Shoppers are always on the hunt for that “too good to be true” price, but what about from the other side? Should brand manufacturers and retailers be just as eager to set a too-good-to-be-true price as shoppers are to find one?

This is the world of loss leader pricing. Done right, and it can be a profitable business strategy. Done wrong, and it could land your business in hot water with customers or even the law.

So how can you tell loss leader pricing is right for you? Let’s figure that out.

What is Loss Leader Pricing?

Loss leader pricing is when one or more products are sold below cost, meaning the sticker price is actually lower than the manufacturing and distribution costs.

This is contrary to many tenets of pricing, which often include setting the best price to balance profit margins, sales, and manufacturing costs. It also goes against basic logic. You’re creating, distributing, or selling this product—why should you sell it at a loss?

In reality, the reasons behind this pricing strategy are more complicated than they may seem on the surface.

Loss leading is very much a balancing act. Highlight new products, enter new markets, build a captive product portfolio, or serve up temporary deals.

Should You Consider Loss Leader Pricing?

Unsurprisingly, there are a number of pros and cons to selling products at a loss.

Pro No. 1: Increase Basket Sizes

The first positive for loss leaders is in consumer buying behavior—shoppers who feel like they’re getting a deal on one product are more likely to buy other items.

This is a basic component of turning loss leader items into a profitable strategy. The idea is that the product sold at a very attractive price will tempt shoppers into spending more. This is great for retailers, as they’re getting a cut of all those sales.

It’s a little trickier for brands. What many do if they’re asking their resellers to price an item as a loss leader is to focus on captive products to turn a profit. A few good examples are electric toothbrushes and manual razors. Toothbrushes can be priced at a loss, while replacement toothbrush heads are marked up slightly. Same with razors, as you can keep the handle and swap out the blades.

Pro No. 2: Launch a Product or Penetrate a Market

Low prices are a big incentive for shoppers to buy, which makes loss leader pricing a possible strategy if you’re looking to launch a new product or enter a new market. For example, you might want to generate some interest quickly and get a few quick wins. So, you price a brand-new product at a loss so more people are willing to take a chance on an unknown item.

Or, you want to expand your business in a new region. You have a tried and trusted product in your home market, but it’s an unknown quantity in a different country. So, you price it low to build up trust here before switching pricing strategies once you’re more established.

In either case, loss leaders can build their own advantage by pricing lower than their competitors might be willing to go.

Pro No. 3: Design Your Store Layout

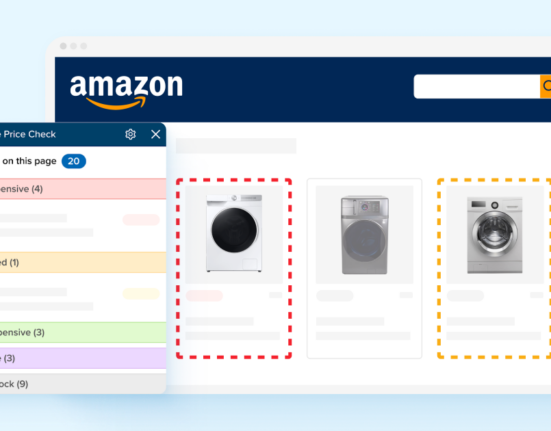

In a boost for retailers, loss leader pricing can actually help you design the layout of your store (or store layout can help you decide which items to price at a loss). The concept here is that items priced in the way back of the store are the loss leaders. Shoppers will be hunting for that deal and will become familiar with that section of your store.

The benefit for you is that they have to walk by all the other items to get there. That’s when you price the profitable products in their footpaths, as most consumers will add to their baskets on the way to the loss leader. This is big in grocery, where many stores put the daily staples like dairy in the back, past some more tempting categories.

Con No. 1: You Set a Price Perception

You might argue that this one could be a pro or a con, but for many businesses, the lack of flexibility can become problematic. What are we talking about? When you commit to a loss leader pricing strategy, you create an expectation with shoppers that your brand is the “cheapest brand.” This perception can be hard to shake, even if you really want to switch up your pricing strategies in the future.

Consumers tend to have good memories when it comes to prices, so it’ll be a jarring move to go from a really good deal to a pretty common price—or worse, to the expensive option. It’s definitely possible, but you need to be smart in when and how you employ loss leader pricing. You can use it only during holidays, only for limited-time products, or spend on marketing when you’re ready to make the change.

What you don’t want to do is make the change with little notice and give your customers a bad surprise.

Con No. 2: Harder for Some Businesses to Absorb the Costs

You have to pay the bills somewhere, and loss leaders typically absorb the manufacturing, warehousing, or distribution costs in order to pass savings on to their consumers. This is easier said than done for some companies.

For example, small-to-medium-sized businesses might have a harder time finding the cash to cover those expenses compared to larger corporations. At some point, you’ll have to do the planning to figure out whether you can afford those up-front expenses in order to roll out a loss leader strategy. The answer will differ for many companies, based on your size, profits, sales numbers, and other metrics.

Con No. 3: It Can Be Illegal!

Forgive us for burying the lede a little bit, but loss leader pricing might not exactly be legal in your area. Like with many aspects of business, consult with your legal counsel before using a loss leader pricing strategy in the real world.

According to the U.S. Federal Trade Commission, loss leader pricing is 100 percent legal in only 10 U.S. states, while a number have partial bans on the strategy, depending on how it’s used. The rest have a general ban on this tactic. It is also banned in many European countries.

The nuances come down to how predatory the pricing strategy is from a consumer perspective. As noted above, some larger companies can use this to force smaller stores to close, as they’re unable to front the costs. On the other hand, it can be beneficial for shoppers, as it can draw them into new stores and introduce them to a variety of products they might not be familiar with.

In general, loss leading is very much a balancing act. If it’s legal where you sell, you need to ensure it’s in the best interest of shoppers. Highlight new products, enter new markets, build a captive product portfolio, or serve up temporary deals. Don’t use it as a way to crush the competition or trick shoppers into buying more when they otherwise wouldn’t.