Every year 30,000 new products are launched, and 83% fail within just 18 months. For FMCG brands, new product launches are pivotal moments that can redefine brand success in retail environments. These launches, whether for new products, flavors, packaging, or something else, are critical not just for growth but for maintaining consumer engagement and competitive edge in the FMCG industry. However, ensuring these products effectively make their way from production to the retail shelf and then to the consumer’s basket is fraught with challenges—from distribution hurdles to ensuring the product resonates with consumers on the shelf.

The Importance of Visibility in New Product Launches

Visibility throughout the distribution and retail process is paramount. For FMCG brands, it’s not just about getting products to the shelves, but also ensuring they arrive in perfect condition, are well-received by consumers, and are displayed in compliance with planned merchandising strategies. Without real-time, reliable data, products get lost, misplaced, damaged, or simply overlooked amidst fierce competition. Let’s talk through a couple of examples:

Shelf Presence:

Maintaining visibility into a product’s journey to the retail shelf is fraught with challenges due to complex supply chains, store-level variability, and the high volume of SKUs that are managed. These complexities are exacerbated by the reliance on third-party distributors, limited real-time data, and the potential for internal theft or loss. Additionally, human error and the pressures of promotional or seasonal demand peaks can lead to products being misplaced, not replenished, or incorrectly scanned, further complicating inventory accuracy.

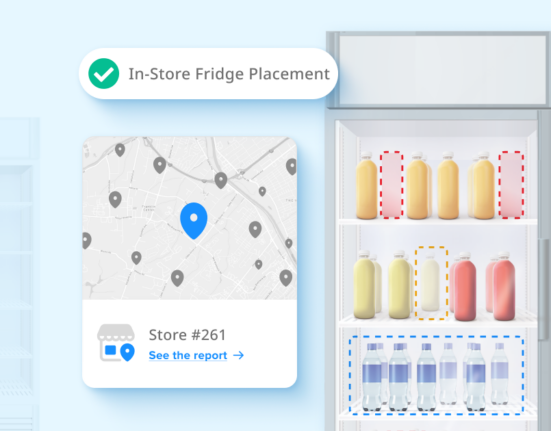

To overcome these hurdles, brands are increasingly leveraging advanced technology solutions like real-time analytics, RFID tracking, and automated systems that alert to stock discrepancies. Crowdsourcing platforms also provide crucial on-ground visibility, with mystery shoppers verifying stock presence, placement, and promotional compliance, thus offering a more immediate and accurate assessment of a product’s shelf presence.

- Case Study 1 (Beverage Brand)

A leading beverage company faced challenges with visibility during the launch of a new flavor at Whole Foods Market. Despite significant promotional investment, initial data from the retail execution team was sparse, providing limited insight into the actual execution challenges. To ensure the campaign’s success, Wiser helped scale the efforts to verify product availability and compliance with promotional plans, providing the company with actionable data to measure the return on investment accurately. This approach not only helped optimize the current campaign but also helped refine future launches, ensuring effective execution and a solid ROI.

- Case Study 2 (Confectionery Brand)

A prominent confectionery brand was aiming to optimize the placement and visibility of its popular ice cream bars. Faced with challenges in navigating complex distribution networks that included small DSD distributors owned by competitors, the brand sought to ensure that its products were both properly stocked and strategically displayed to maximize impulse purchases. By guaranteeing effective distribution and optimal placement, the brand successfully averted potential losses between $1 to $1.5 million. The insights gathered were instrumental in refining marketing strategies and adjusting planograms, ensuring a stronger market presence.

- Case Study 3 (Ice Cream Brand)

This Ice Cream manufacturer sought to address distribution and in-store execution challenges within the first two weeks of launching a new product. The brand had implemented a promotional strategy offering discounted prices on new flavors and invested in branded point-of-sale displays to attract shoppers. However, audits conducted across 400 stores revealed that at least 60% of stores did not display the new flavors, and only some of the new offerings were available in 40% of the stores. The insights from Wiser’s real-time data indicated significant issues, which were promptly addressed by coordinating with retail partners to rectify the merchandising gaps. Strategic intervention allowed the brand to optimize in-store promotions and significantly improve product uptake, turning potential early setbacks into a successful rollout.

Consumer Perception:

Despite the extensive effort and investment in developing a new product or flavor, its success can quickly falter based on consumer perceptions at the point of sale. Key factors like packaging quality, shelf placement, and pricing play critical roles in attracting consumer attention and influencing purchase decisions. If the packaging fails to stand out or seems inferior, or if the product is poorly positioned on store shelves, it may go unnoticed regardless of its intrinsic qualities. Additionally, pricing strategies that do not align with perceived value can deter potential buyers, especially when positioned next to competitors offering similar benefits at a lower cost or with better-established brand trust. Early consumer reviews also heavily impact a product’s reception; negative feedback can significantly dissuade other potential customers. Brands must carefully manage these aspects to ensure that the product not only reaches the shelf but also resonates positively with consumers, thereby maximizing the chances of a successful launch.

- Case Study 1 (Probiotic Shot Brand)

A health shot brand launching new products in urban markets wanted to understand both distribution effectiveness and consumer perception. To ensure a successful rollout, the brand enlisted Wiser’s shoppers to verify whether the new health shots were accurately placed and available across selected stores. Beyond checking distribution, these shoppers were also tasked with providing firsthand feedback on the product by evaluating the packaging appeal, taste, and overall brand perception. They rated the shots on various attributes, including flavor and health benefits, providing critical consumer insights directly to the brand. This dual-focused approach allowed the brand to quickly gather actionable data on both the physical availability of the product and its reception among target consumers.

- Case Study 2 (Spice /Condiments Brand)

This brand, newly launched in a competitive category, faced uncertainty regarding its product placement across different store layouts. Concerned about whether they would be shelved in the general condiment aisle, ethnic foods section, or elsewhere, the brand engaged Wiser’s network to navigate these varied retail landscapes. The shoppers were tasked with locating the items, noting the location, and reporting on the ease or difficulty of finding them. This information helped the brand understand the actual vs. expected placement discrepancies, as well as the shopper’s journey and experience in finding the products. The collected data provided valuable feedback to refine the brand’s retail strategy, ensuring better visibility and accessibility, and aligning product placement with consumer expectations to enhance shopping convenience and product discoverability.

Promotional and Display Compliance:

Once a product is distributed to retail stores, execution challenges can significantly impact its success, even if it has been strategically placed and marketed. Several key execution issues can arise:

- Non-Compliance with Promotional Plans: Often, specific promotional displays or shelving arrangements agreed upon are not implemented correctly at the store level. This can include displays being set up in the wrong location within the store, incorrect assembly of promotional materials, or failing to feature the product prominently as planned.

- Inventory Management Issues: Even if a product reaches the store, it might not be promptly or correctly stocked on shelves. It might be left in the backroom due to miscommunication, lack of space, or oversight, causing missed opportunities during critical launch phases.

- Incorrect Product Placement: Products placed in the wrong section or mixed up with non-competing categories can lead to poor sales performance. Consumers looking for specific items in expected areas might completely miss the new product if it’s not where it’s supposed to be.

Illustrative Case Studies:

- Case Study 1 (Confectionery Brand)

A leading confectionery brand placed significant investment in new merchandising racks designed to feature a popular snack line across thousands of retail locations. However, initial internal audits revealed that many racks were placed incorrectly, obstructed by other store displays, or had issues with stock levels and tagging. By employing real-time, crowdsourced data, the brand was able to systematically address these compliance issues, significantly enhancing product visibility and boosting sales.

- Case Study 2 (Beverage Brand at Health Food Chain)

During a new product launch, a beverage brand planned for prominent promotional displays in a major health food chain. Despite the strategic planning, early checks indicated problems with display execution and product placement—some products were mispositioned in less optimal locations due to warehouse delivery systems and store staff handling. The brand used crowdsourced audits to verify the presence and correct placement of the product, which helped rectify the placement issues and recover potential sales losses by ensuring the promotional displays were correctly executed.

- Case Study 3 (Snack Brand at Convenience Stores)

A snack brand collaborated with a data service to ensure their new product was displayed as planned in convenience stores. The initial deployment showed that the “Lane Blocker” displays, intended to be installed at checkout areas, faced numerous issues. About 25% of the displays were missing, 50% were not oriented correctly, and the correctly oriented ones often featured the wrong products. Improper execution jeopardized the intended ROI of the display investment. The brand responded by conducting detailed audits to collect factual, shelf-level data, allowing them to quickly address and correct these discrepancies.

In each case, the brands faced significant challenges in ensuring that their execution strategies were followed through at the store level. By leveraging detailed, real-time data and correcting course swiftly, they managed to overcome these hurdles, ensuring that their new products not only reached the shelves but also performed optimally in highly competitive retail environments.

Leveraging Data for Enhanced Execution

To navigate these challenges, brands are increasingly turning to technology solutions that provide comprehensive visibility and actionable insights. A sophisticated data-driven approach allows brands to:

- Monitor Shelf Conditions: Utilize crowdsourced data to gain unbiased information on shelf conditions and compliance, reducing reliance on potentially biased or delayed field reports.

- Ensure Promotional Compliance: Track promotional execution in real-time across various locations to ensure consistency with brand standards and campaign plans.

- Action on Data: Integrate insights from both physical and digital shelves to quickly adapt strategies, ensuring brands remain competitive and responsive to market dynamics.

- Understand Sales Performance: Analyze direct shelf-level data to uncover the reasons behind product performance, providing a clear path to addressing issues and capitalizing on opportunities.

- Strengthen Retail Partnerships: Provide robust data to retail partners to justify shelf placement and promotional strategies, enhancing collaboration and driving mutual success.

Conclusion

For FMCG brands, the stakes are high during new product launches. The ability to effectively monitor and respond to retail conditions can make the difference between a successful launch and a missed opportunity. By embracing a unified platform that provides comprehensive visibility across both physical and digital retail landscapes, brands can not only anticipate challenges but also dynamically respond to them, ensuring that new products receive the reception they deserve.

In today’s retail environment, data isn’t just a tool; it’s the cornerstone of strategic decision-making, enabling brands to master the art of the launch and continue to thrive in a competitive marketplace.