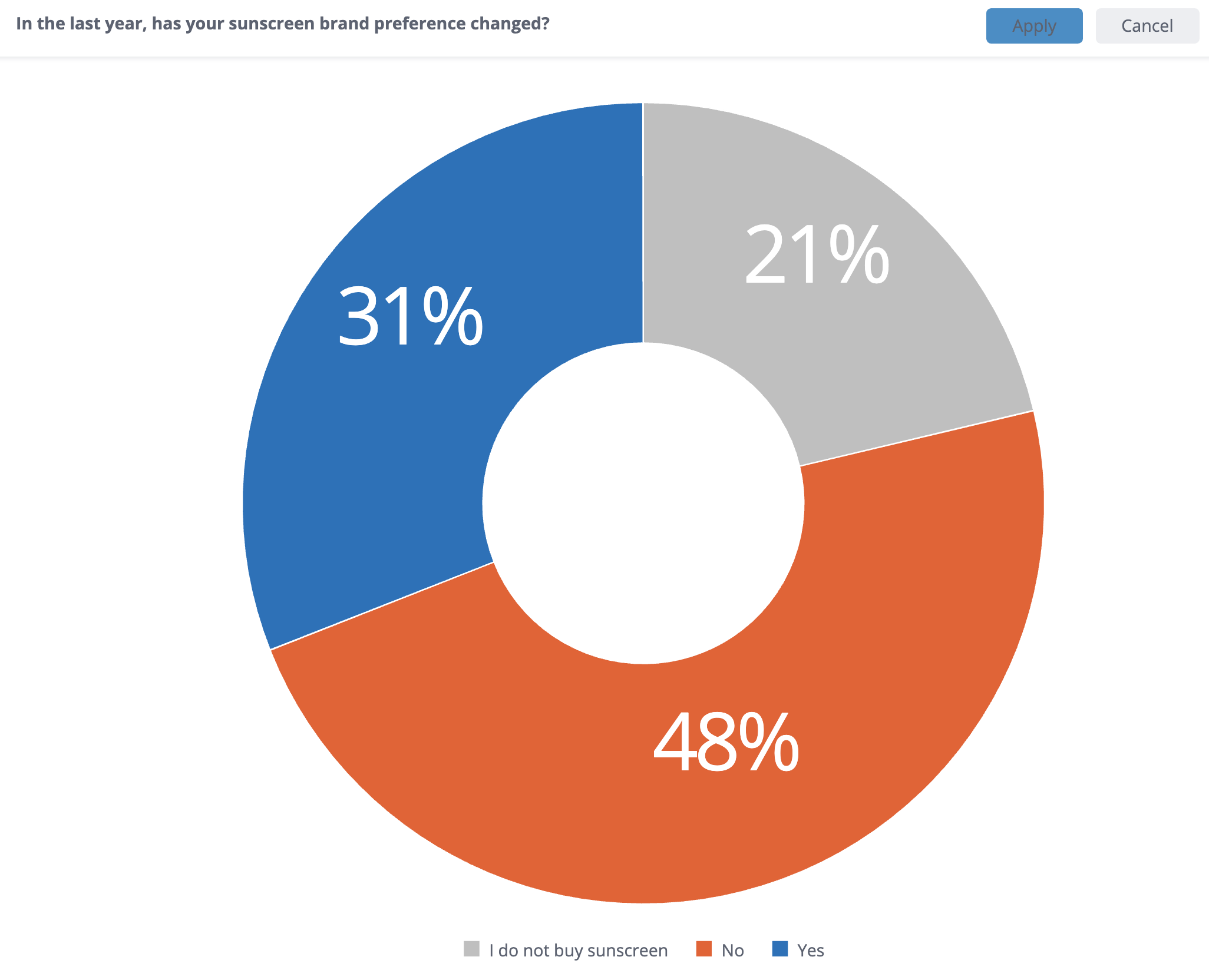

The following question naturally becomes: “Have consumers always been this ingredient-focused with regard to sunscreen purchases?”

Out of the 31 percent of consumers who stated that their sunscreen preference has changed in the last year, 65 percent of consumers said that the reasoning was due to either realizing the ingredients were harmful in their previous preference or finding cleaner ingredients in a new choice.

Among other major reasons for switching sunscreen brands, 30 percent of consumers stated that they’ve searched for a lower-priced sunscreen.

Private Label Sentiment

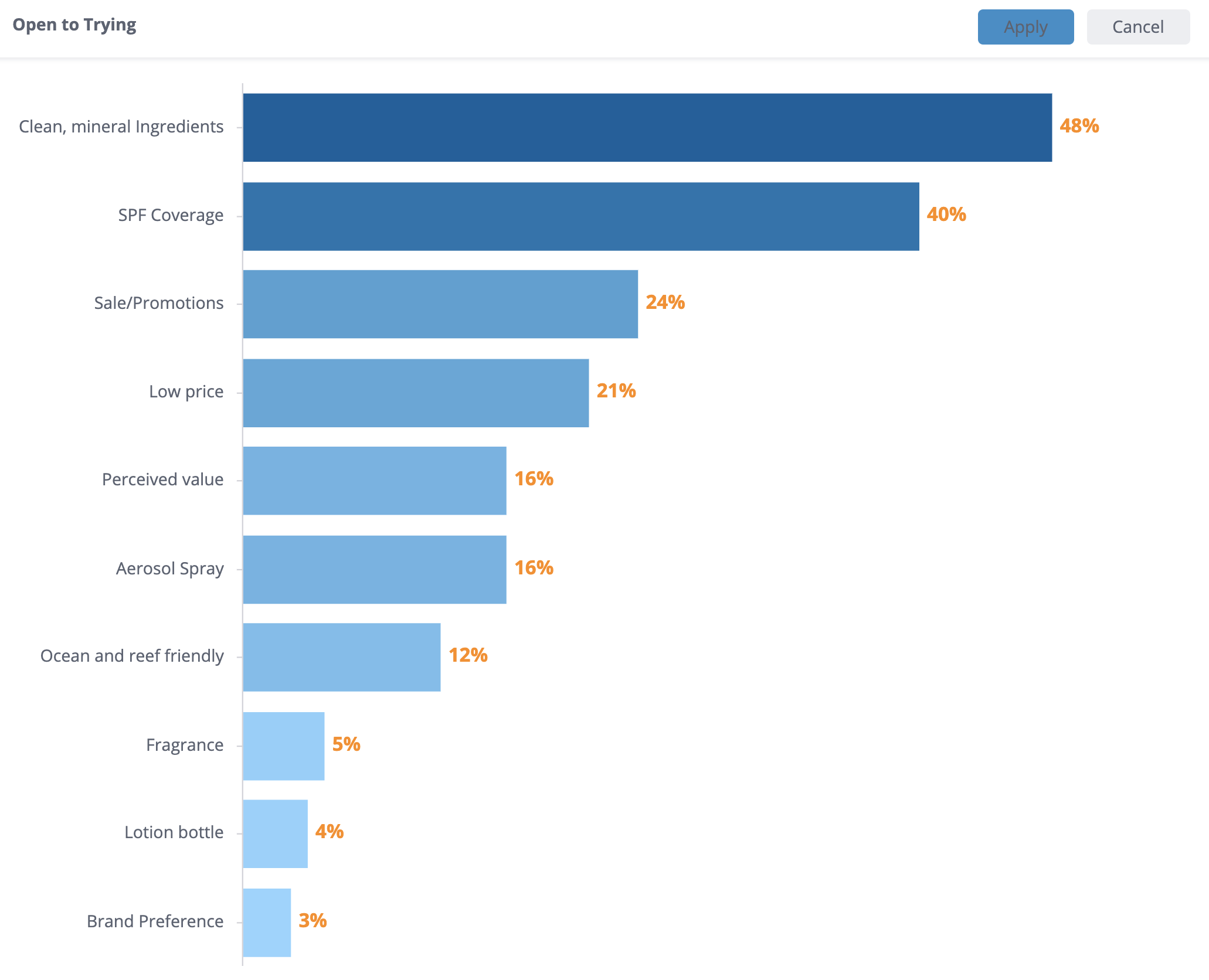

Out of the 66 percent of consumers who said that they would be open to trying the private label Live Better sunscreen, their top reason was because of the clean, mineral ingredients.

Sixteen percent of consumers stated that they were not open to trying the Live Better sunscreen primarily because it was not on sale.

Key Takeaways for Brands:

Takeaway No. 1

Consumers who have switched their brand preference for sunscreen in the last year did so primarily on the basis of clean, mineral ingredients and lower price points.

Takeaway No. 2

Clean, mineral ingredients is the leading reason why consumers are likely to try CVS’s Live Better private label sunscreen.

Herbal Supplements

Looking instead at consumers’ choices of herbal supplements, our secret shoppers consider natural and recognizable ingredients among their top purchase criteria. When asked to expand upon this, consumers provided the following answers:

- “I am very wary of unknown additives to supplements.”

- “If I can’t understand what’s in it, I don’t take it.”

- “I go with ingredients I’m familiar with”

- “I look for clean ingredients and a vegetarian capsule”

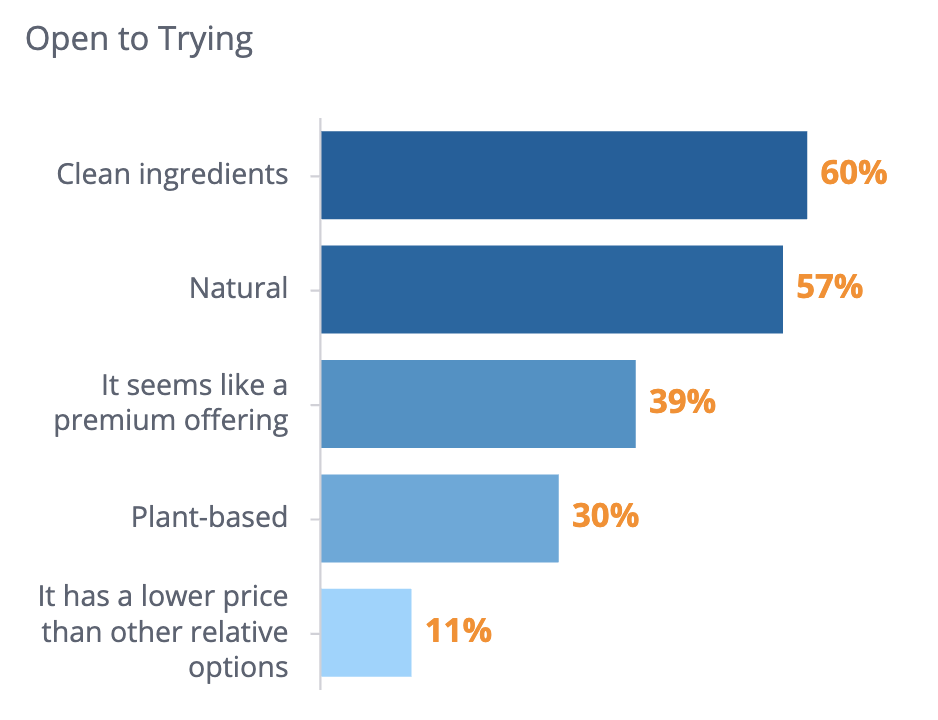

In terms of private label preference, 68 percent of consumers said that they would be open to trying herbal supplements from the Live Better line. Out of those open to trying it, 60 percent stated that clean ingredients were the reason behind their intent.

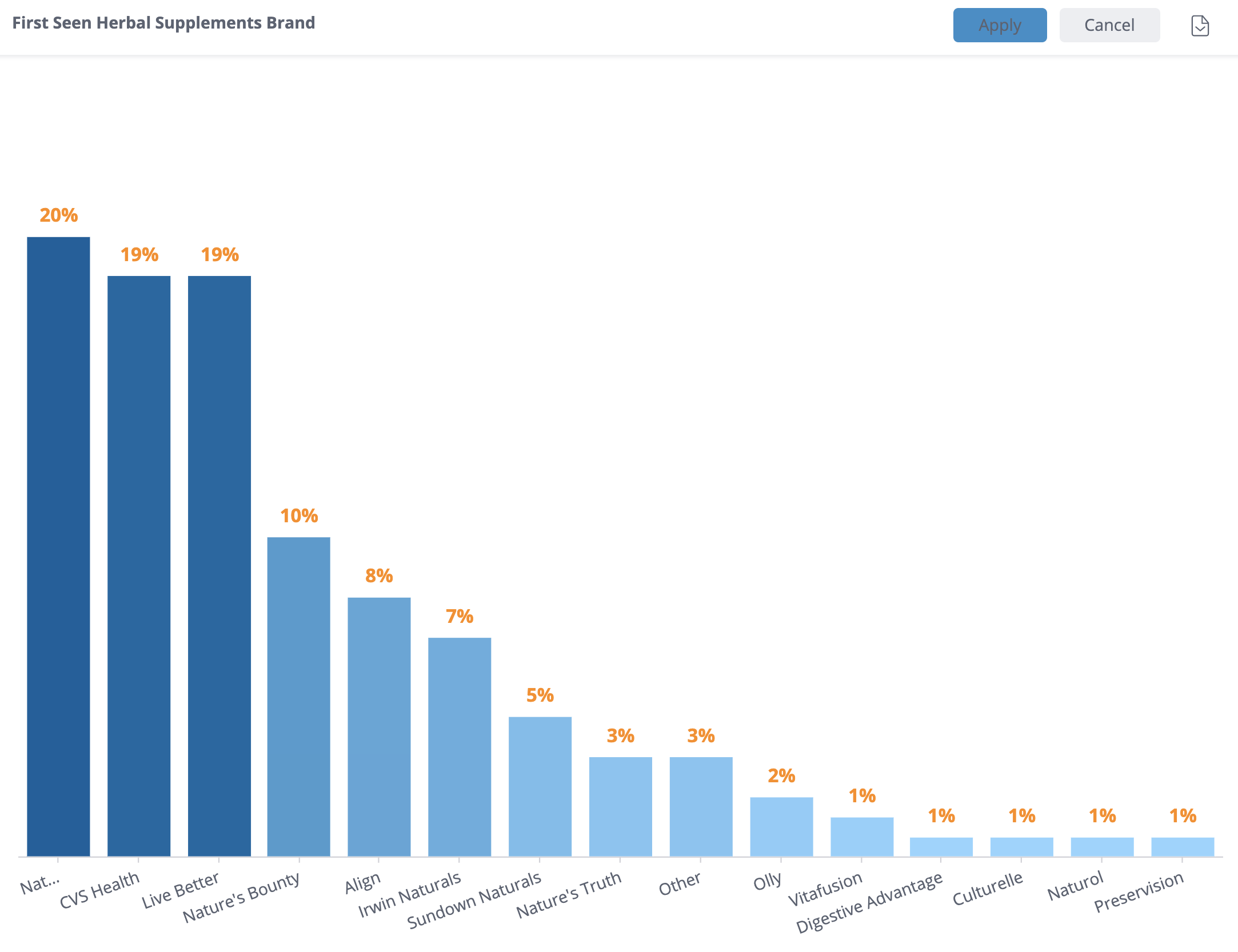

What’s interesting here is that both CVS Health and Live Better private label offerings were also the first brands to be seen on the shelf among 38 percent of consumers.

Key Takeaways for Brands

Takeaway No. 1

Ensure that you are placed in a shelf position that is easily seen when the consumer arrives to the category section.

Takeaway No. 2

Include words related to “clean,” “natural,” and “plant-based” on your packaging if you haven’t done so already to increase the likelihood of selection for purchase.

We can see in both of the sunscreen and herbal supplement categories that consumers are open to trying the private label offering on the basis of clean ingredients alone.

Keep An Eye on Private Label Trends

If brands aren’t doing so already, it would be strategic to benchmark how consumers are evaluating their product’s ingredients to stay competitive amid the rise in private label. While a brand’s ingredients may be recognizable internally, are consumers recognizing them as clean externally at first glance?

A common example is the ingredient Riboflavin, which is listed in numerous foods. Prior to researching, I had always thought of this ingredient as a synthetic, chemically induced additive. In fact, it’s an essential Vitamin (B2). The question becomes, related to any unknown beneficial ingredient, is how many consumers are choosing the product that has Vitamin B2 listed instead of Riboflavin? What does the private label ingredient list read?

For brands that are experiencing a velocity decline in comparison to private label, or suspect that this may happen in the future, contact Wiser to begin benchmarking your ingredients today among our crowd of secret shoppers.