A unilateral pricing policy is a policy by which a manufacturer announces the minimum acceptable resale price for a product, and may refuse to conduct business with any reseller it catches selling those products under that price.

UPPs give manufacturers a means of controlling the retail price of their products without a violation of antitrust law for possible anti-competitive behavior. Let’s look at how UPPs came about, how online retail impacted the need for UPPs, and the differences between this policy and a minimum advertised price policy.

A Brief History of Unilateral Pricing Policies

The origin of unilateral pricing policies can be traced back to the Sherman Antitrust Act of 1890. Broadly speaking, this act aimed to prohibit anti-competitive agreements and unilateral attempts to monopolize or attempt to monopolize a market. This includes behaviors such as price-fixing and other collusive activities to restrict trade.

Most U.S. antitrust law developed by U.S. federal courts have their roots in the Sherman Act.

One important case in American anti-trust law was U.S. v. Colgate & Co, which took place in 1919. What the courts decided in U.S. v. Colgate & Co. was that manufacturers were entitled to the freedom to choose which resellers they want to work with and to set their desired prices. While resale price maintenance remained illegal per se, this court decision provided a narrow exception for manufacturers to simply cut ties with a reseller who is in non-compliance with the UPP.

Another important case is from 2007—Leegin Creative Leather Products, Inc. v. PSKS, Inc. In this case, leather apparel manufacturer Leegin decided it no longer wanted to work with Kay’s Kloset, a reseller that refused to comply to Leegin’s pricing policy and was continually marking the products down. Leegin wanted to avoid a price war and instead focus on selling based on quality and the strength of its brand.

When Leegin cut ties with Kay’s Kloset, the latter’s parent company PSKS, Inc sued Leegin, alleging the manufacturer violated anti-trust law by only working with retailers that agreed to the UPP. The court decided in favor of PSKS, Inc, refusing to hear the pro-competitive benefits of Leegin’s price strategy.

This has led some to believe that all forms of resale price maintenance are legal, but there is still some risk of running afoul of anti-trust law. The idea of a UPP is to avoid all confusion and force all resellers to play by the same rules while preventing prices that could be detrimental to a brand.

A unilateral pricing policy is when a manufacturer announces the resale price at which it wants a product to be sold, and may refuse to conduct business with any reseller it catches selling those products under the price.

How Online Retail Influenced Unilateral Pricing Policies

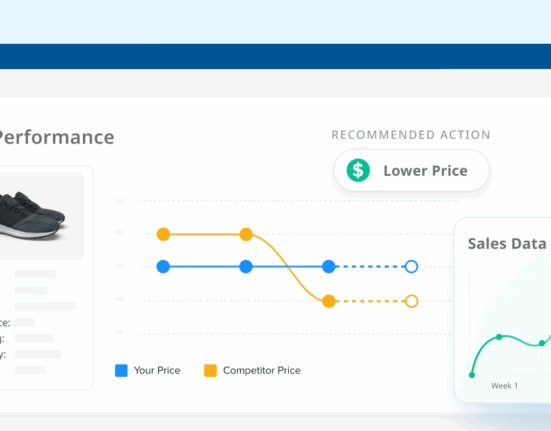

Online retail posed an interesting challenge for manufacturers’ UPPs. Brick-and-mortar retailers could be held accountable for both their advertised prices and in-store display prices. But online retailers could have different prices in different places on their sites. For example, a product page could advertise one price, but when the user adds the item to their cart, the price could be lower, indicating a different resale price.

This alone was not beyond the reach of a strong UPP, but the rise of online marketplaces presented some even greater challenges to manufacturers and traditional retailers’ abilities to control the prices at which their goods were sold on internet marketplaces. Amazon, eBay, Alibaba, and later, Walmart and Sears, created massive marketplaces where third-party retailers of all sizes could sell almost anything.

This created a highly competitive environment in which smaller retailers could come in and compete with hyper-competitive prices. Authorized retailers and manufacturers who were playing by the rules sometimes struggled to compete while they were held to minimum prices set by UPPs and MAP policies. Moreover, unauthorized resellers were hurting manufacturers’ brand values and poaching sales from other partners in the supply chain.

UPPs are a powerful legal means of stopping everyone from an unscrupulous distributor to a fly-by-night gray marketer who is sapping brand value and lowering margins for those who are playing by the rules.

It’s about protecting retailers from being undercut by shady operations and the consumer who may not receive the level of service they should, such as legitimate return policies or warranties.

UPP vs MAP

It’s worth understanding the difference between unilateral pricing policies and minimum advertised prices. While the two have similar end goals, there are some key differences between them.

Let’s review both definitions:

Minimum Advertised Price Definition

A minimum advertised price is an agreement between a manufacturer and reseller in which the reseller must advertise the manufacturer’s product at or above the price set by the manufacturer.

Unilateral Pricing Policy Definition

A unilateral pricing policy is when a manufacturer announces the resale price at which it wants a product to be sold, and may refuse to conduct business with any reseller it catches selling those products under the price.

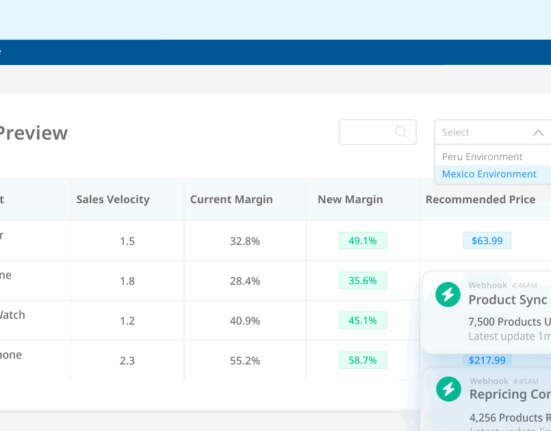

The key difference is whether the pricing policy is set through an agreement between a manufacturer and reseller, or by an announcement by the manufacturer alone.

A UPP is non-negotiable, whereas a MAP policy can be negotiated as part of an agreement. In the case of a UPP, the manufacturer and retailer are considered completely separate actors and are free to choose to work together or not. A UPP is not an agreement, while a MAP policy is.

Another important distinction is that a UPP applies to both the advertised price as well as the resale price of a product. MAP policies apply only to advertised prices – resellers are generally still free to sell the products at another price. It may be totally fine for a retailer to sell a product below MAP as long as it is advertised in compliance with the MAP policy.

As in the previous section, this can cause confusion for eCommerce retailers, where the advertised price and resale price are often one and the same. A UPP can remove some confusion and prevent eCommerce retailers from doing things such as showing a different price once the item has been added to the shopping cart.

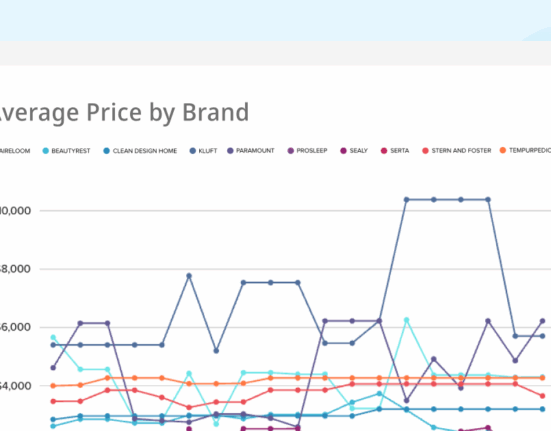

Understand the advantages and disadvantages of both pricing policies—and where each is applicable—to determine the best approach to price optimization and brand protection.