Whole Foods has long been a valuable ally for emerging food brands. Many of the products stocked on Whole Foods’ shelves are considered small label—brands not owned by a larger company, such as Proctor & Gamble or Mars.

These emerging brands have an uphill battle as they look to establish a foothold in the consumer packaged goods space. They’ve just recently begun selling in stores and face competition from more recognizable brands, even in a store such as Whole Foods that leans toward smaller companies.

In search of some guidance, we mobilized our network of mystery shoppers with one goal in mind: to learn which new and emerging brands stood out on the shelves of Whole Foods. Here’s what we found.

Small Labels and Whole Foods

Whole Foods and small label brands go hand-in-hand. The allure of Whole Foods for many shoppers is as an alternative, healthier, and socially conscious destination compared to other major grocers.

As a result, the shelves of Whole Foods are filled with small labels alongside the major CPG players. Our mystery shoppers reported that 97 percent of Whole Foods had small label snack brands present, across more than 160 Whole Foods stores nationwide. Ninety-six percent had small label beverage brands on display, while 89 percent displayed small label hot sauces.

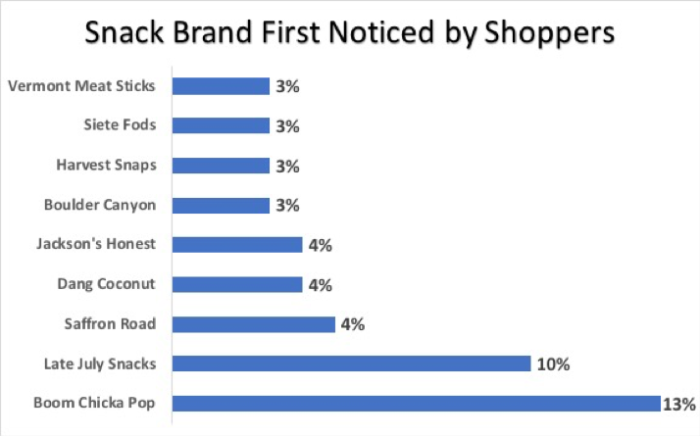

Looking at just snacks, which brands were first noticed by shoppers? In first came Boom Chicka Pop at 13 percent, followed by Late July Snacks at 10 percent.

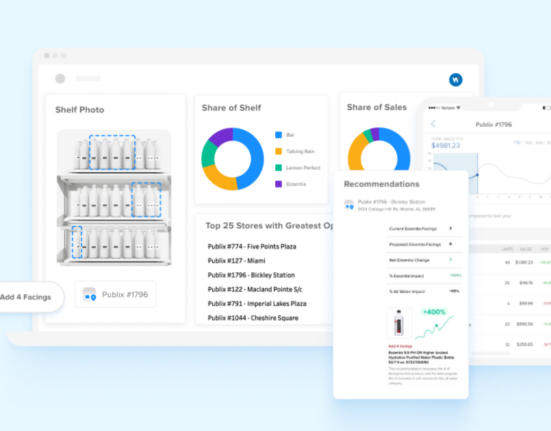

Why is this the case? There are several reasons small label brands can be first seen. The brand is ideally featured on an end cap or checkout display. These locations are highly trafficked and increase the likelihood of a brand being noticed. Other tactics include effective planograms and well-stocked shelves. Out-of-stocks don’t benefit anyone, especially emerging brands.

Boom Chicka Pop has brightly colored packaging and color-coordinated planograms that could draw the eyes of shoppers.

What are Whole Foods Shoppers Buying?

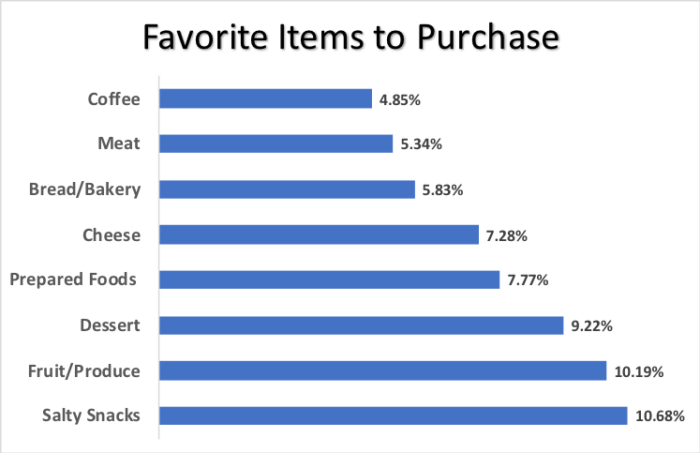

Naturally, certain brands may have an advantage simply based on what product they are selling. This is nothing new, but we were curious which products—separate of individual brands—were driving shoppers to Whole Foods.

Salty snacks were No. 1, with nearly 11 percent of shoppers heading to Whole Foods in search of this category of product. In second was fruit and produce, which aligns with Whole Foods’ emphasis on organic produce, followed by dessert items and prepared foods.

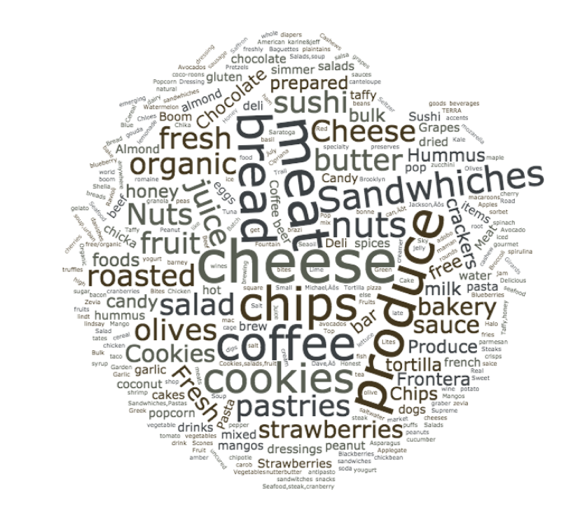

On a more granular level, Whole Foods shoppers are after one type of product: cheese. Cheese was incredibly popular when asked which specific type of food was purchased, along with the aforementioned salty snacks—chips, crackers, nuts—and produce.

What’s Next for Emerging Brands

Whole Foods and all grocers are valuable allies for emerging food brands. These small labels must make sure that their retailers are working in their best interests in order to capture the attention of shoppers.

As noted, merchandising and display compliance is a big part of that. Brands should monitor promotional displays, end caps, floor stands, and more across their retailer network. They should also make sure that out-of-stocks are remedied as quickly as possible.

Brands can also leverage mystery shoppers, such as Wiser’s network used here. Crowdsourced data can be completed via a mobile app and provide insights into more locations than ever before. Connect with Wiser today for more details on our compliance, market intelligence, and retail optimization solutions.